数据显示,今年前11个月赴日中国旅客达870万人次,较2024年增近40%;2024年则被描述为「几乎成长到三倍」。中国旅客占日本总入境旅客逾20%,使任何增速下滑都被迅速放大到餐饮、导游、包车、民宿、和服租赁等依赖中文服务与微信支付/支付宝结算的业态。

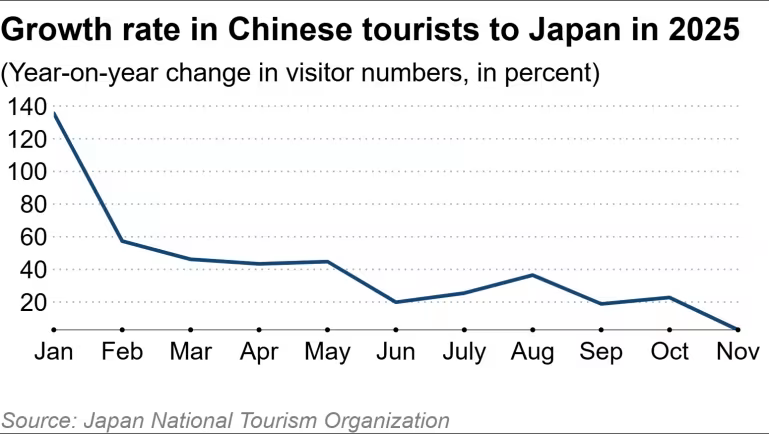

趋势在11月明显降温:在航班削减下,中国旅客11月增长仅3%,与年初以来的两位数扩张形成对比。政策面也趋严:日本10月将经营管理签证最低资本门槛提高6倍至3000万日圆,并加码学历与经验要求,叠加在日中国居民(6月底逾90万人、占外国居民23%)对排外情绪与监管加速的担忧。

After China’s Nov. 14 warning advising citizens to avoid travel to Japan, the China-focused “one-dragon” tourism supply chain in Japan—Chinese-run lodging, transport, food, entertainment, and payment flows—saw rapid contraction. One analyst suggested the untracked market could exceed ¥1 trillion ($64B) annually, but December bookings were widely canceled and fee collection became contentious.

China remains Japan’s largest inbound source: 8.7 million visitors arrived in the first 11 months, nearly 40% higher than 2024, after 2024’s visitor count was described as nearly tripling. With Chinese tourists accounting for over 20% of total visitors, even modest slowdowns quickly hit Chinese restaurants, guides, chauffeurs, vacation rentals, and kimono-rental shops built around Chinese-language service and WeChat Pay/Alipay.

The statistical inflection appeared in November: growth from China slowed to just 3% as airlines reduced Japan flights, contrasting with earlier double-digit expansion. At the same time, tighter rules raised business-manager visa capital requirements sixfold to ¥30 million and added stricter qualifications, amplifying uncertainty among over 900,000 China nationals in Japan (23% of foreign residents as of end-June).