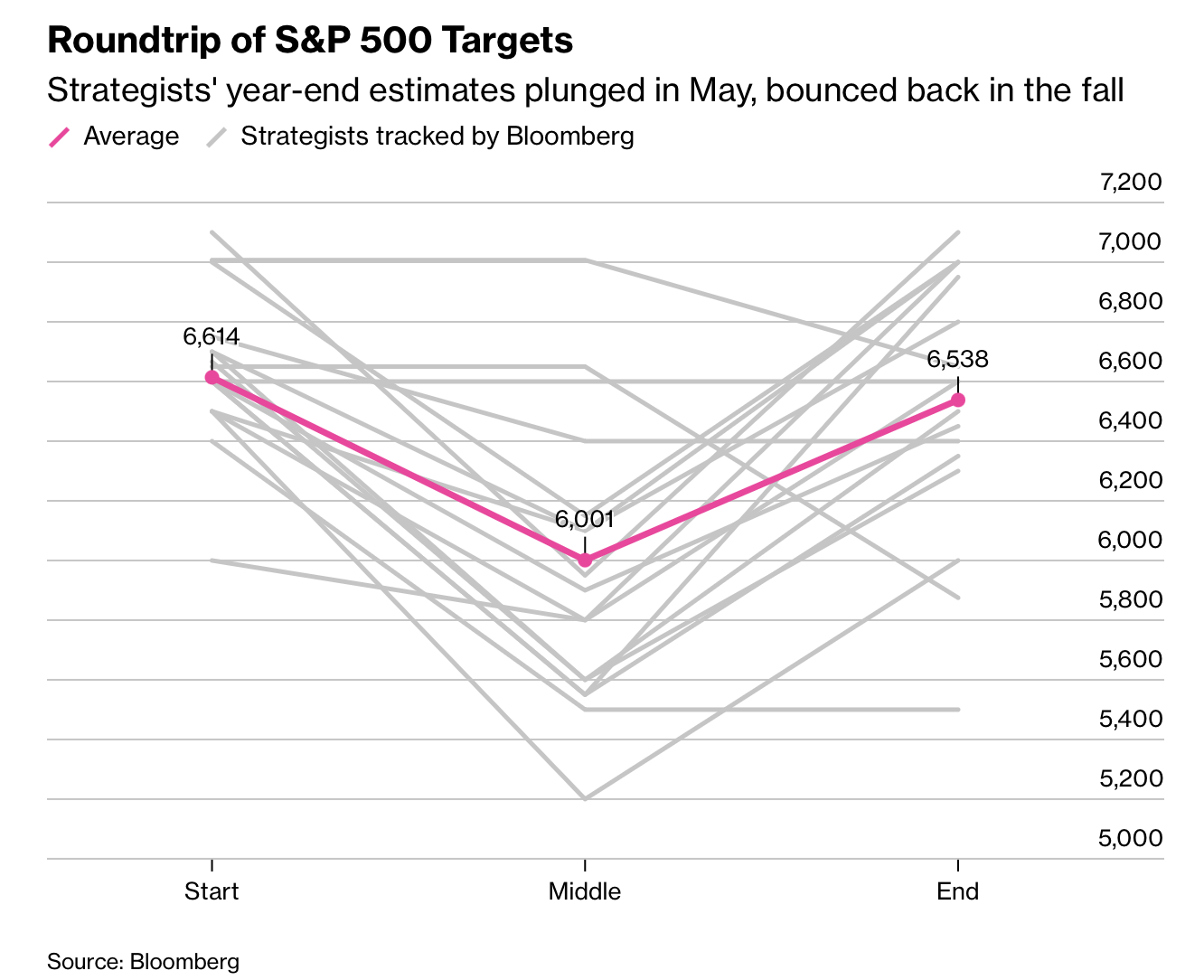

个别目标集中在约7,100至7,700:Ed Yardeni看7,700(较上周五收盘约+11%),Christopher Harvey看7,450(约+8%),摩根大通看7,500。2025年的经验强化了“别低估市场”:标普曾在2月中旬至4月初下挫近20%、逼近熊市,策略师以疫情崩盘以来最快速度下修预测,之后又因为自1950年代以来最迅速的反弹之一而回调上修。

预测失准的数字同样醒目:Harvey押注2025年年终7,007,实际约6,930,仅差约1%;摩根大通4月一度预测2025年下跌12%,最终市场全年仍上涨近18%。风险场景分歧仍大:美银基准目标7,100,但衰退情境可能下跌20%,若盈余大幅超预期则可能上涨25%;支撑多头的数据包括第三季经济增速为两年最快、企业获利预计再现两位数成长,且五大科技巨头贡献了今年标普涨幅近一半。

