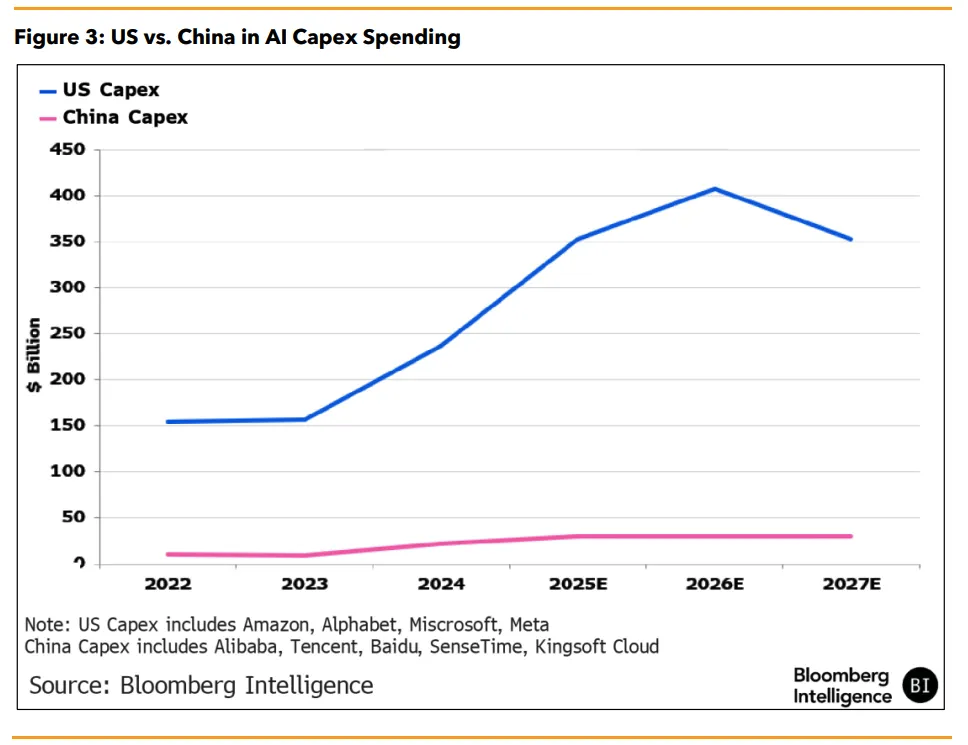

中国在生成式 AI 竞赛中位居全球第二,但产业结构呈现“高投入、低回报”特征。Bloomberg Intelligence 指出,中国 AI 资本支出预计在 2026 年约为 320 亿美元,不足美国三大云厂商动辄每家逾 1,000 亿美元的十分之一;DeepSeek 9 月将输出 token API 价砍至 0.42 美元,较 GPT-4o/5 低 96%、较 Claude Sonnet 4 低 97%,反映极端价格战压缩行业利润。国内厂商普遍依赖免费开源模型与极低 API 定价,加上阿里、百度、腾讯等主动补贴国家 AI 战略,使商业化能力长期受限。

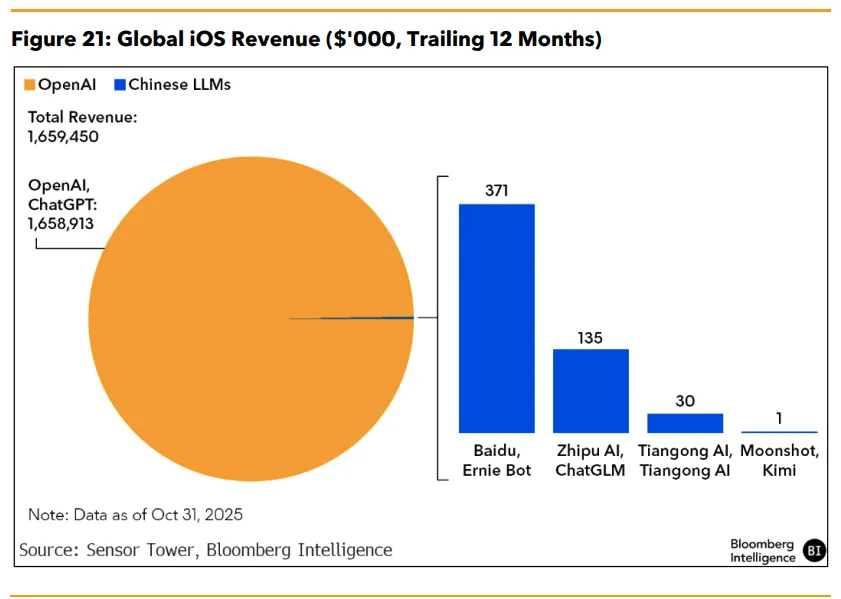

杀手级应用缺失进一步限制收入增长。ChatGPT 与 Gemini 在美国能通过订阅建立稳定收入,但在中国,价格竞争迫使多家平台放弃收费,百度在 4 月将文心一言改为全免费。更高算力的图像、音乐、视频生成尚无成熟盈利路径,快手 Kling 是少数成功案例,但年收入仅约 1 亿美元。AI 受限于模式识别本质,缺乏真正上下文理解与推理力,难以创造全新市场。与此同时,中国科技股上涨主要源于情绪而非利润改善,恒生科技指数 2025 年盈测由 7 月的 +3% 下修至 –9%,即便市场预期 2026 年反弹 +28%,BI 认为过度乐观。

