信用分析师警告,随著杠杆上升,Netflix 可能从目前标准普尔 A 级、穆迪 A3 级被降至 BBB 区间。摩根士丹利建议在公司大量发新债与潜在评级下调之前,卖出 2034 年与 2054 年到期的 Netflix 债券。若监管机构否决此交易,Netflix 将需支付 58 亿美元分手费,却拿不到任何新资产。尽管如此,债券风险利差几乎未变,穆迪近日仍确认 A3 评级,只是将展望由正面调整为稳定,以反映风险略增。

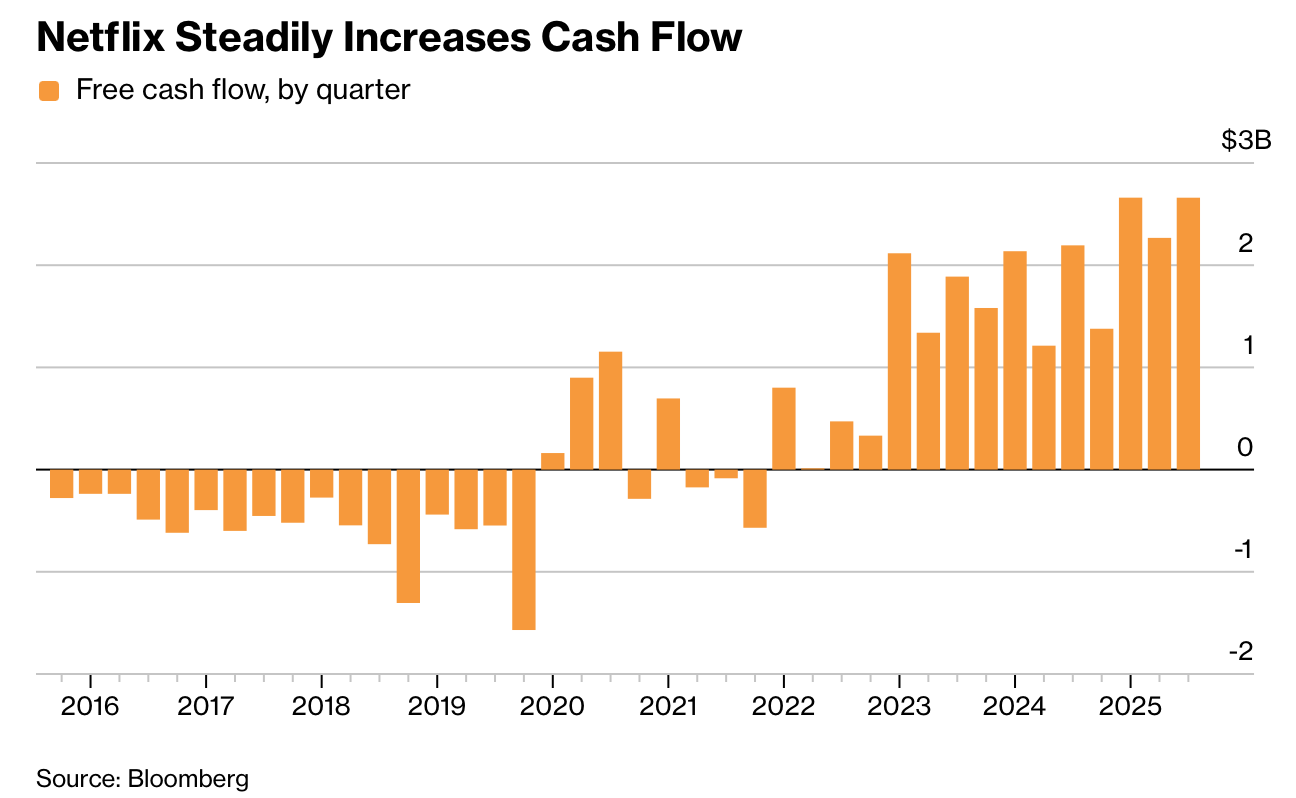

若按目前条款完成收购,Netflix 总债务预计将跃升至约 750 亿美元,而明年税息折旧摊销前获利(Ebitda)预估为 204 亿美元,意味著净负债约为 Ebitda 的 3.7 倍。随著获利成长,杠杆率预期在 2027 年降至中 2 倍区间。公司如今每年产生逾 69 亿美元自由现金流,较疫情前 185 亿美元债务高峰时期大幅改善,也让过去被称为「Debtflix」的负债体质大为转强。

Netflix plans to fund its $72 billion acquisition of most of Warner Bros. Discovery largely with new borrowing, adding to a balance sheet that already carries about $15 billion of debt. The company has lined up $59 billion of temporary bank financing that it expects to refinance with roughly $25 billion of bonds, $20 billion of delayed-draw term loans, and a $5 billion revolving credit facility, while also using internal cash flow. A competing hostile bid from Paramount Skydance values Warner Bros. at over $108 billion including debt, about $26 billion above Netflix’s offer.

Credit analysts warn that Netflix’s rising leverage could trigger a downgrade from its current A/A3 ratings toward the BBB tier as it absorbs Warner Bros. Morgan Stanley recommends selling Netflix notes due 2034 and 2054 ahead of heavy new issuance and possible rating cuts. If regulators block the deal, Netflix would owe a $5.8 billion breakup fee without gaining new assets. Even so, bond risk premiums have barely moved, and Moody’s recently affirmed the A3 rating while shifting the outlook to stable from positive.

If the acquisition closes on current terms, Netflix’s total debt is projected to jump to about $75 billion, while next year’s earnings before interest, taxes, depreciation and amortization are estimated at $20.4 billion, implying net debt of roughly 3.7 times Ebitda. By 2027, that leverage ratio is expected to fall to the mid-2x range as earnings grow. The company now generates more than $6.9 billion of free cash flow annually, a sharp improvement from its pre-pandemic debt peak of $18.5 billion that earned it the nickname 'Debtflix'.