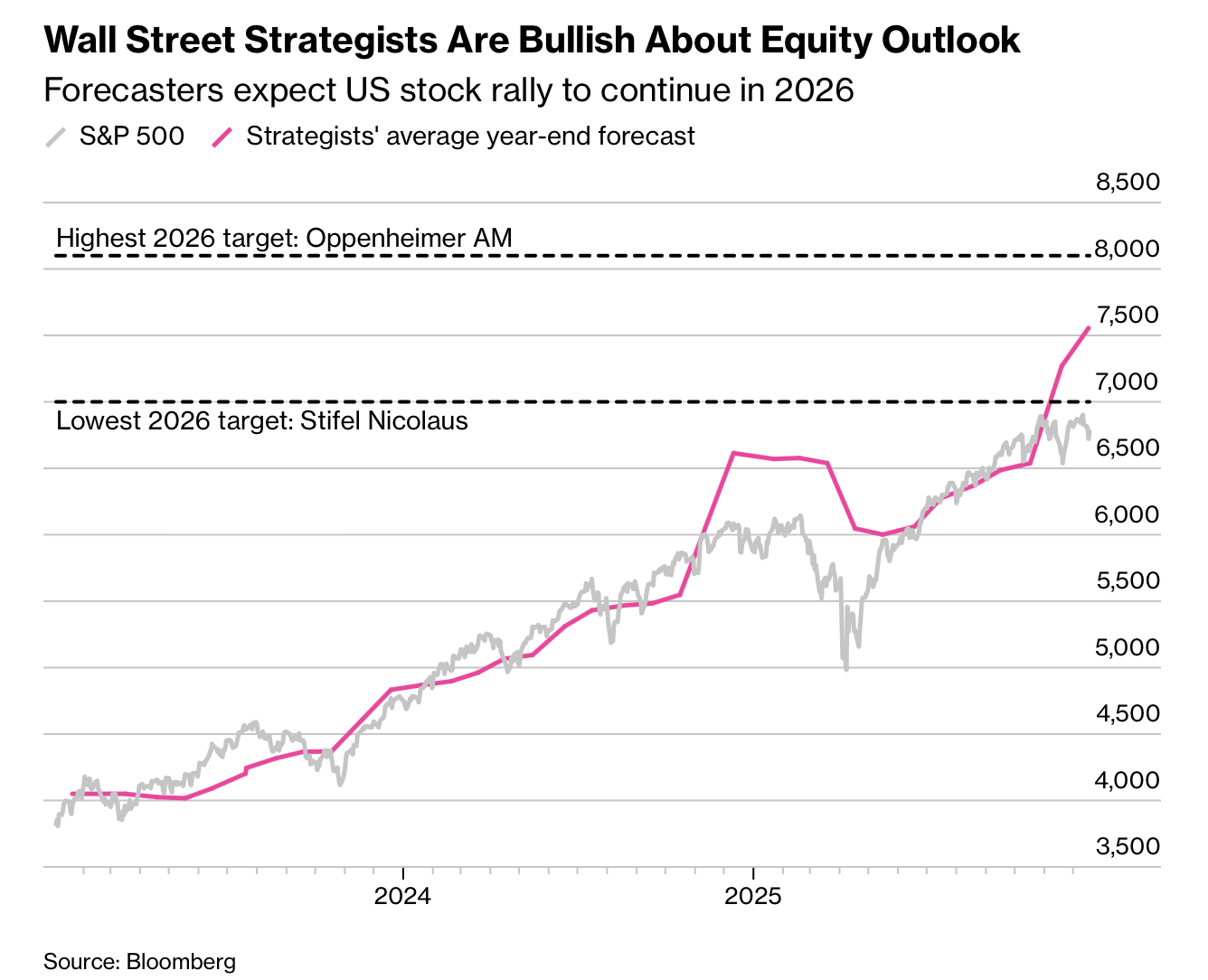

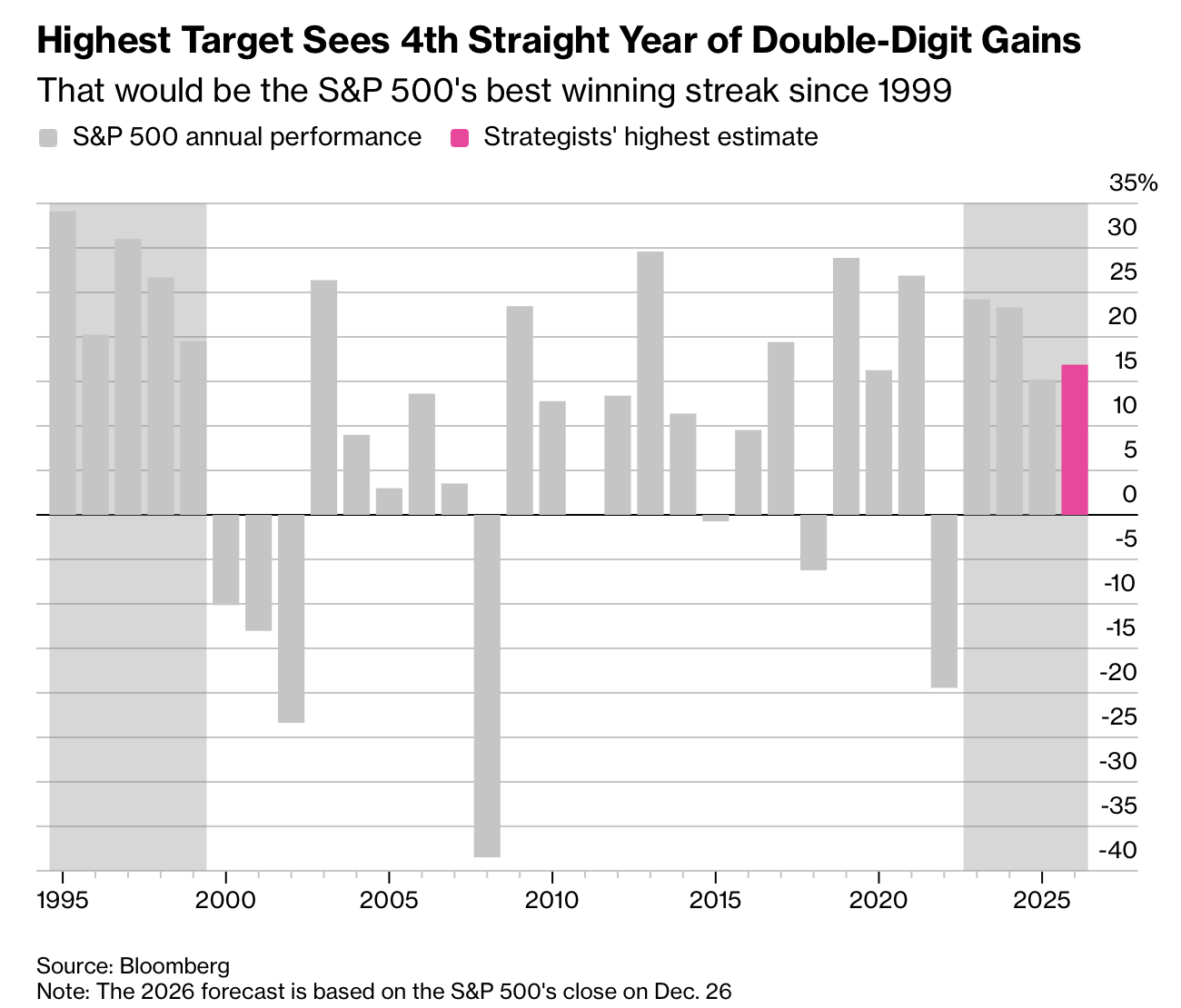

Wall Street has converged on a rare 2026 call: among 21 strategists tracked by Bloomberg, none forecast a decline, and the average year‑end target implies about a 9% gain. That would extend the S&P 500’s run to a fourth straight yearly advance, the longest winning streak in nearly two decades. The index is up roughly 90% from its October 2022 low, amplifying both confidence and the risk of one‑sided consensus.

Targets cluster around 7,100–7,700: Ed Yardeni sees 7,700 (about +11% versus Friday’s close), Christopher Harvey sees 7,450 (about +8%), and JPMorgan sees 7,500. The 2025 path reinforced “don’t underestimate the market”: the S&P fell nearly 20% from mid‑February to early April, driving the fastest wave of forecast cuts since the Covid crash, before a rebound described as among the swiftest since the 1950s.

Recent misses quantify the uncertainty: Harvey’s 2025 call of 7,007 landed near an actual ~6,930 (about 1% short), while JPMorgan swung from a -12% 2025 forecast in April to a year that ultimately rose nearly 18%. Scenario ranges remain wide: Bank of America’s base is 7,100, but a recession could mean -20% and upside earnings could mean +25%. Bulls cite Q3 growth at the fastest pace in two years, another year of double‑digit earnings growth, and the five biggest tech firms driving nearly half of this year’s S&P advance.