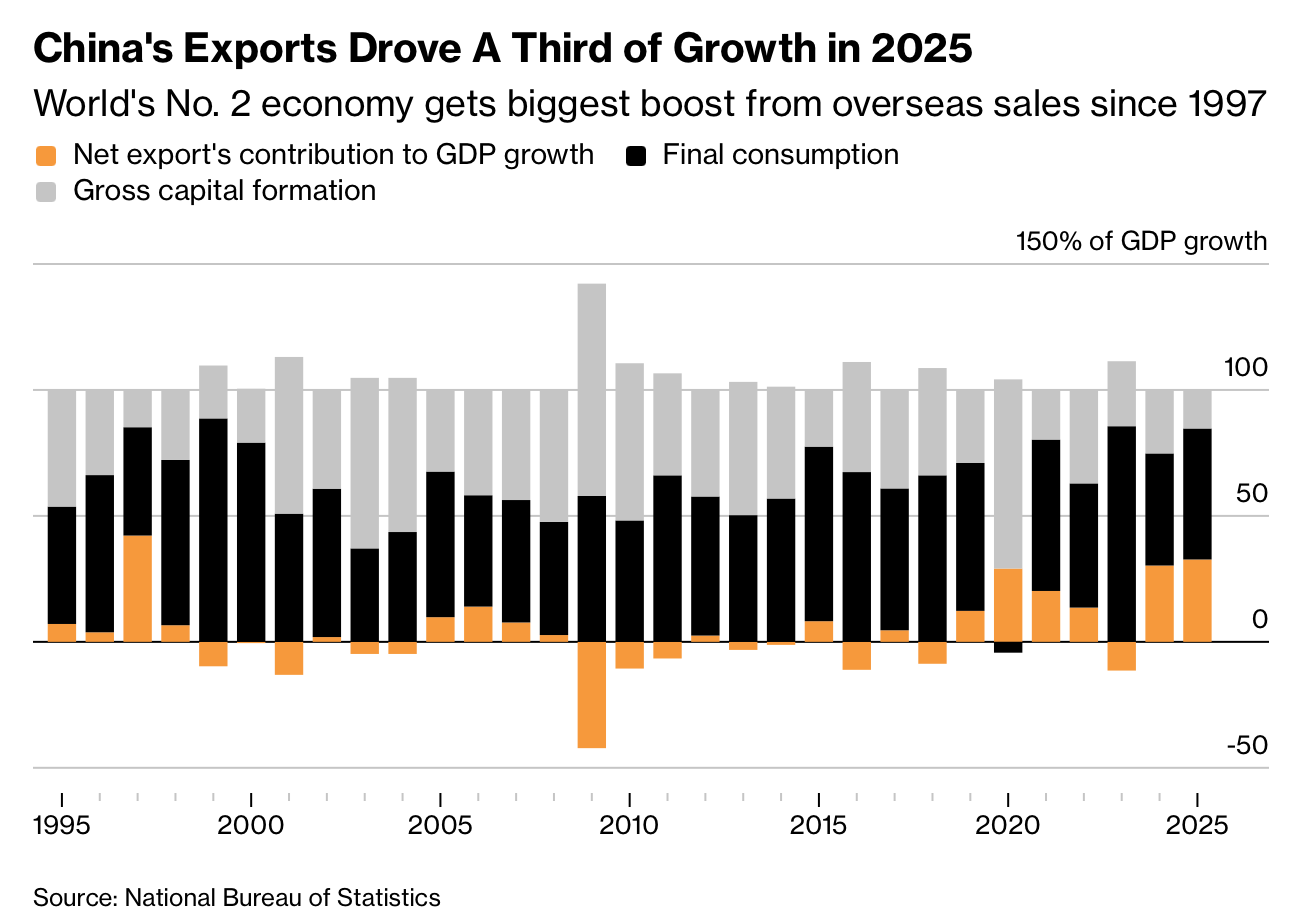

在国内通缩与投资萎缩的背景下,中国正更加依赖出口拉动增长。数据显示,出口在2025年对中国5%经济增速的贡献为1997年以来最大,占据增长的最大份额,而国内房地产仍低迷、通缩创下自1970年代以来最长周期、投资首次出现年度下滑。与此同时,美国总统特朗普对欧洲盟友的关税威胁,客观上为中国出口提供了缓冲空间。彭博经济研究估计,若相关威胁落地,到6月美国对欧洲伙伴的关税上调幅度可能高达37.2个百分点,明显高于对中国的水平。

