欧洲对稀土的依赖最难解除,而当中国在去年开始限制出口时,欧洲制造商在2月4日华盛顿关键矿产峰会之前陷入恐慌。中国的筹码来自一条近乎垄断的供应链:约70%的开采矿石、超过90%的精炼,以及九成的磁体,并由整合为少数国家冠军和一套追踪每一吨稀土的系统支撑。

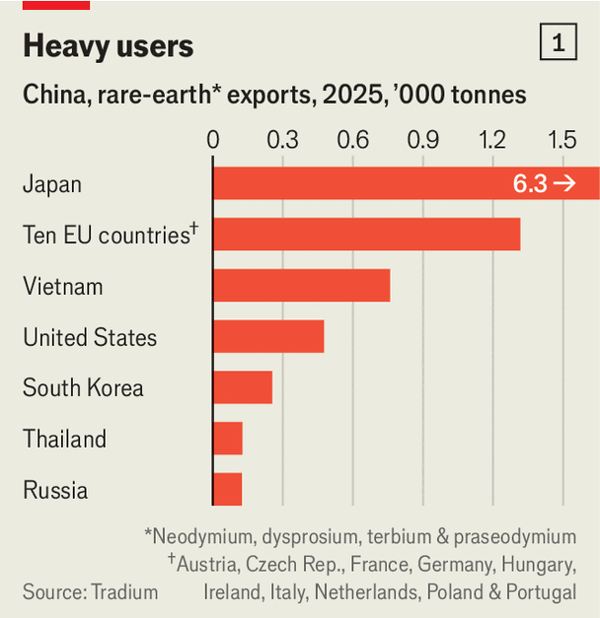

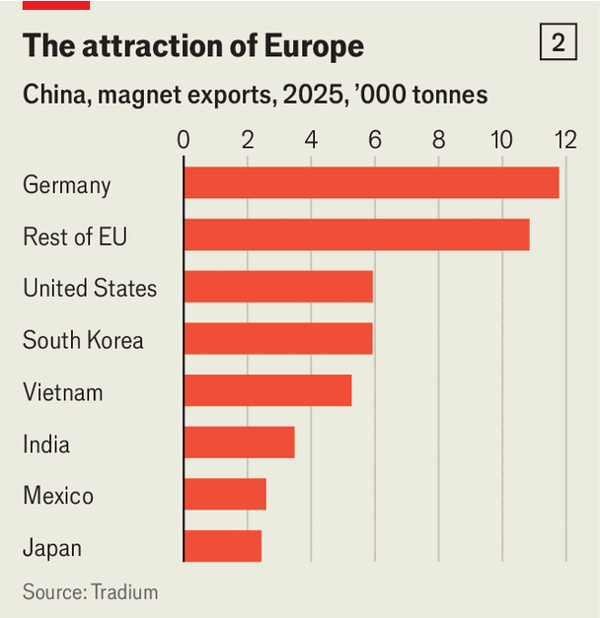

欧洲比美国更暴露——进口关键材料的规模仅次于日本居首,且德国是永磁体的最大进口国——因此在去年夏天涉及ASML的高科技管制之后,中国的报复性限制迫使企业申请许可并交出贸易机密。10月达成的12个月停战使出口重启,但1月对日本再次收紧,加之日本自2010年以来15年的领先以及欧盟27国、动辄两打人参加的协调电话会议,凸显欧洲处境仍然多么脆弱。

在拥挤的2025–26项目管线中,Project Blue列出10个政府支持项目,其中4个由美国赞助,而欧洲只有1个(法国西南部的Carester);同时欧盟12月3日的ResourceEU战略在34种“关键”商品中勉强凑出€3bn($3.6bn),其中只有2种是稀土,而德国的基金支持3个项目。Benchmark Minerals预测到2030年欧盟对关键稀土氧化物的需求可能是美国的2×–3×,且每5个磁体中就有1个流向欧洲,这意味着如果供应冲击再现,联合采购、储备和价格支持工具可能将起决定性作用。

Europe’s rare-earth dependence is the hardest to unwind, and when China began restricting exports last year European manufacturers panicked ahead of a February 4 critical-minerals summit in Washington. China’s leverage comes from a near-monopoly supply chain: about 70% of mined ores, over 90% of refining, and nine-tenths of magnets, backed by consolidation into a handful of champions and a system tracing every tonne.

Europe is more exposed than America—importing more key materials than any country except Japan, with Germany the largest importer of permanent magnets—so China’s retaliatory restrictions after last summer’s high-tech controls (involving ASML) forced firms to seek licences and surrender trade secrets. A 12‑month truce reached in October restarted exports, but January’s renewed tightening toward Japan, plus Japan’s 15‑year head start since 2010 and the EU’s 27-country, two-dozen-attendee coordination calls, underline how fragile Europe’s position remains.

In the crowded 2025–26 pipeline, Project Blue lists 10 government-backed projects, with 4 sponsored by America versus just 1 by Europe (Carester in southwestern France), while the EU’s December 3 ResourceEU strategy scrapes together €3bn ($3.6bn) across 34 “critical” commodities of which only 2 are rare earths and Germany’s fund backs 3 projects. Benchmark Minerals projects EU demand for key rare-earth oxides could be 2×–3× America’s by 2030 and that 1 in 5 magnets will go to Europe, implying that joint procurement, stockpiles, and price-support tools may be decisive if supply shocks recur.

Source: Europe is at China’s mercy to get crucial raw materials

Subtitle: And it is losing out to America in the race for alternatives

Dateline: 1月 29, 2026 07:18 上午 | Berli