MSCI China 指数成分企业在第三季出现 1.1% 的负向盈余惊喜,延续前季疲弱走势,覆盖指数市值 97% 的公司中,房地产与消费板块的失误抵消原材料与金融的正面表现。工业利润在短暂反弹后再度转跌,使通缩压力持续。电动车厂商 Li Auto、Nio 与 Xpeng 受价格战与补贴减少拖累,营收与交付指引皆未达预期;Xiaomi EV 与 Geely 虽录得强劲增长,但税收优惠缩减使其面临利润率风险。材料企业因金价飙升而显著受益,Zijin Mining 净利大增 57%,Jiangxi Copper 增长 35%;太阳能企业仅小幅改善,Longi Green Energy 第三季亏损收窄。

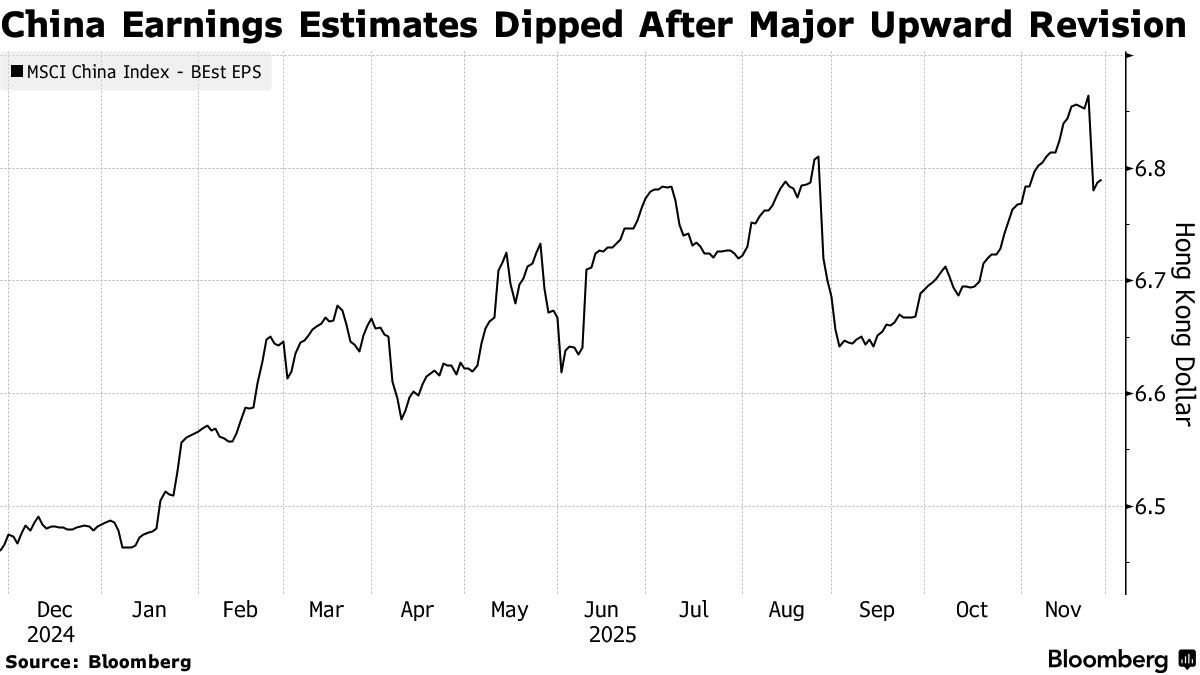

投资者先前因 Xi Jinping 的“反内卷”承诺而推升多板块估值,但企业盈利改善有限,使中国对抗通缩的成效受质疑。豪宅销售逆势上升,显示消费呈现“K 型”结构,有利高端奢侈领域。然而科技股动能减弱,Alibaba 利润暴跌,因消费补贴与数据中心支出跳升;Baidu 出现史上最严重单季营收跌幅,反映广告走弱与高成本的 AI 投资压力。整体来看,今年股市涨幅主要由估值扩张驱动,缺乏盈利支撑。

MSCI China 的积极预期倚赖 2026 年电商增长回升与价格战缓和。Morgan Stanley 表示未来指引至关重要,弱消费可能压制非必需品支出。分析师普遍认为 2026 年盈利复苏为关键变量,反内卷措施预计将扮演更大角色,但当前数据趋势显示复苏动力不足,市场仍面临持续通缩与盈利下修风险。

MSCI China Index members recorded a 1.1% negative earnings surprise in the third quarter, extending prior weakness, based on companies representing 97% of index market capitalization. Real estate and consumer-sector disappointments offset materials and financials. Industrial profits resumed decline after a brief rebound, reinforcing deflation pressures. EV makers Li Auto, Nio, and Xpeng missed revenue and delivery forecasts due to price wars and reduced subsidies; Xiaomi’s EV unit and Geely posted strong growth but face margin risks as tax incentives shrink. Materials firms benefited from surging gold prices, with Zijin Mining posting a 57% net-income jump and Jiangxi Copper up 35%. Solar firms showed slight improvement, with Longi narrowing losses.

Investors previously bid up sectors expecting Xi Jinping’s “anti-involution” pledge to drive an earnings turnaround, but results remain weak. Luxury property sales bucked the downturn, signaling a K-shaped consumption pattern favoring premium segments. Technology stocks lost momentum: Alibaba’s profits plunged amid rising subsidy and data-center spending, while Baidu reported its steepest quarterly revenue drop on record due to weakening ads and costly AI projects. Much of this year’s equity gains have been valuation-driven, lacking earnings support.

Any bullish MSCI China outlook relies on expectations of faster e-commerce growth in 2026 as price wars ease. Morgan Stanley stressed that year-end and 2026 guidance will be decisive, warning that soft consumption may suppress discretionary spending. Analysts argue that earnings recovery will be critical in 2026, with anti-involution measures likely to play a larger role, but current data trends point to insufficient momentum, ongoing deflation, and continued earnings downgrades risk.