结果与保守派的「搭便车效应」(修宪、如夫妻别姓等社会议题,以及更鹰派的安全立场)有关,加上竞争对手在右派相对乏力,以及主流反对派阵营的崩溃。政策与财政辩论的核心在于她承诺将食品的 8% 消费税冻结 2 年:在日本国债(JGB)殖利率上升之际,她在竞选期间低调主打,但选后表示谈判将加速,并可能接著提出税法修正案;高盛(Goldman Sachs)认为暂时性调降未必会对财政指标造成实质恶化,同时警告政治风险在于「暂时」减税可能变成永久,尤其若再加上更高的国防支出与上升的利息成本,可能把债务对 GDP 比率推上长期上行路径。

市场起初重新定价所谓的「高市交易」(股票上涨、日圆下跌、殖利率上升,包括 30 年期殖利率),尽管穆迪分析(Moody’s Analytics)指出日本的赤字如今是 G-7 中最小,且财政状况约为 15 年来最强;仅食品减税一项估计就会使年度收入减少约 5 兆日圆。在国内,自民党拿下 316 席,在 465 席的议院取得 2/3 超级多数,可掌控委员会、推翻参议院否决,并推动修宪动能;短期时程包含 1 月 19 日解散、可能在 2 月 18 日召开特别国会以选出首相,以及 4 月度过财政年度预算截止期(通常约需 2 个月审议,如今被压缩,意味可能需要暂行预算)。未来风险取决于如何为国防增支筹资、日本央行(BOJ)正常化(某一基准情境预期在 6 月与 12 月每 6 个月升息一次,并在 2027 年 6 月再升一次),以及地缘政治与既定里程碑:3 月 19 日赴美会见唐纳德・川普(Donald Trump)总统、4 月川普与习近平(Xi)在中国会面,以及在深圳于 11 月 18-19 日举行的 APEC 上可能出现日中领袖接触窗口。

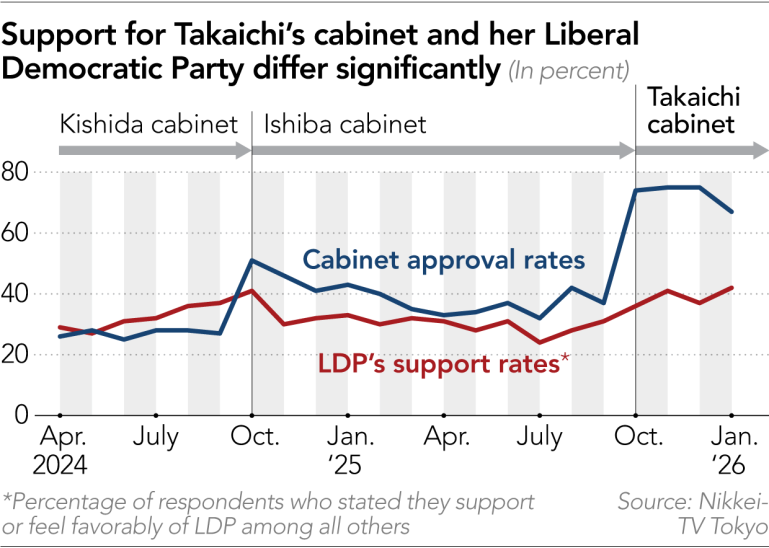

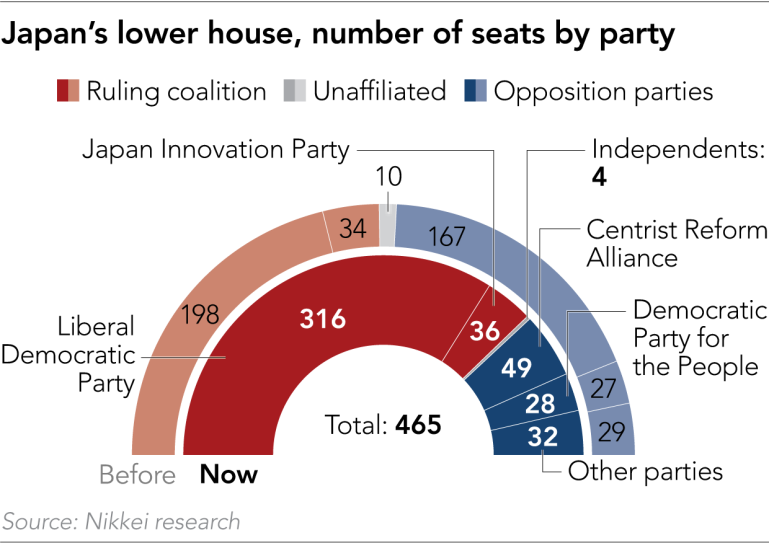

Prime Minister Sanae Takaichi called a snap lower house election and won a postwar-scale landslide, Japan’s 2nd national election in under 16 months, giving the Liberal Democratic Party (LDP) a strong mandate while she says she will still keep the coalition with the Japan Innovation Party. The win follows unusually strong personal numbers, with her approval hovering near 70% since taking office in October versus an LDP support rate around 40%, and markets are now focused on how far she will really push an aggressive agenda of tax cuts and higher defense spending that had already unsettled investors pre-election.