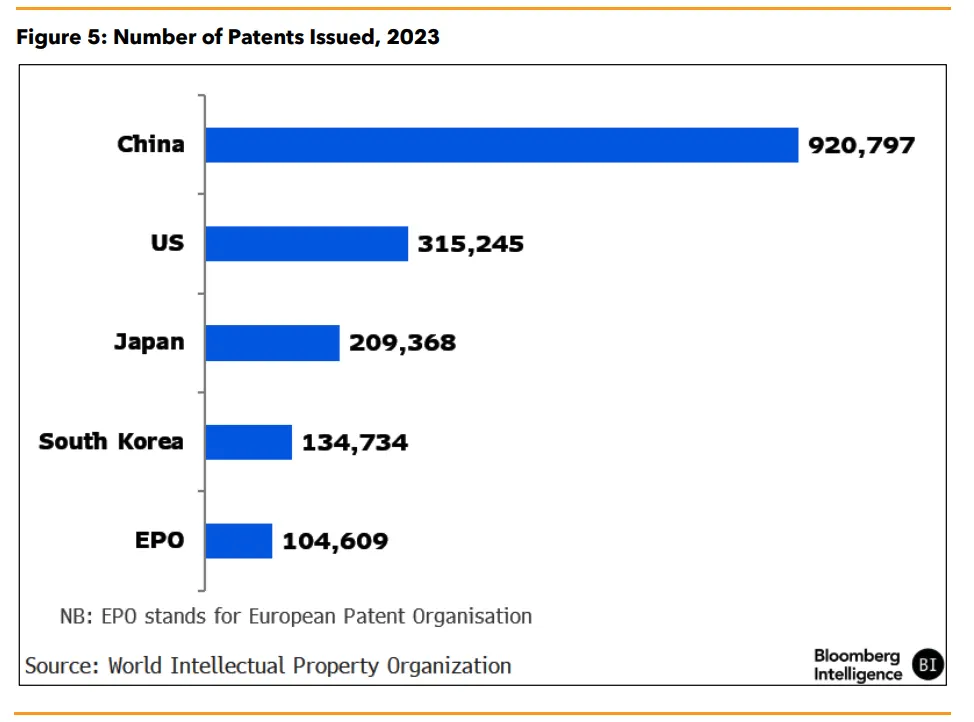

长期看,中国具备规模庞大的本土人才与科研投入,在专利、5G、电动车、光伏等领域突破显著,DeepSeek 的意外崛起也印证创新能力增强。然而缺乏顶级 Nvidia 芯片、资本开支受限、消费者软件付费意愿弱,使中国 AI 商业化路径漫长且利润微薄。美国占据二季度全球前十大 AI 融资案中的九个,并掌握最强硬件供应链,形成结构性领先,使中企即便技术进步也面临长期资金与市场化鸿沟。

China ranks second globally in generative AI but operates under a “high-investment, low-return” model. Bloomberg Intelligence estimates China’s AI capex for 2026 at about $32 billion—less than one-tenth of the >$100 billion each signaled by Alphabet, Meta, and Amazon. DeepSeek’s September output-token API cut to $0.42 represents a 96% discount to GPT-4o/5 and 97% below Claude Sonnet 4, underscoring intense price competition and thin margins. Free open-source models and ultra-low API pricing, combined with Alibaba, Baidu, and Tencent effectively subsidizing national AI ambitions, suppress commercial profitability.

The absence of killer applications further limits monetization. While ChatGPT and Gemini can generate steady subscription revenue in the US, Chinese platforms face such severe price pressure that many abandoned charging entirely—Baidu made Ernie Bot free in April. Compute-heavy image, music, and video generation lack viable revenue models; Kuaishou’s Kling is among the few successes, but generates only about $100 million annually. Current AI, driven by pattern recognition rather than true reasoning, cannot create new markets. Meanwhile, Chinese tech valuations reflect sentiment, not earnings: the Hang Seng Tech Index 2025 earnings outlook fell from +3% in July to –9%. Even the consensus expectation of a 28% rebound in 2026 is viewed by BI as overly optimistic.

Over the long term, China retains strength in talent and sustained science investment, with notable breakthroughs in patents, EVs, 5G, solar, and DeepSeek’s rise. But lacking access to top-tier Nvidia chips, facing constrained capex, and given weak consumer willingness to pay for software, China’s AI commercialization path remains long with limited profit potential. The US dominates hardware supply and nine of the 10 largest global AI fundraising deals in Q2, positioning American firms structurally ahead and leaving Chinese players with persistent funding and market-monetization gaps.