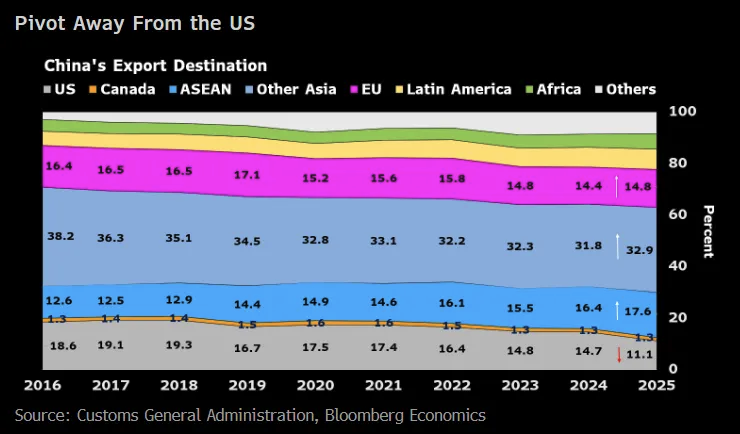

贸易格局的变化正带来短期机遇。加拿大近期与中国达成协议,回撤电动车关税;欧盟也在权衡以最低价格机制替代关税,这可能利好中国车企。经济学家预计2026年中国出口同比增长约6%,而北京对刺激内需的加码意愿有限,市场普遍预期政策利率全年仅下调约20个基点。受此影响,2026年GDP平减指数可能仍为负或仅回到零,意味着企业收入与工资承压,中国将通过更低价格的出口在全球范围内抑制通胀。

