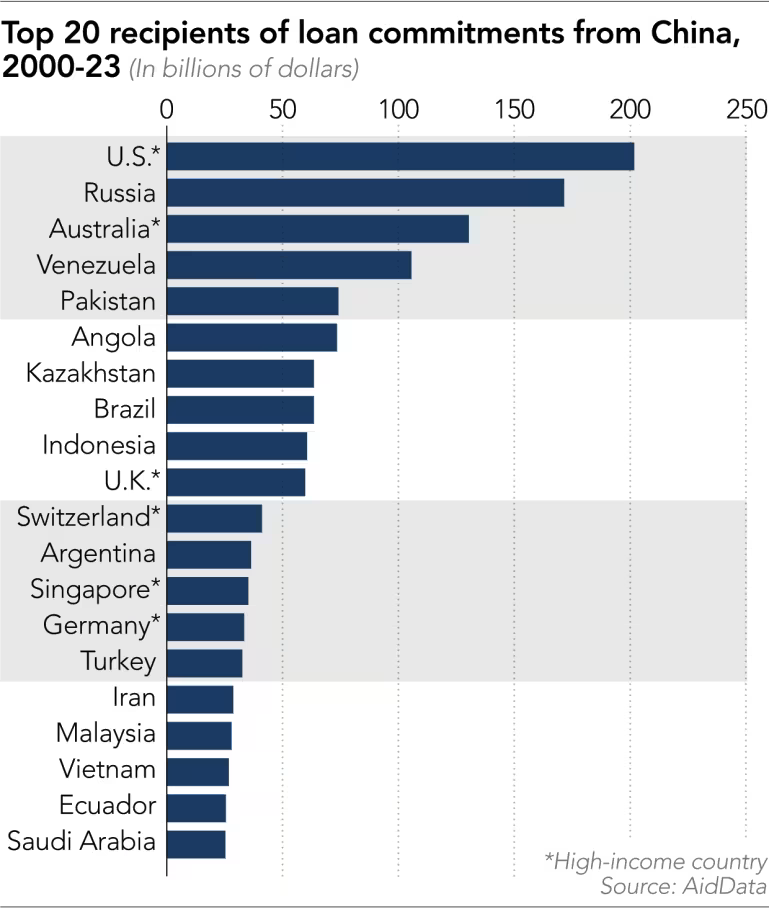

AidData追踪2000—2023年3万余个项目显示,中国对外融资重心由低收入国家转向富裕经济体:面向低收入与中低收入国家的份额由88%降至12%,面向中高收入与高收入国家的份额则由24%升至76%。美国获得超2000亿美元,居全球首位;英国获600亿美元,欧盟整体获1610亿美元。中国对外贷款及赠款总额达2.2万亿美元,覆盖217个国家与地区,使其成为全球最大官方债权人。基础设施贷款占比由75%跌至不足25%,凸显政策从发展援助转向围绕关键矿产、无人机、量子科技等战略目标。

中国在美国的融资投向多元,包括北弗吉尼亚数据中心、JFK与LAX机场航站楼、Dakota Access输油管道,并资助了密歇根机器人企业等高科技并购。Amazon、AT&T、Verizon、Tesla、GM、Ford、Boeing、Disney等亦获中国国有债权人提供营运与循环信贷。报告称这类融资旨在支撑关键基础设施建设或使中资企业收购美企关键技术。G7国家则以“模仿”方式竞争,压缩官方发展援助同时寻求通过并购关键资产提升影响力。

报告指出,中国对外融资透明度自2022年后急剧下降。研究人员无法再获得未删节合同,原因包括通过离岸壳公司绕行、设定严格保密条款、借非中方实体承担公众接口与大规模删节文件等。AidData认为,这些措施使中国在跨境金融体系中“降低可见度”,而此时全球对透明度的需求反而上升。

AidData’s review of more than 30,000 projects from 2000–2023 finds a sharp pivot in China’s overseas finance toward richer economies: the share directed to low- and lower-middle-income countries fell from 88% to 12%, while lending to upper-middle- and high-income countries rose from 24% to 76%. The U.S. was the top recipient, receiving over USD 200 billion, followed by the U.K. at USD 60 billion and the EU at USD 161 billion. China extended USD 2.2 trillion in loans and grants across 217 countries, making it the world’s largest official creditor. Infrastructure lending dropped from 75% to below 25%, reflecting a shift from development aid toward strategic goals in critical minerals, drones, and quantum technologies.

Chinese financing in the U.S. spans data centers in Northern Virginia, terminals at JFK and LAX, the Dakota Access pipeline, and acquisitions of high-tech firms such as robotics companies in Michigan. Major corporations including Amazon, AT&T, Verizon, Tesla, GM, Ford, Boeing, and Disney have tapped Chinese state lenders for working capital and revolving credit. These flows often support critical infrastructure or facilitate Chinese firms’ access to U.S. technology. The report argues G7 countries are competing largely through “mimicry,” cutting development aid while mobilizing funds to acquire strategic assets.

AidData notes transparency has deteriorated sharply since 2022, with access to unredacted loan contracts collapsing. Possible causes include routing funds through offshore shell firms, strict confidentiality clauses, outsourcing public-facing roles to non-Chinese entities, and extensive redactions. These measures allow China to operate “beneath the radar” of regulators and counterintelligence agencies, even as global demand for transparency rises.