尽管欧洲在开发前沿人工智能模型方面落后,但在应用层面仍具优势。施耐德电气已部署约100个AI应用,摩根士丹利估计其每年可节省约4亿欧元,占总成本不足1.5%。欧洲在2024年仅建成3个前沿模型,落后于美国的40个和中国的15个,且缺乏本土超大规模云服务商;然而,对生产率的广泛提升而言,采用AI比出售AI更重要。

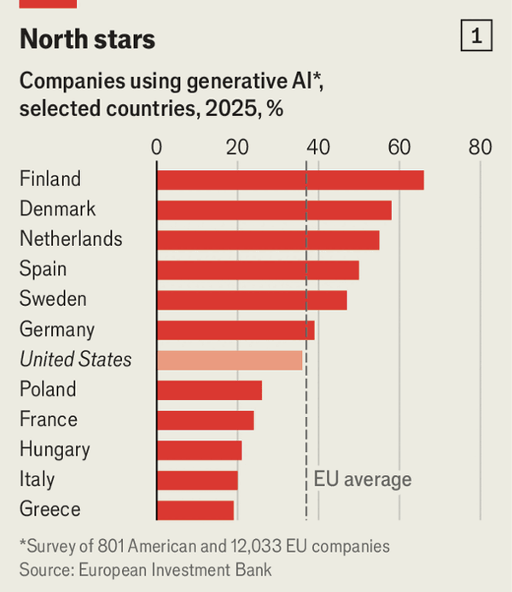

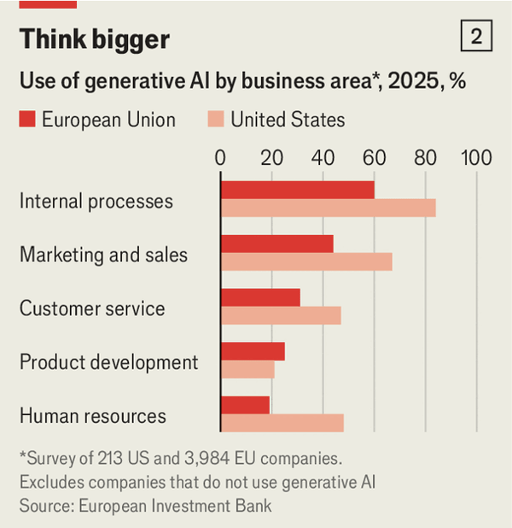

个人与企业层面的采用正在加速。微软数据显示,欧洲32%的人使用生成式AI,高于美国的28%和中国的16%。欧洲投资银行调查显示,37%的欧盟企业已采用生成式AI,与美国的36%相当,但区域差异明显:芬兰66%、丹麦58%,而意大利和希腊分别仅20%和19%。此外,欧洲企业的应用范围更窄:仅55%的欧盟AI用户在至少两个业务领域使用该技术,而美国为81%。

制造业是欧洲的强项。48%的欧洲制造商使用AI(含传统机器学习与大数据),高于美国的28%。西门子在巴伐利亚工厂运行逾100个算法已超过五年;施耐德电气早在2021年便任命首席AI官。啤酒商嘉士伯将AI用于销售、包装与物流。风险在于监管与经济压力:欧盟AI法案虽设定安全标杆,但可能增加采用成本;同时增长乏力与外部竞争或抑制投资。长期竞争力要求企业加大而非削减AI投入。

Although Europe trails in building cutting-edge AI models, it retains an edge in application. Schneider Electric has deployed around 100 AI applications, with Morgan Stanley estimating roughly €400m in annual savings—under 1.5% of total costs. Europe built just three frontier models in 2024, versus America’s 40 and China’s 15, and lacks hyperscalers; yet for broad productivity gains, adopting AI matters more than selling it.

Adoption is accelerating among individuals and firms. Microsoft finds 32% of Europeans use generative AI, above America’s 28% and China’s 16%. A European Investment Bank survey shows 37% of EU companies use generative AI, similar to America’s 36%, but with wide variation: Finland at 66% and Denmark at 58%, versus Italy at 20% and Greece at 19%. Usage breadth lags: only 55% of EU AI users deploy it in at least two business areas, compared with 81% in the United States.

Manufacturing is Europe’s stronghold. Forty-eight per cent of European manufacturers use AI (including traditional machine learning and big data), versus 28% in America. Siemens has run over 100 algorithms at a Bavarian factory for more than five years; Schneider hired a chief AI officer in 2021. Carlsberg applies AI to sales, packaging and logistics. Risks remain from regulation and weak growth: the EU AI Act may raise adoption costs, while economic pressures could curb investment. Long-term competitiveness demands the opposite—more AI investment.