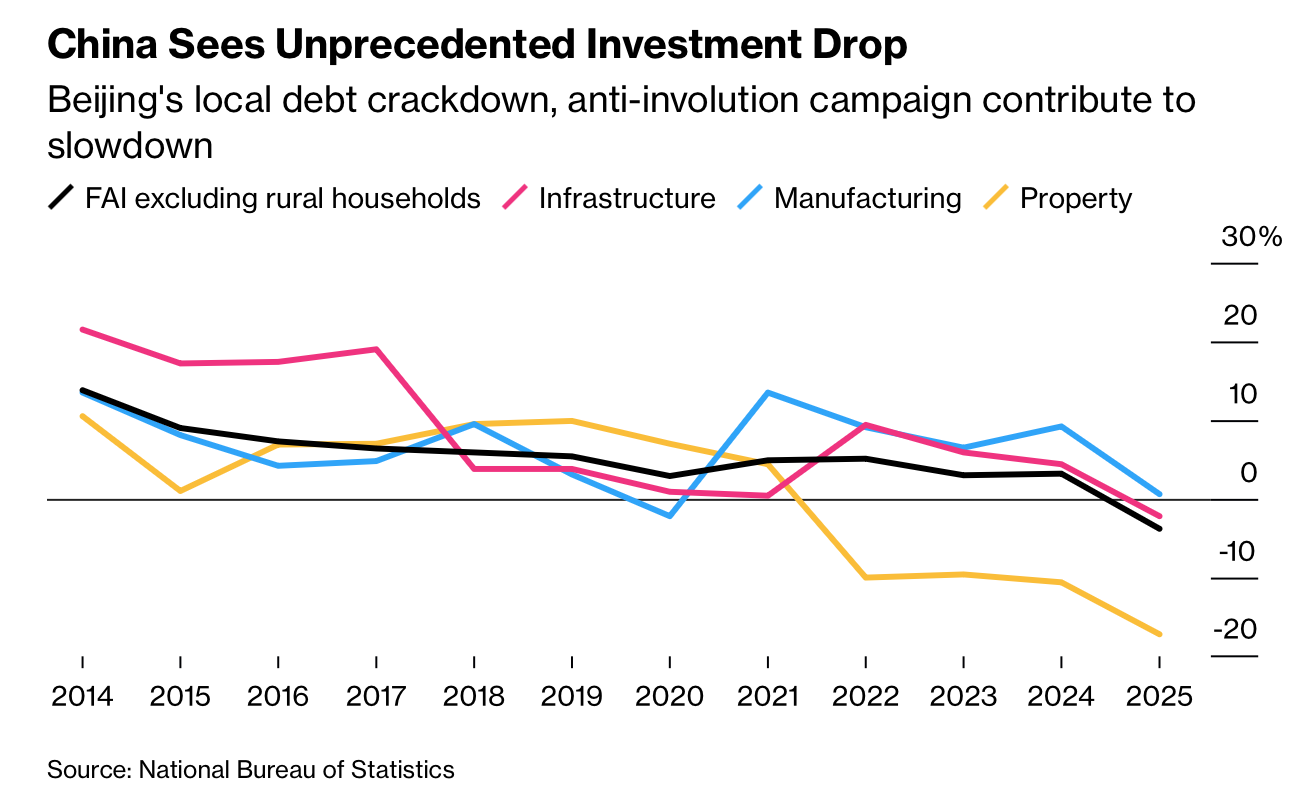

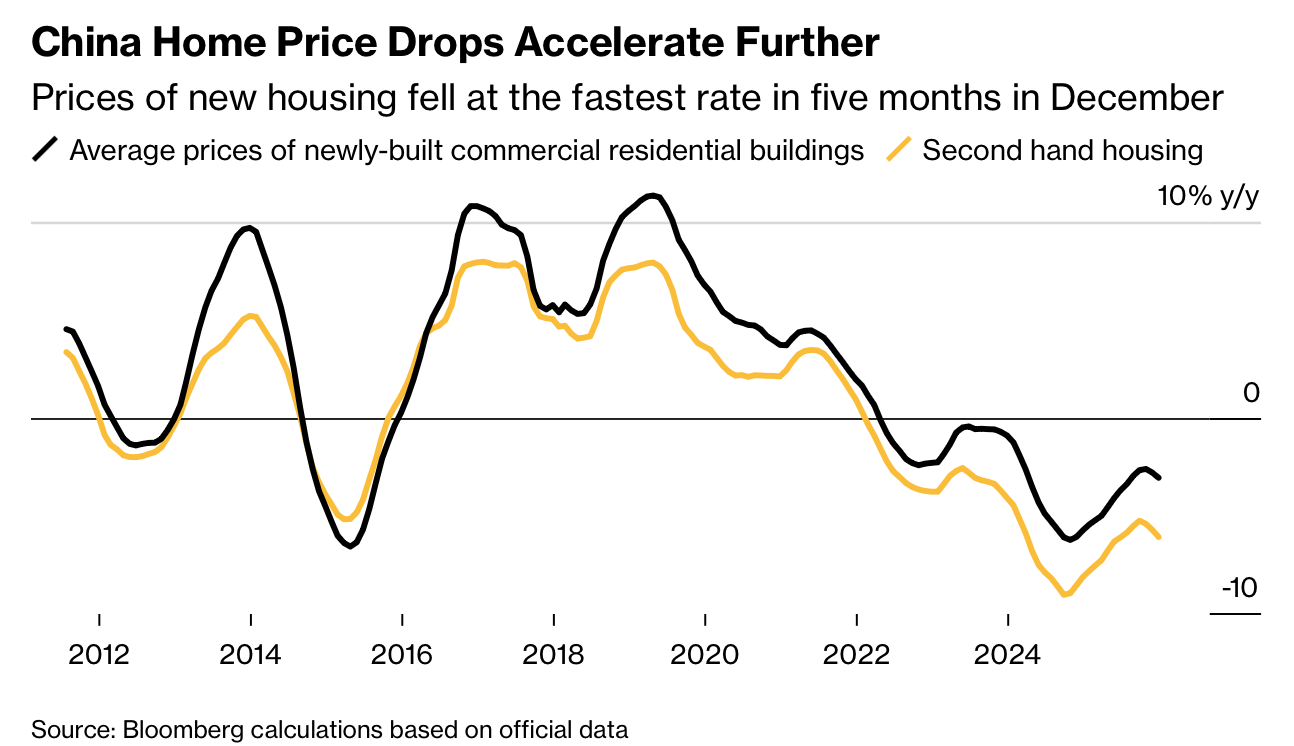

政策取向已出现转变。2025年中国贸易顺差创纪录后,财政赤字被提高至三十多年新高,但随着出口寻找新市场,政策重心转向化解地方债务,基础设施投资罕见下降。价格改善更多来自暂时因素,如金价上涨和天气推高蔬菜价格,部分商品因去产能政策小幅反弹。房地产下行的根本问题尚未触底。总体而言,特朗普对盟友的施压为中国带来窗口期,但中长期再平衡向消费驱动的挑战依然存在。

As China grapples with deflation and shrinking investment, exports have become the main growth engine. Data show exports accounted for the largest share of China’s 5% growth in 2025 since 1997, masking weak domestic demand marked by a moribund property sector, the longest deflationary spell since the 1970s, and the first annual drop in investment. At the same time, US President Donald Trump’s tariff threats against European allies have eased pressure on China’s exporters. Bloomberg Economics estimates US tariff hikes on Europe could reach 37.2 percentage points by June, far higher than those imposed on China.

Shifts in trade dynamics are creating short-term opportunities. Canada has rolled back electric-vehicle tariffs, and the EU is weighing minimum-price arrangements instead of duties, potentially benefiting Chinese automakers. Economists expect China’s exports to grow about 6% year on year in 2026, while Beijing is seen limiting stimulus for domestic demand, with policy rate cuts totaling roughly 20 basis points. As a result, the GDP deflator is likely to remain negative or return only to zero in 2026, keeping pressure on corporate revenues and wages and exporting deflation abroad via cheaper goods.

Policy priorities have adjusted accordingly. After a record trade surplus in 2025, China raised its budget deficit to the highest level in over three decades, then shifted focus toward reducing local government debt, contributing to a rare decline in infrastructure investment. Recent price improvements stem mainly from temporary factors such as higher gold prices and weather-driven food costs, while selective commodities rebounded modestly amid capacity curbs. The property downturn has yet to bottom out. Overall, Trump’s strong-arming of allies has opened a window for Beijing, but structural challenges to rebalancing toward consumption remain.