私人养老金风险上升的核心在于资金管理者试图在“储蓄不足、寿命更长、收益不足”三项约束下获取不可能的额外回报。北美保险公司投资组合中私人信贷占比已从十年前的约 31% 升至约 35%,而保险业正大规模承接大型固定收益养老金负债,并以离岸再保险与不透明的私人资产来压低所需资本金。在账面上,这些资产承诺更高收益,允许更少拨备,但其估值缺乏透明度与流动性,导致未来兑付时风险集中暴露。国际清算银行指出保险公司依赖规模较小的评级机构评估私募资产,使信用风险被夸大评为“更安全”。

传统确定给付养老金之所以长期出现资金缺口,是因为制度性激励鼓励管理者假定能持续跑赢市场,从而低估未来负债;这导致美国大量企业计划在 1970 年代前后倒闭或被强制关闭。而如今流向私募市场的趋势重现此结构性误判。当保险公司投资失利时,部分州对其监管力度弱于对私营养老金的监管,若资产缩水,退休人员可能缺乏保护。公共养老金同样因高收益假设与不当风险管理而长期资金不足,反证“风险分摊”并不能消除激励扭曲。

相较之下,确定供款计划(如 401(k))的优势在于资产透明、成本低且监管改进。但一项允许其投资私人及更复杂资产的政策提案被视为潜在错误,只要此类资产不被放入默认投资选项,系统性风险可控。确定供款主要弱点在于其擅长累积资产却难以管理退休支出风险;未来政策设计必须坚持透明、监管完善且避免任何“无成本高收益”的虚假承诺。

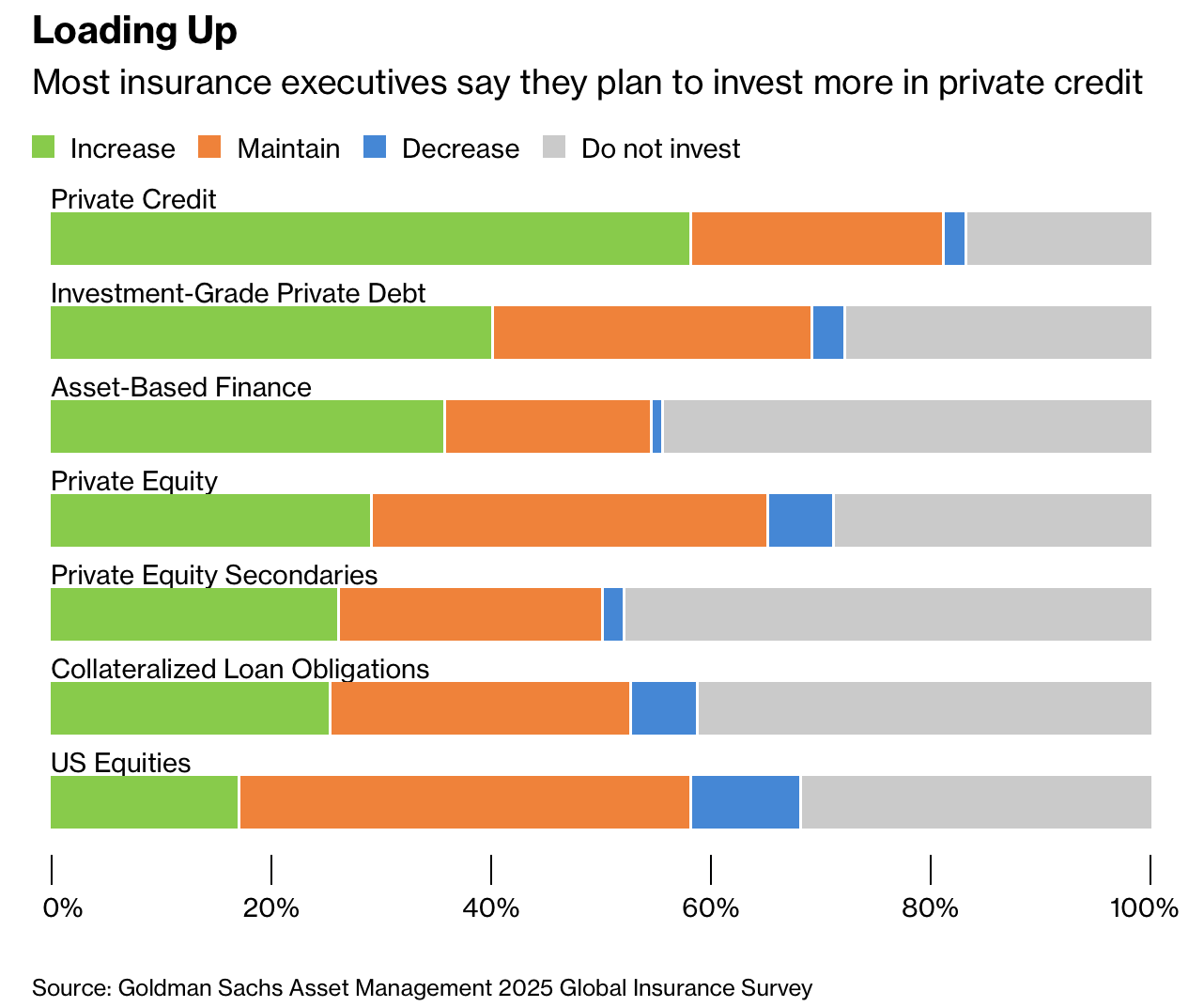

The rising risks in private pensions stem from managers attempting to evade the immutable constraints of “save more, work longer, or take more risk.” Private credit now makes up roughly 35% of North American insurers’ portfolios, up from about 31% a decade ago, as insurers assume defined-benefit liabilities and rely on offshore reinsurance and opaque private assets to minimize capital requirements. Higher stated returns allow lower reserves, but illiquidity and unclear valuations create payout risks. The Bank for International Settlements warns insurers lean on smaller ratings agencies, inflating creditworthiness assessments.

Traditional defined-benefit pensions have chronically underfunded liabilities because institutional incentives encourage unrealistic return assumptions, often leading to insolvencies before regulatory tightening in the 1970s. Today’s surge into private markets repeats this pattern: if insurers’ investments falter, retirees may face weaker protections due to lighter state-level regulation. Public pensions’ persistent shortfalls further demonstrate that risk pooling does not eliminate incentive distortions.

Defined-contribution plans such as 401(k)s benefit from transparency, low-cost investment options, and improved oversight. A proposal to permit investment in private or exotic assets is risky, though problems should remain limited if such assets are not placed in default options. Their main weakness is inadequate management of retirement spending risk despite strong asset accumulation. Future policy solutions must remain transparent, well-regulated, and avoid any pretense of delivering returns without cost.