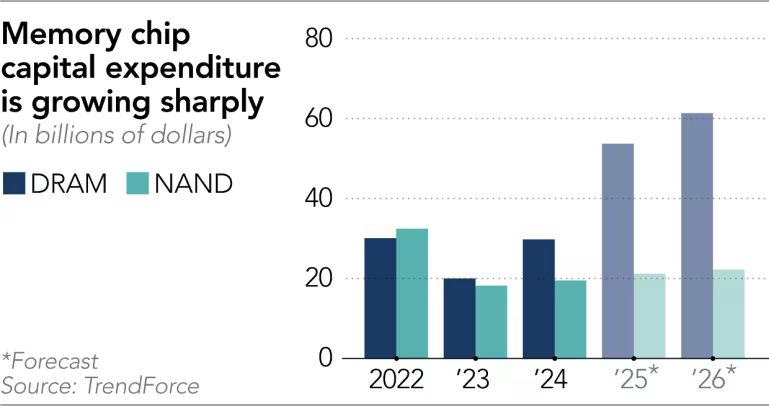

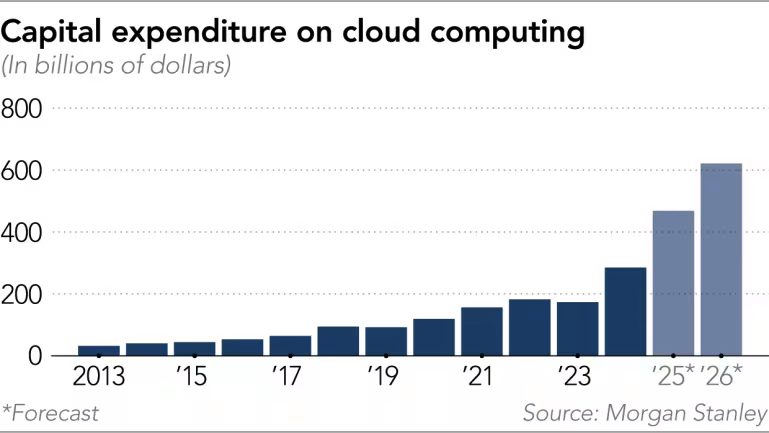

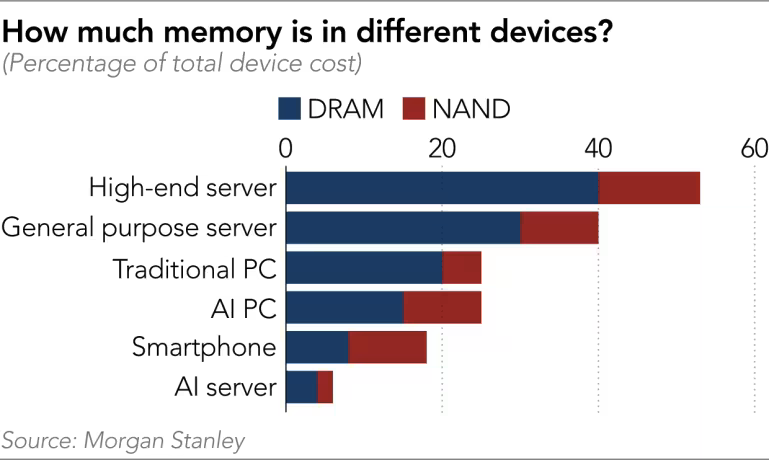

全球AI基础设施建设推升DRAM、NAND与HBM需求,使三星、SK海力士、Micron等主要厂商2025–2026年产能几乎“售罄”。OpenAI单月签下90万片HBM晶圆订单;云服务商AI服务器投入将从2024年的2850亿美元跃升至2025年的4680亿美元、2026年的6210亿美元。DDR4被迫让位于DDR5及HBM生产,导致DDR4现货价同比飙升840%至约30.30美元,甚至高于DDR5的约20美元(同比+316%)。NAND供应同样吃紧,预计2026年前缺口将持续。

行业高端化导致中小厂商与白牌PC面临断供风险。大型客户锁定供应,但较小买家需每日竞价,部分NAND厂商今年已涨价70%,仍无法获得额外数量。SSD需求在2025年三季度后急剧上升,使2026年NAND“bit gap”预计超过10%,相较2025年的不足2%。行业分析预计2025年四季度NAND平均价将上涨15–20%,2026年上半年再涨低至中双位数。HBM优先化亦推高传统DRAM价格,AI需求正在“挤出”非AI应用的供给。

股价随周期强劲反弹,Micron六个月涨幅超过150%,三星超过70%,Winbond利用率回到100%。尽管行业盈利率已从常态的约15%升至当前的15–20%,并可能在2026年刷新纪录,但下游压力显著。Pegatron称DRAM供应“手停口停”;Asus库存仅四个月,预计需调价消化成本。若内存涨价过快,手机与PC厂商或被迫压缩其他组件预算并提高终端售价,削弱需求。行业仍警惕双重下单扭曲周期持续性。

Surging AI infrastructure demand has pushed DRAM, NAND, and HBM capacity to near full utilization for 2025–2026 at Samsung, SK Hynix, Micron, and peers. OpenAI alone secured 900,000 HBM wafers per month, while cloud AI-server spending is projected to jump from USD 285 billion in 2024 to USD 468 billion in 2025 and USD 621 billion in 2026. Production is shifting from DDR4 toward DDR5 and HBM, driving DDR4 spot prices up 840% year-on-year to about USD 30.30 — above DDR5 at roughly USD 20 (up 316%). NAND is similarly strained, with shortages expected through 2026.

Prioritization of AI customers leaves smaller buyers exposed. Some NAND suppliers have raised prices more than 70% this year yet cannot deliver more units. SSD demand surged in late 2025, creating an estimated 2026 NAND bit-gap above 10%, versus under 2% for 2025. Analysts expect NAND prices to rise 15–20% in Q4 2025 and increase again by low-to-mid teens in early 2026. AI-driven allocation is crowding out non-AI segments, pushing broader commodity memory prices higher.

Stock performance reflects the supercycle: Micron shares have risen over 150% in six months, Samsung more than 70%, and Winbond returned to 100% utilization. While industry operating margins, normally around 15%, have climbed into the 15–20% range and may hit records in 2026, downstream strain is mounting. Pegatron calls DRAM supplies “hand-to-mouth”; Asus holds only four months of inventory and may raise prices. Rapid memory inflation risks forcing smartphone and PC makers to cut other component budgets or lift retail pricing, weakening demand. The sector remains uncertain about cycle duration and susceptible to double-booking distortions.