中国公布了一揽子以数字为核心的激励措施以提振投资和消费,其中包括规模达5000亿元人民币(约720亿美元)的贷款担保工具,期限为两年,旨在鼓励民营企业扩大借贷用于发展。该计划支持合格企业在设备、原材料采购及技术改造等方面的支出,由Ministry of Finance发布。配套政策还包括对中小企业提供为期两年的贴息支持。

具体而言,中小企业在与固定资产或政策性银行融资工具覆盖项目相关的贷款上,可获得年化1.5个百分点的利息补贴,单一借款人可享受贴息的贷款上限为5000万元人民币。财政部副部长Liao Min表示,这些措施的直接目标是降低融资成本、提高融资可得性,并通过改善利润状况来刺激民间投资。

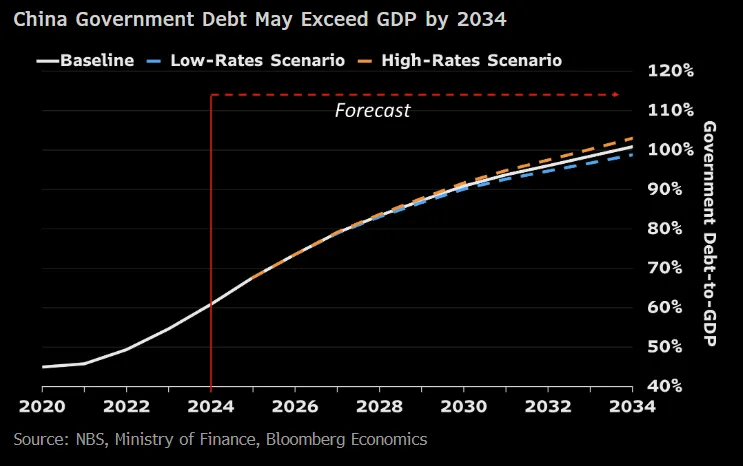

政策出台的背景是最新数据显示,中国经济在去年呈现“二速增长”:出口强劲支撑工业生产,使全年增速达到约5%的官方目标,但消费疲弱、投资出现前所未有的下滑。领导层已将2026年扩大内需列为首要任务。财政部表示,2026年公共支出将高于2025年,预算赤字和政府债券发行规模维持在“必要”水平,同时延长消费者贷款贴息政策至今年底,并将企业设备更新和技术创新相关借款纳入支持范围,以在稳增长与财政可持续性之间取得平衡。来源:Bloomberg

China announced a numerically significant package to boost investment and consumption, centered on a 500 billion yuan ($72 billion) loan guarantee facility lasting two years to encourage private companies to borrow for expansion. The program supports spending on equipment, raw materials, and technology upgrades, according to the Ministry of Finance. Complementary measures include targeted interest subsidies for small and medium-sized enterprises.

Specifically, SMEs can receive an annual interest subsidy of 1.5 percentage points for two years on loans tied to fixed assets or projects covered by policy bank financing tools, with a per-borrower cap of 50 million yuan in subsidized loans. Vice Finance Minister Liao Min said the measures aim to lower borrowing costs, improve access to financing, and translate cost savings into higher profitability to spur private investment.

The policy backdrop is recent data showing a two-speed economy last year: strong exports supported industrial output and helped growth reach the official target of about 5%, while consumption remained weak and investment suffered an unprecedented slump. Leaders have made boosting domestic demand the top priority for 2026. The ministry said public spending this year will exceed 2025 levels, with the budget deficit and government bond issuance kept at “necessary” levels, while extending consumer loan discounts through year-end and expanding support to include technology-related borrowing, balancing near-term stimulus with fiscal sustainability. Source: Bloomberg