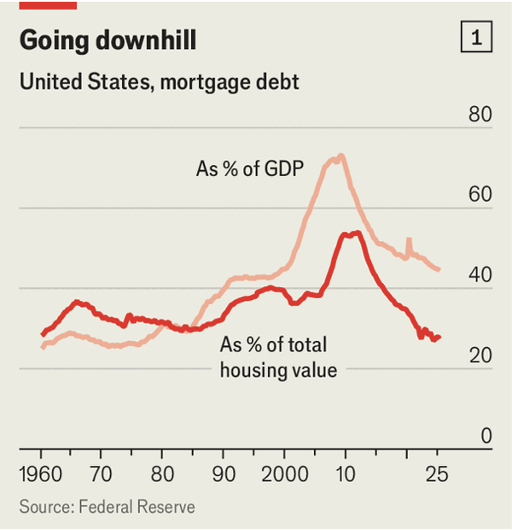

美国目前的抵押贷款债务总额为13.5万亿美元,占国内生产总值(GDP)的44%,比2007-09年金融危机前下降近30个百分点,是自1999年以来的最低水平。同时,抵押贷款债务仅占美国家庭房产价值的27%,为65年来最低。过去五年,美国购房月还本付息中位数从1000美元增至2100美元,而新发放抵押贷款自2022年以来仅占住房总财富的不到1%,疫情前和金融危机前均远高于此。

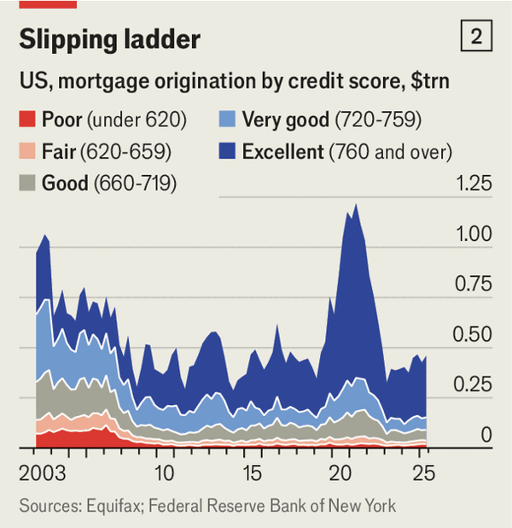

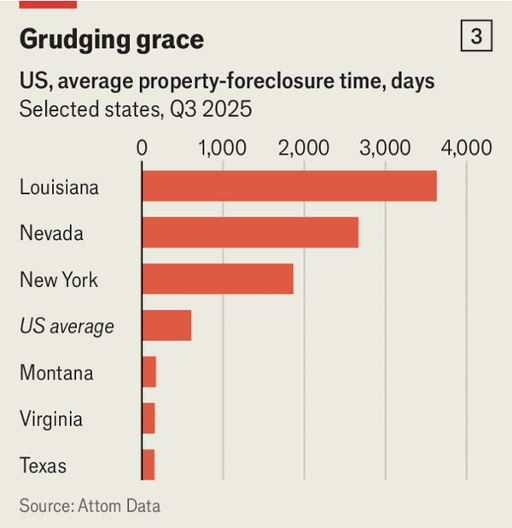

从2003年到2007年,发放给信用评分低于720分借款人的抵押贷款比例从35%升至45%,但如今仅为22%。2007年起,房利美和房地美收紧购债标准,2010年多德-弗兰克法案实施后,对高风险贷款进一步限制,利率只还利息贷款减少,费用上限设立,法拍流程趋严。若低信用借款占比维持在25%,经济学人估算额外可发放1.6万亿美元贷款,相当于800万笔20万美元房贷。

信贷紧缩和高借款门槛阻碍房屋转手与新房供应。多户住宅建造在危机后四年反弹,而独栋住宅至今仍落后于危机前水平。目前住房短缺300万到400万套。租金和房价在亚特兰大、凤凰城等地持续飙升。大房东成为政治关注对象,但针对资本提供者的监管可能进一步恶化供应不足。若不及时填补缺口,放宽抵押贷款政策只会推高房价,而非改善可负担性。

America’s current mortgage debt stands at $13.5 trillion, equivalent to 44% of GDP—a decline of nearly 30 percentage points since the 2007-09 financial crisis and the lowest level since 1999. Mortgage debt now totals just 27% of household property value, a 65-year low. The median US monthly principal and interest payment surged from just above $1,000 to $2,100 in five years. New mortgages since 2022 account for less than 1% of housing wealth, far below pre-pandemic and pre-crisis levels.

Between 2003 and 2007, the share of mortgages issued to borrowers with credit scores below 720 rose from 35% to 45%; now, it has fallen to just 22%. Since 2007, tightened lending standards by Fannie Mae and Freddie Mac and the 2010 Dodd-Frank Act have limited risky loans, capped fees, and made foreclosures harder. If low-score lending had stabilized at 25%, The Economist estimates $1.6 trillion more loans—equal to 8 million $200,000 mortgages—might have been issued.

Restrictive credit and tight standards hinder property turnover and new housing supply. Multifamily construction rebounded post-crisis in four years, but single-family homes still lag behind pre-crisis levels. Currently, there is a 3 to 4 million home shortage. Rents and prices continue to soar in cities like Atlanta and Phoenix. Large landlords face political scrutiny, but more regulation could worsen shortages. Unless supply expands, easier mortgage access risks only pushing prices further out of reach.