过去一年,中国在人工智能领域的影响力显著扩大。中国已成为开放权重模型的全球领导者;在Hugging Face平台上,中国模型的下载量已超过美国。多家公司表现突出:阿里巴巴的Qwen在9月成为最受欢迎的模型;美国公司宣布以逾20亿美元收购一家迁至新加坡的中国实验室;1月两家中国模型商在香港上市后股价大涨。尽管在专有模型基准上仍落后于美国头部公司,中国开放模型的性能已相当接近。

真正的难题在于盈利。数据显示,在截至10月的12个月里,ChatGPT通过苹果应用商店收入达17亿美元,而最受欢迎的10款中国聊天机器人合计仅约50万美元。多数中国模型仍免费,主要收入来自为企业部署模型与提供算力基础设施,但成效有限:MiniMax在2025年前九个月营收仅5,300万美元,却亏损5.12亿美元,Z.ai同样深度亏损。竞争异常激烈,彭博估计中国在9月已有500多个模型,较两年前的14个激增;而国内企业软件支出总额约500亿美元,不到美国的十分之一。

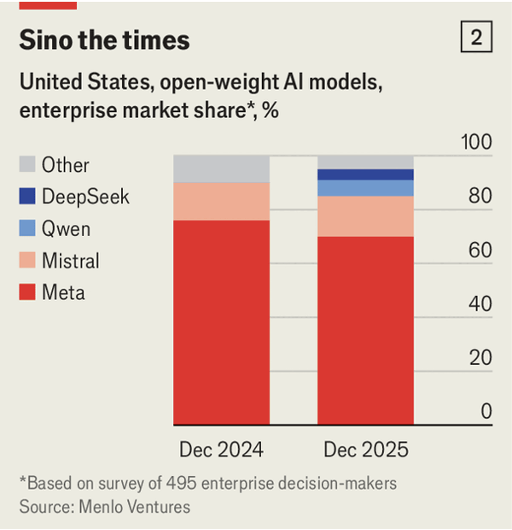

因此,中国模型商转向海外。新兴市场带来部分订单;大型中国云厂商今年预计在数据中心投资700亿美元,重点在亚洲、拉美和中东。西方市场潜力更大,但采用主要来自精打细算的初创公司;美国企业中中国模型仅占开放模型使用的约10%。顾虑集中在数据隐私与监管风险,且即便采用,往往在自有基础设施运行,难以转化为云收入。地缘政治不确定性加剧这一挑战。对阿里巴巴、腾讯等巨头而言,AI可嵌入既有业务并不致命;对众多中国AI初创公司,淘汰赛已然逼近。

Over the past year, China’s influence in artificial intelligence has grown markedly. It is now the global leader in open-weight models; on Hugging Face, downloads of Chinese models have overtaken those from America. Several firms stand out: Alibaba’s Qwen became the most popular model in September; an American firm announced a $2bn-plus acquisition of a Chinese lab relocated to Singapore; and two Chinese model-makers listed in Hong Kong in January with soaring shares. Although proprietary benchmarks are still led by U.S. giants, Chinese open models are close in performance.

The real problem is monetisation. In the 12 months to October, ChatGPT earned $1.7bn via Apple’s App Store, versus about $500,000 combined for the ten most popular Chinese chatbots. Most Chinese models remain free, relying on enterprise deployment and infrastructure services for revenue, with limited success: MiniMax booked $53m in sales in the first nine months of 2025 but lost $512m, and Z.ai is also deeply in the red. Competition is ferocious—Bloomberg estimates over 500 Chinese models by September, up from 14 two years earlier—while domestic enterprise software spending totals about $50bn, under a tenth of America’s.

Chinese firms are therefore looking abroad. Emerging markets offer some growth; major Chinese cloud providers are set to invest $70bn this year in data centres across Asia, Latin America and the Middle East. The West is the bigger prize, but adoption there is led by cost-conscious startups; Chinese models account for roughly 10% of open-model usage among U.S. enterprises. Privacy and regulatory risks deter large firms, which often run Chinese code on their own infrastructure, limiting cloud revenue. Geopolitics compounds the challenge. Big incumbents can absorb losses by embedding AI into core services; for China’s many AI startups, a shake-out looms.