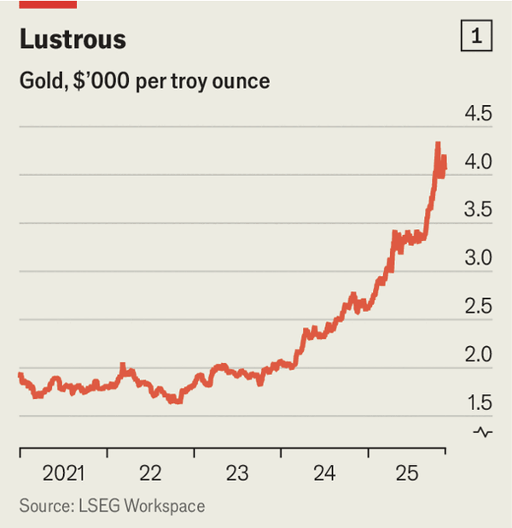

最近黄金价格波动显著,自10月20日创下每盎司$4,380的历史新高后,急剧下跌,目前徘徊在$4,100左右。尽管如此,当前价格较今年1月高出54%,并比1980年调整通胀后的峰值高出42%。分析师观点分歧:部分人预计价格将温和上升,甚至在明年突破$5,000,而看空者则认为黄金已进入下跌通道。黄金的买家转变为机构投资者、央行和投机者,但目前的涨势与以往金融危机期间的上涨有所不同。

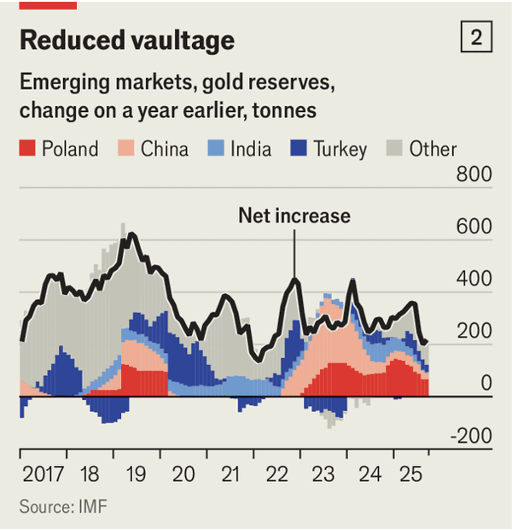

今年在经济未现衰退、标普500同期间上涨近30%且实际利率仍高的背景下,黄金价格自2024年3月以来几乎翻倍。虽然部分人归因于央行出于美元贬值担忧增加购金,但数据却显示美元汇率稳定和美国30年期国债收益率持平,新兴市场央行购买量虽有提升但绝对量较小且买盘集中在极少数央行,IMF数据显示央行购买速度已较去年放缓。

近期黄金价格波动主要受到投机资金驱动。9月底对冲基金持有的黄金多头合约达到创纪录的200,000份(约619吨);ETF净买入也大增。10月ETF资金流出并出现100吨净卖出后,价格随之下跌,随后ETF资金又迅速回流。由此可见,黄金价格高度跟随这些短线资金的动态。初期由央行购金带动的涨势,如今已演变成投机资金推动的“动量交易”模式,若行情反转,坚定持有者面临巨大风险。

Recently, gold prices have fluctuated significantly. After reaching a record $4,380 per ounce on October 20, prices fell sharply and hovered around $4,100. Still, the current price remains 54% higher than in January and 42% above the inflation-adjusted 1980 peak. Analysts are divided: some expect a gentle rise or even a break above $5,000 next year, while bears believe gold is set to descend. Gold buyers have shifted among institutional investors, central banks, and speculators, but the current rally differs from past increases during financial crises.

This year, gold’s price has nearly doubled since March 2024 despite no recession, with the S&P 500 up nearly 30% in the same period and real interest rates remaining high. Some attribute the rise to central bank buying amid concerns about dollar debasement, yet data show the dollar's exchange rate has stabilized and 30-year Treasury yields have been mostly flat. Emerging market central banks’ gold purchases have increased but remain small in absolute terms and are concentrated in a few banks, with IMF data indicating a slowdown in official buying since last year.

Recent gold price movements are mostly driven by speculative funds. In late September, hedge funds’ long positions in gold futures reached a record 200,000 contracts (about 619 tonnes), while ETF net purchasing was also strong. After ETF outflows and net hedge fund sales of 100 tonnes last month, prices dipped, but ETF inflows have since rebounded. Thus, gold prices closely track these flighty funds. What began as a reserve adjustment by central banks has snowballed into a self-propelled momentum trade; if the trend reverses, strong hands now have much at stake.