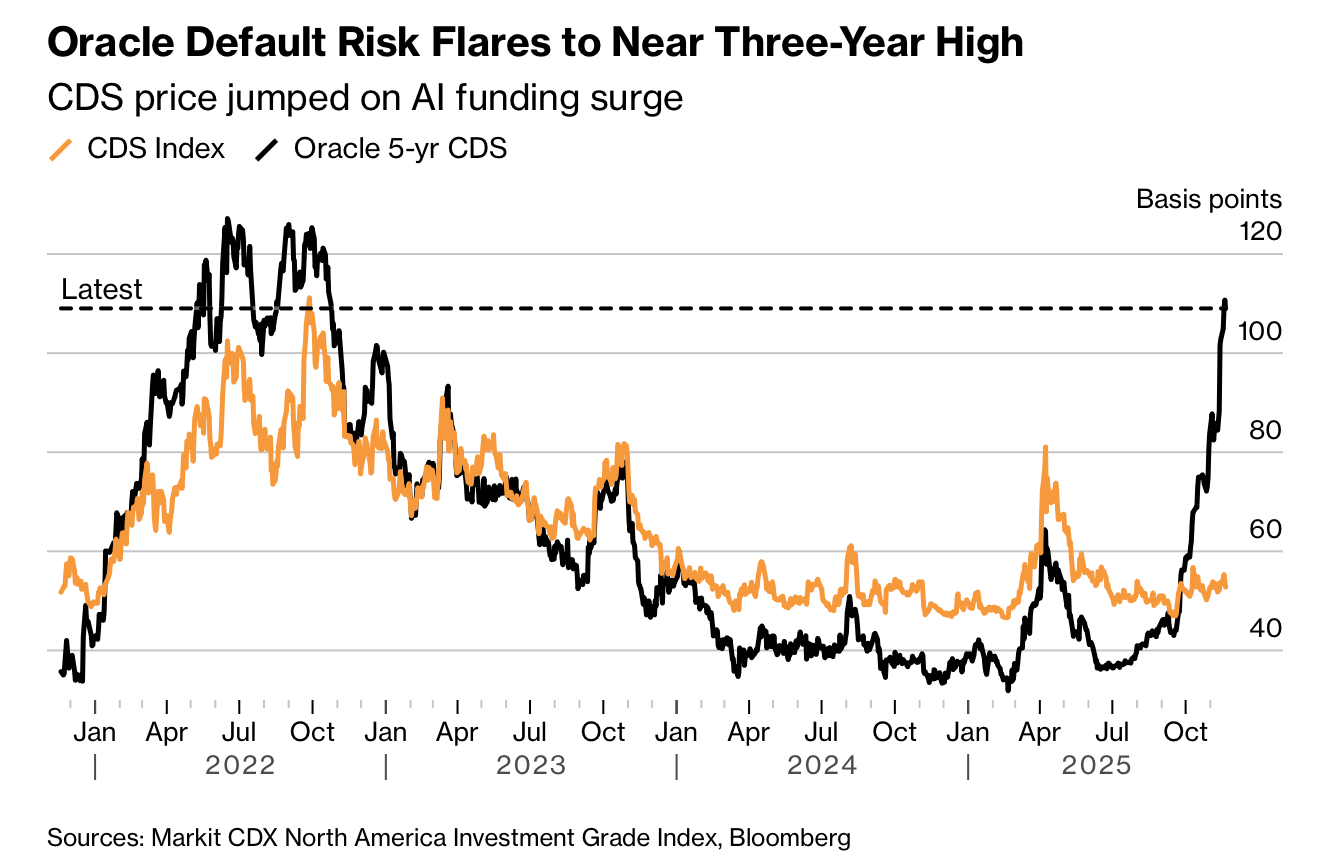

近月保护 Oracle 五年期债务违约的 CDS 年价从约 0.37 个百分点飙升至高点 1.11 个百分点,即为每 1,000 万美元名义本金付约 111,000 美元,成交量在截至 11 月 14 日的七周内扩张至约 50 亿美元,较去年同期的 2 亿美元出头扩大逾 20 倍。同期股价自 9 月 10 日以来累计下跌约三分之一,显示市场将 Oracle 视为 AI 风险的信用晴雨表。尽管其市值约 6,200 亿美元且维持投资级评级,但市场押注一旦 AI 信心动摇,其 CDS 将进一步暴涨,可对冲 AI 板块的广泛回撤。

Oracle 位于巨额 AI 资本开支链条核心,包括与 OpenAI、SoftBank 共同参与 5,000 亿美元的 Stargate 项目,并由约 20 家银行提供约 180 亿美元项目融资建设 New Mexico 数据中心园区。公司亦在 9 月发行 180 亿美元投资级债券,为年度最大规模之一。市场对其杠杆路径的预期急剧上调:Morgan Stanley 预计其调整后净债务将从约 1,000 亿美元在 2028 财年增至约 2,900 亿美元,因而建议买入其五年 CDS 与五年期债券。

AI 融资潮正在重塑债市规模。JPMorgan 预计未来数年企业将为 AI 投资发行约 1.5 万亿美元投资级债券,垃圾债与杠杆贷款市场亦将被相关债务淹没。Citadel Securities 估计 hyperscalers 今年净发行约 1,000 亿美元投资级债券,并认为明年至少持平。该机构称 AI 是 hyperscalers 的“Manhattan Project”,企业认为“不过度投入”的风险不亚于投入过度。

Recent months saw Oracle’s five-year CDS cost surge from roughly 0.37 percentage point to a peak of 1.11 percentage points annually, or about $111,000 per $10 million of notional, with trading volume ballooning to about $5 billion in the seven weeks through Nov. 14 versus just over $200 million a year earlier. Shares fell about one-third from Sept. 10, cementing Oracle as the credit proxy for AI risk. Despite a roughly $620 billion market cap and investment-grade ratings, traders expect its CDS to spike further if confidence in AI weakens, offering a hedge against broad AI-driven selloffs.

Oracle sits at the center of massive AI-related capex, including participation with OpenAI and SoftBank in the $500 billion Stargate project, supported by roughly $18 billion in project-finance loans from about 20 banks to build a New Mexico data-center campus. The firm also issued $18 billion of high-grade bonds in September, one of the year’s largest deals. Morgan Stanley forecasts its net adjusted debt will more than double from about $100 billion to roughly $290 billion by fiscal 2028, prompting recommendations to buy its five-year CDS and five-year bonds.

AI financing is reshaping credit markets. JPMorgan projects around $1.5 trillion of high-grade corporate issuance tied to AI in coming years, with junk bonds and leveraged loans likewise inundated. Citadel Securities estimates hyperscalers will issue about $100 billion of net high-grade bonds this year, viewing that as a floor for next year. Its analysts call AI the hyperscalers’ “Manhattan Project,” with executives seeing the risk of under-investing as equal to, or greater than, the risk of overspending.