1956年,“首次退休”时沃伦·巴菲特25岁;1969年38岁时第二次退休;12月31日,95岁的他将第三次——也可能是最后一次——退休,卸任美国市值第九大公司的首席执行官。伯克希尔既是金融巨无霸(美国第二大财产与责任险公司,持有近7000亿美元的可交易股票、债券与现金),也是工业集团(控制约200家公司,包括美国四家“一级”铁路之一的BNSF等)。

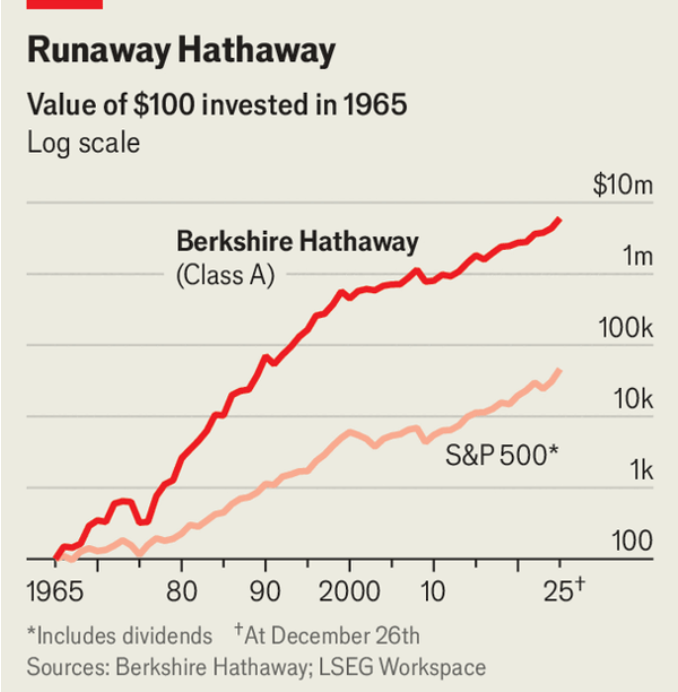

自1965年掌控以来,伯克希尔股价长期跑赢标普500;其投资既包含“价值”也包含“成长”,2016—2018年买入苹果成为最赚钱的投资之一。持仓规模凸显“护城河”组合:苹果约650亿美元、可口可乐280亿美元、美国银行320亿美元、穆迪130亿美元,另持有维萨30亿美元、万事达卡20亿美元,并持有美国运通约五分之一(580亿美元)。

1967年收购National Indemnity后,保险“浮存金”成为资本引擎,且保险资产中约一半投入集中股票组合;大型交易曾由此融资,包括2010年收购的BNSF(2023年转为伯克希尔直接子公司)以及对西方石油约四分之一的持股。接班人Gregory Abel将面临人事与配置考验:Todd Combs于12月转投摩根大通,同时在利率下行时3800亿美元现金的机会成本上升;伯克希尔对Chubb已有8%持股、1967年以来未发股息,并在A/B股结构与B股机构持有上升(及巴菲特持股未来可能转为B股)的推动下走向更常规治理。

The insurance float has been consistent since 1967, with half of the assets in concentrated stocks like BNSF, which was bought in 2010 and moved in 2023, along with a quarter stake in Occidental. With Gregory Abel's succession, Todd Combs is leaving in December, while cash reserves are at $380 billion, and costs are rising as rates fall. There is consideration for an 8% stake in Chubb, alongside a history of no dividends since 1967 and limited buybacks.

In 1956 Warren Buffett first “retired” at 25; he retired again in 1969 at 38; on December 31, at 95, he will retire a third—and likely final—time, stepping down as chief executive of America’s ninth-most-valuable company. Berkshire is both a financial colossus (America’s second-largest property-and-liability insurer with nearly $700bn in tradeable stocks, bonds and cash) and an industrial conglomerate controlling around 200 companies, including BNSF, one of America’s four “class 1” railroads.

Since taking control in 1965, Berkshire’s shares have trounced the S&P 500; its record blends “value” and “growth,” and the 2016–2018 Apple buying spree became one of its most profitable moves. The moat-heavy portfolio is sized in tens of billions: Apple about $65bn, Coca-Cola $28bn, Bank of America $32bn, Moody’s $13bn, plus smaller stakes in Visa ($3bn) and Mastercard ($2bn) and roughly a fifth of American Express ($58bn).

Source: As Warren Buffett retires, uncertainty looms for Berkshire Hathaway

Subtitle: What direction will his anointed successor take?

Dateline: 12月 30, 2025 05:49 上午 | New York