The result is tied to a conservative “coattail effect” (constitutional revision, social issues like separate surnames, and a hawkish security posture), plus relative weakness on the right among rivals, and a collapse of the mainstream opposition bloc. Policy and fiscal debate centers on her promise of a 2-year freeze of the 8% consumption tax on food: she campaigned quietly on it as JGB yields rose, but post-election said talks would accelerate and a tax-law revision bill could follow; Goldman Sachs argued a temporary cut may not materially worsen fiscal metrics, while warning the political risk is a “temporary” cut becoming permanent, especially alongside higher defense outlays and rising interest costs that could push the debt-to-GDP ratio onto a long-run upward path.

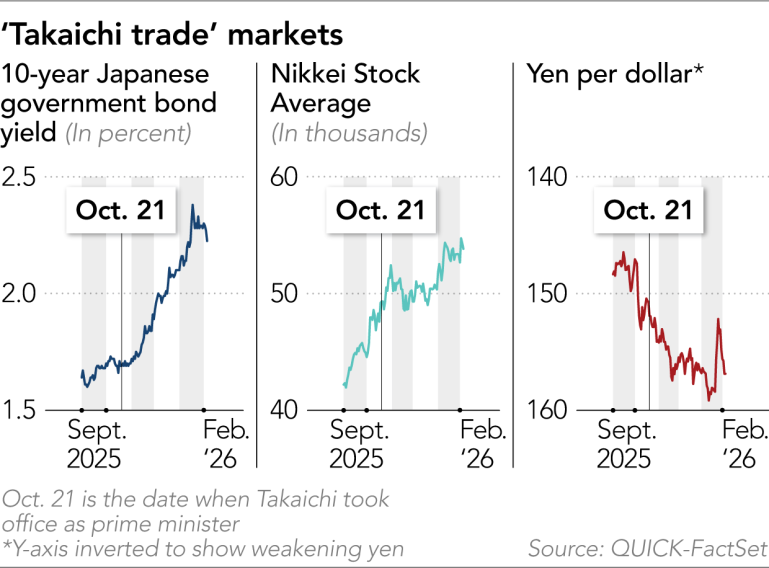

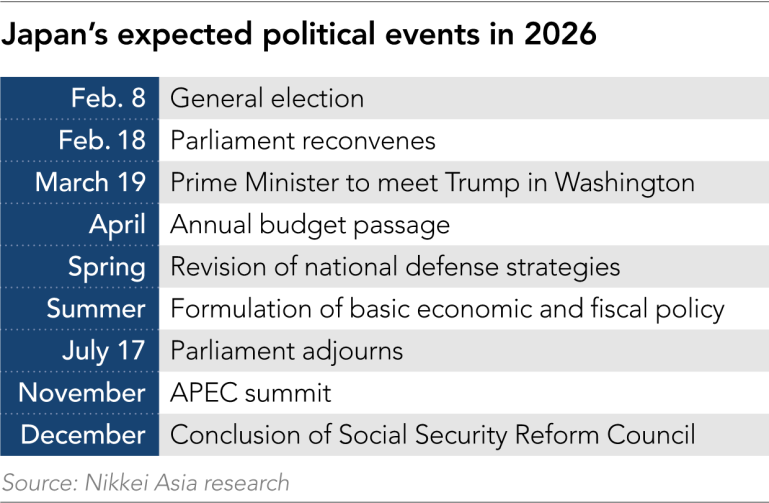

Markets initially repriced into the so-called “Takaichi trade” (stocks up, yen down, yields up, including 30-year yields), even as Moody’s Analytics noted Japan’s deficit is now the smallest in the G-7 and fiscal conditions are the strongest in about 15 years; the food-tax cut alone is estimated to reduce annual revenue by about 5 trillion yen. Domestically, the LDP won 316 seats, a 2/3 supermajority in the 465-seat chamber, enabling committee control, override of an upper-house veto, and momentum toward constitutional amendments; near-term timelines include a Jan. 19 dissolution, a likely Feb. 18 special session to elect the prime minister, and an April fiscal-year budget deadline (often about 2 months of deliberation, now compressed, implying an interim budget). Forward risk hinges on financing defense increases, BOJ normalization (one baseline expects hikes every 6 months in June and December and again in June 2027), and geopolitics with scheduled milestones: a Mar. 19 U.S. trip to meet President Donald Trump, a Trump–Xi meeting in China in April, and a potential Japan–China leader contact point at APEC in Shenzhen on Nov. 18-19.