2026年美国经济可能更快增长,因为7月通过的BBB减税法将带来“相当于两年的减税合并在一年”的效果,Piper Sandler估算其价值约1910亿美元,体现在对2025年收入的追溯性退税以及更低的月度预扣税。该行认为仅这一项就可使GDP增加约0.3%,而2025年经济大概增长1.9%,相比之下,费城联储11月调查的经济学家共识预测2026年增速将放缓至1.8%。

在2025年第三季度GDP以4.3%的年化速度增长之后,10—11月创纪录的43天联邦政府停摆可能压低了2025年末的活动,但支出全面恢复可能带来约相当于GDP的0.6%的增量,而更弱的国税局执法可能再增加约相当于GDP的0.25%。关税在其他条件不变时会使2026年收入升至2150亿美元(2025年为1140亿美元)并意味着财政收缩,但最高法院若裁定约一半关税违法,可能触发约相当于GDP的0.5%的退税并削弱2026年关税收入,从而使预算立场更偏刺激。

货币政策已经更宽松:美联储在12月10日将利率下调至3.5–3.75%,为自2022年以来最低,且比2024年9月低1.75个百分点,随着5月领导层更替以及诉讼可能空出席位,2026年进一步降息仍有可能。市场也在计入支撑:华尔街共识预计标普500在2026年上涨9%;全球顺风包括布伦特原油为61美元、接近四年低点,以及可能的刺激(如日本约相当于GDP的0.4%),但风险包括通胀仍偏高、2%目标的可信度承压,以及国债风险溢价上升从而推高长期利率。

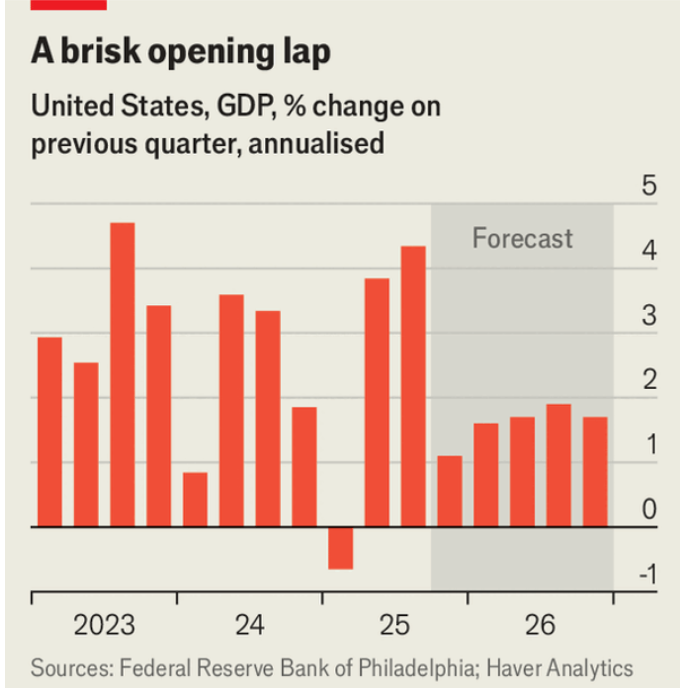

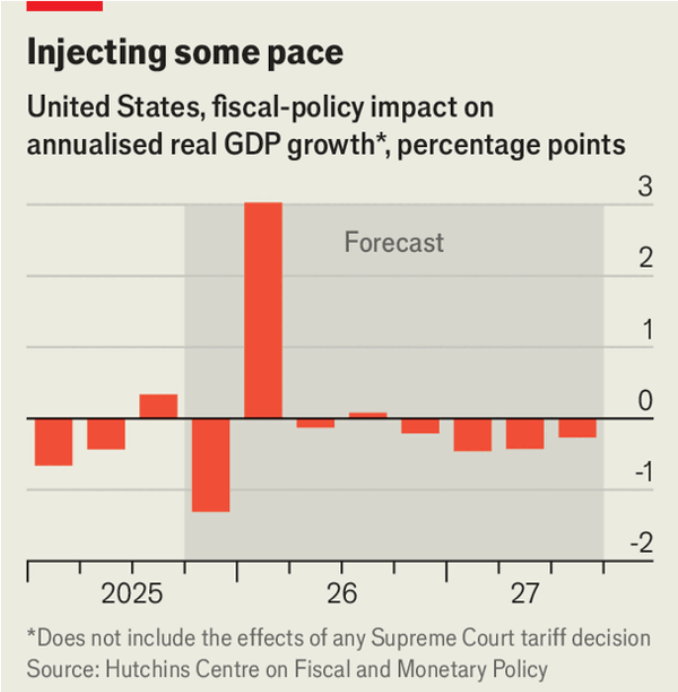

US growth in 2026 could accelerate as the BBB tax-cut law enacted in July delivers “two years of tax cuts in one” worth about $191bn via retroactive 2025 refunds and lower monthly withholding. Piper Sandler estimates this alone adds about 0.3% to GDP after roughly 1.9% growth in 2025, versus a Philadelphia Fed survey consensus of 1.8% growth for 2026.

After 4.3% annualised growth in Q3 2025, a record 43-day federal shutdown in Oct–Nov likely depressed late-2025 activity, but a full resumption of spending could add about 0.6% of GDP, and weaker IRS enforcement could add about 0.25%. Tariffs would otherwise raise revenue to $215bn in 2026 from $114bn in 2025 and imply fiscal contraction, yet a Supreme Court ruling that about half of tariffs are unlawful could trigger about 0.5%-of-GDP refunds and reduce 2026 tariff intake, making the budget stance more stimulative.

Monetary policy is already looser: on Dec 10 the Fed cut rates to 3.5–3.75%, the lowest since 2022 and 1.75 percentage points below September 2024, with more cuts plausible as leadership shifts in May and court cases may open seats. Markets also price in support—Wall Street expects the S&P 500 to rise 9% in 2026—while global tailwinds include Brent at $61 near a four-year low and potential stimulus such as Japan at about 0.4% of GDP, but risks include still-high inflation, pressure on the 2% target, and a rising Treasury risk premium that could lift long-term rates.

Source: America’s economy looks set to accelerate

Subtitle: A monetary-fiscal loosening is coming

Dateline: 12月 30, 2025 06:36 上午