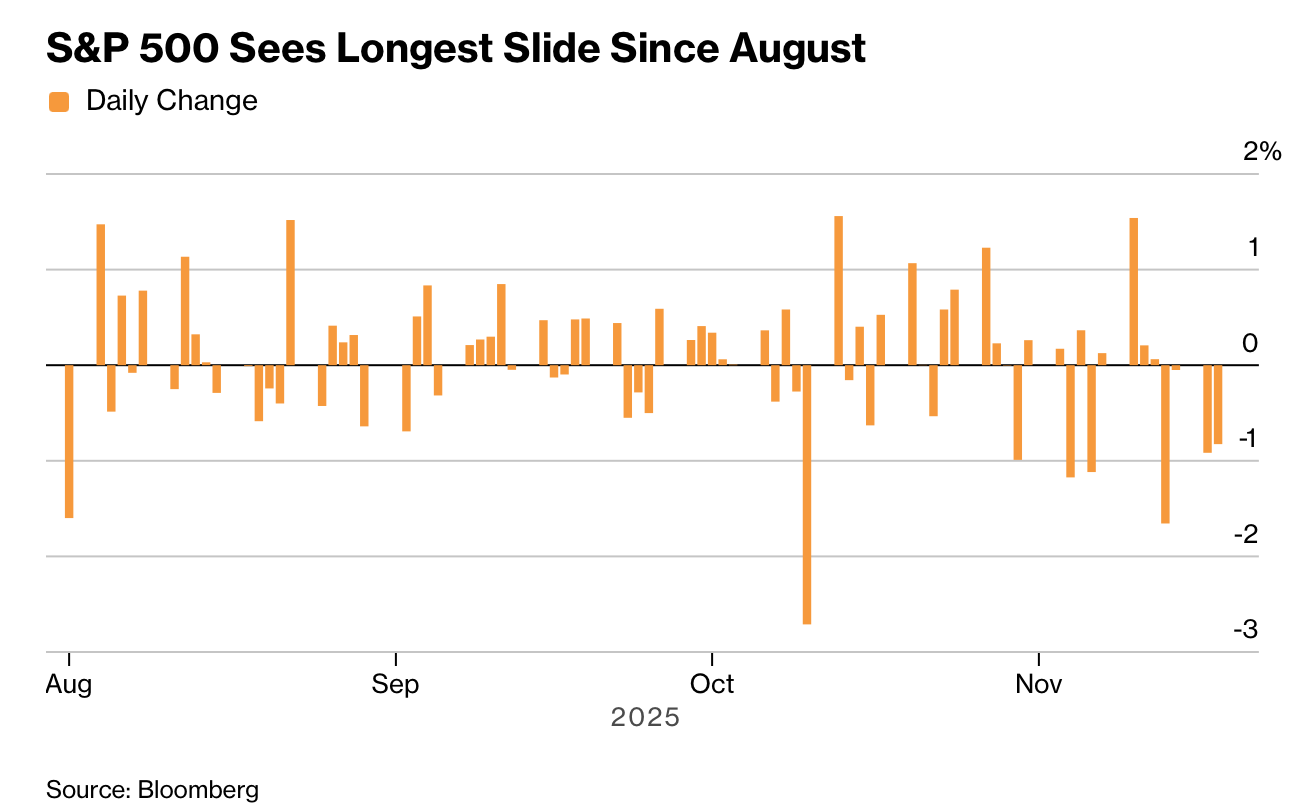

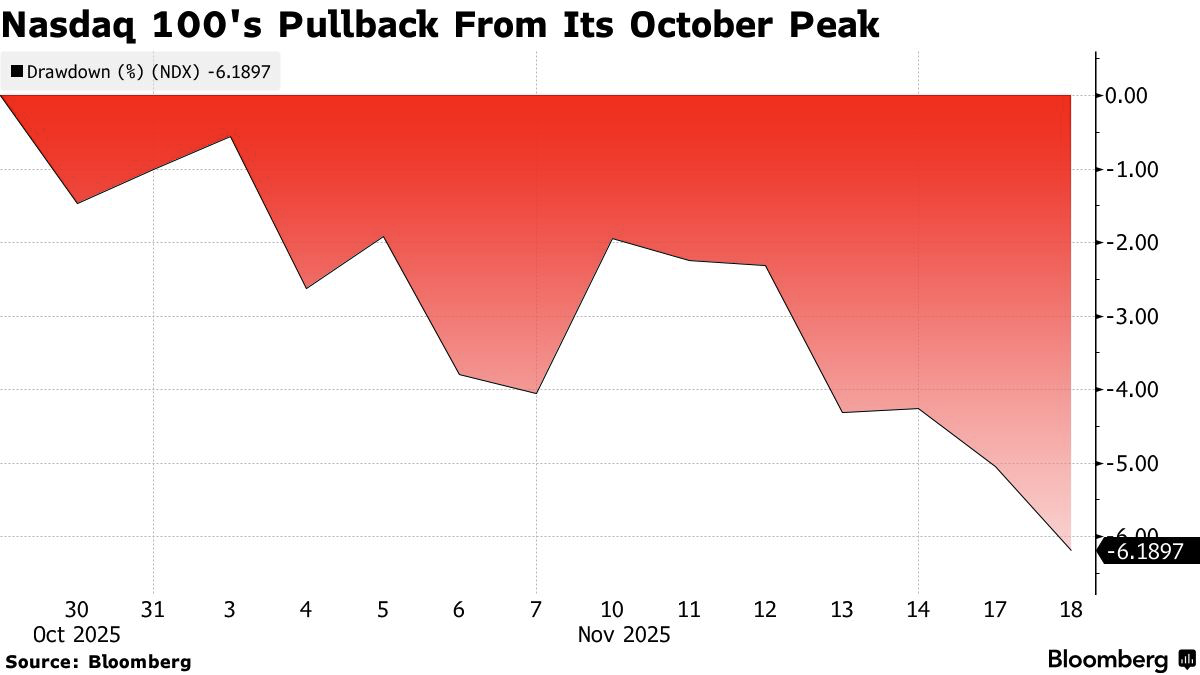

科技巨头抛售引发S&P 500连续第四日下跌、累计近1%,创8月以来最长跌势;科技巨头指数跌1.8%,VIX徘徊在25附近。Nvidia在业绩公布前下跌2.8%,其市值单体已超过能源、材料、房地产之和,部分交易日甚至超过包含公用事业在内的组合。市场担忧AI资本开支增速与盈利滞后背离,BofA调查显示现金仓位跌破关键阈值触发卖出信号,股市敞口仍为2月以来最高,使仓位成为风险资产“逆风”。比特币跌破9万美元后反弹,10年期美债收益率降至4.12%。

分析人士警告AI估值需重新定价。JPMorgan称行业将面临修正,可能波及S&P整体。Redburn首次将Microsoft与Amazon评级从买入下调至中性,质疑生成式AI的牛市逻辑。而HSBC则认为AI支出主要来自现金充裕的巨头,并非泡沫。尽管Nvidia过去11次财报中有8次“全线超预期”,但股价在财报日开盘至收盘八次下跌,显示投资者兑现利润;但分析预期其仍将超预期,且AI周期处于早期阶段。

宏观面加剧市场不安。部分民调委员称12月降息可能被重新定价,因官员担忧通胀放缓停滞。企业债利差近数周高位。美国初请人数维持在23.2万,ADP数据显示截至11月1日四周企业平均每周裁员2500人,反映就业降温。因政府停摆,官方10月就业数据延迟发布,市场转向本周公布的9月就业报告;若数据疲弱,或重新打开12月降息空间并推动年末上涨行情。

A selloff in mega-cap tech dragged the S&P 500 down nearly 1% for a fourth straight session — its longest skid since August. A tech megacap gauge fell 1.8%, and the VIX hovered near 25. Nvidia slid 2.8% ahead of earnings; its standalone market value now exceeds the combined energy, materials, and real-estate sectors, and on some days even surpasses their total including utilities. Concerns are rising that AI capex is outpacing revenue gains. A Bank of America survey showed cash levels falling below a key threshold, triggering an equity “sell signal,” with stock exposure at its highest since February. Bitcoin rebounded after dipping below $90,000, and 10-year Treasury yields eased to 4.12%.

Analysts warn AI valuations require recalibration. JPMorgan sees a looming correction that could spill into the S&P. Redburn cut Microsoft and Amazon to neutral for the first time since 2022, questioning the clarity of the generative-AI bull case; HSBC counters that deep-pocketed incumbents, not leveraged startups, drive spending. Despite Nvidia posting eight “triple plays” in its last 11 reports, its stock has closed lower on eight earnings days, reflecting profit-taking. Still, analysts expect Nvidia to beat expectations and reaffirm a strong early-cycle AI demand path.

Macro signals are amplifying unease. Rate-cut expectations for December are fading as Fed officials warn inflation progress may stall. Credit spreads across IG and junk hover near multiweek highs. Initial jobless claims held at 232,000, and ADP data show firms shed an average of 2,500 jobs per week in the four weeks to Nov. 1, indicating labor softening. With official October jobs data delayed by the shutdown, markets await Thursday’s September report; weaker results could revive hopes for a December cut and fuel a year-end rally.