在过去二十多年里,智能手机形成了史上最赚钱的双头垄断之一:苹果以 iPhone 占据高端,谷歌以 Android 覆盖几乎所有其他机型,并且谷歌每年向苹果支付巨额费用以保持其搜索引擎为默认选项,同时两者还宣布苹果将把谷歌的 Gemini 大模型用于计划于今年推出的升级版 Siri。挑战者仍在加速:1 月 19 日 OpenAI 表示其设备“按计划”将在今年下半年亮相,两天后又传出苹果在研发可穿戴“别针”,Meta 把资源从 VR 头显转向 AI 智能眼镜,亚马逊已向 Echo 音箱推出 Alexa+ 并将很快扩展到眼镜和耳机。

智能手机前景转弱的量化信号更明确:Counterpoint 预计今年全球出货量将下滑 6%(先前预测为下滑 2%),且看不到 2027 年反弹,而 2025 年出货量曾增长 2%。成本与供给也在挤压:过去 15 个月里,手机常用的 12GB DRAM 成本上升了 70 美元,同时“晶圆代工之战”让更高价值的 AI 芯片(如面向 Nvidia 等设计商)优先占据产能,使手机厂商更难锁定所需芯片并承受利润压力。

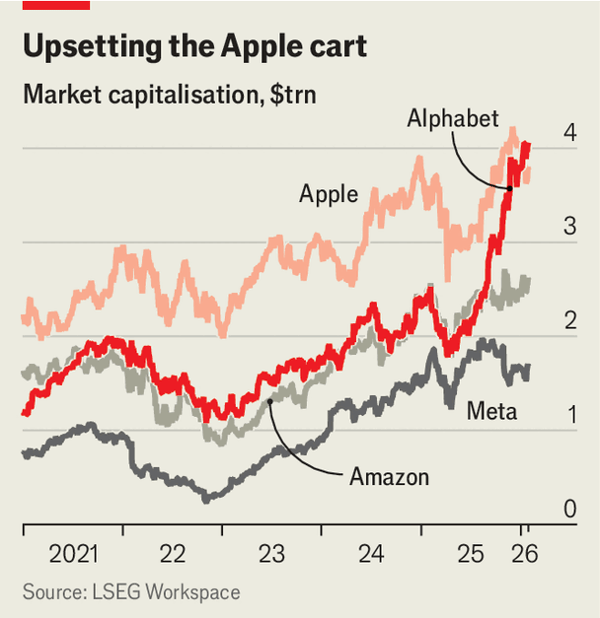

商业模式上的“抽成”和数据变化进一步推高替代设备的动机:开发者在苹果生态内应用内购买最高需支付 30% 佣金,OpenAI 的订阅收入若经 iPhone 或 Android 购买也要被分走一部分,而 Meta 虽主要靠广告变现,却在 2021 年因用户可选择退出跨应用与网站追踪而受挫。规模对比仍悬殊:HSBC 估算全球智能眼镜用户约 1500 万,而苹果被认为仅去年就售出约 2.5 亿部 iPhone(约 17 倍),且隐私、散热与电池限制持续存在——2014 年发布的谷歌眼镜约一年后即被叫停,2023 年 11 月高调推出的 AI 别针也因过热与续航等问题失败;长期看更可能是“边缘”设备配合口袋里的“算力圆盘”或手机,并且随着 Gemini 跨苹果与 Android 嵌入,Alphabet 的市值近期已超过苹果,双头垄断内部的利益分配或被改写。

Over the past two decades, smartphones have produced one of the most lucrative duopolies in business history: Apple’s iPhone at the top end and Google’s Android on nearly every other handset, reinforced by Google paying Apple large sums each year to remain the default search engine, even as both now plan to use Google’s Gemini models to upgrade Siri this year. Challengers are still accelerating: on January 19 OpenAI said its device was “on track” for the second half of the year, two days later Apple was reported to be building a wearable “pin,” Meta is shifting resources from VR headsets to AI smart glasses, and Amazon has launched Alexa+ for Echo speakers with plans to extend it to smart glasses and earbuds.

Quantitative signs also point to a tougher smartphone cycle: Counterpoint expects global shipments to fall 6% this year (worse than a prior 2% decline forecast), sees no rebound in 2027, and notes shipments grew 2% in 2025. Cost and supply pressures are rising too: the price of the 12GB of DRAM commonly used in a phone has increased by $70 over the past 15 months, while a “foundry war” favors higher-value AI chips, making smartphone makers less important customers and squeezing margins and access to capacity.

Business-model tolls and data shifts add incentive to bypass phones: developers can pay up to a 30% commission to Apple on in-app purchases, OpenAI must cede a share of subscriptions bought via iPhone or Android, and Meta—though ad-funded—was hit by Apple’s 2021 opt-out tracking change. The installed base remains lopsided—HSBC estimates 15m smart-glasses users worldwide versus an estimated 250m iPhones sold last year alone (about 17x)—and privacy, heat, and battery constraints persist, with Google Glass launched in 2014 and halted about a year later and a much-hyped AI pin launched in November 2023 flopping; the nearer-term path is “edge” gadgets paired with a pocket “puck” or smartphone, while Gemini’s spread across both ecosystems may shift spoils inside the duopoly as Alphabet’s market value has recently moved past Apple’s.

Source: Will the smartphone survive the AI age?

Subtitle: The Apple-Android duopoly is under attack from OpenAI, Meta and Amazo

Dateline: 1月 29, 2026 05:47 上午 | San Francisco