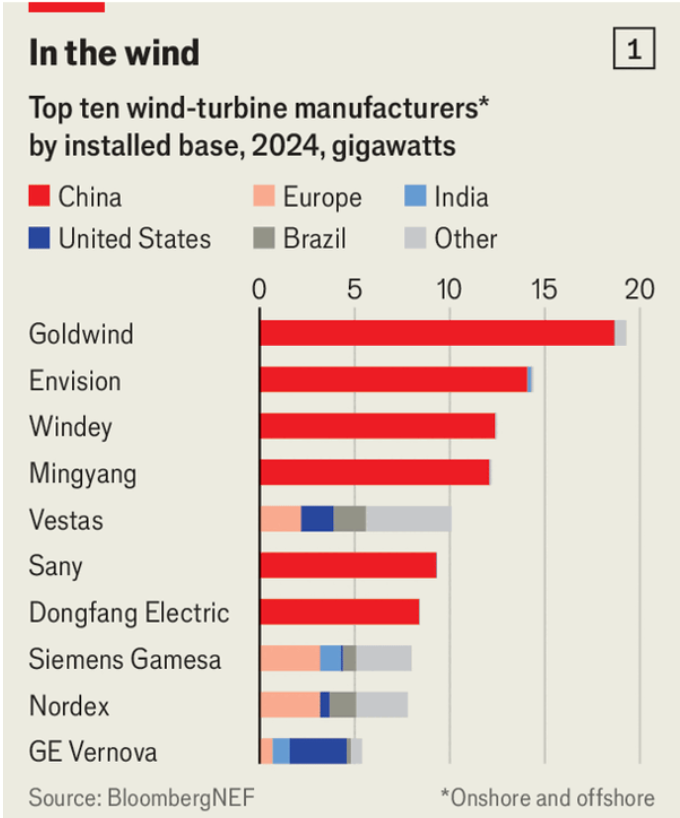

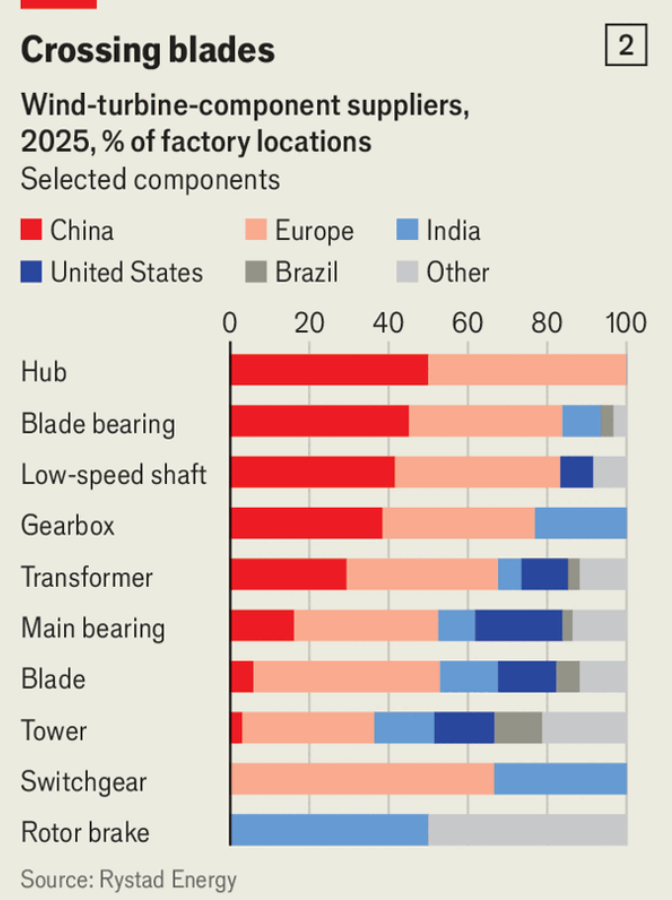

欧盟计划到2030年将已装机风电容量几乎翻倍至425吉瓦(GW);英国到同年将海上风电容量提高到50GW,这需要在现有基础上增加到四倍。尽管维斯塔斯、西门子歌美飒和诺德克斯等龙头在中国以外的累计装机基础最大,但自2022年以来钢材成本上升、制造失误、利率走高与项目取消已压缩利润并削弱需求。

2024年中国贡献了全球新增风电装机的70%以上,但补贴逐步退出且产能过剩显现:2024年可生产相当于99GW的机组,却只安装了87GW(约88%的产能利用率)。运营利润率从2021年的平均18%降至2024年的10%,并首次低于欧洲同行。

因此中国企业加速出海,海外新增装机从2023年的1GW、2024年的2GW跃升至2025年的9GW,并在2025年拿下中国以外市场约18%的份额(为2024年的三倍)。诸如英国6GW开发合作与在苏格兰投资至多15亿英镑(20亿美元)建厂等项目正遭遇安全与保护主义阻力,可能让欧洲的脱碳目标更难实现。

The EU plans to nearly double its installed wind capacity to 425 GW by 2030, while Britain is targeting 50 GW offshore, requiring a quadrupling of efforts. Despite leading manufacturers like Vestas and Siemens Gamesa, challenges since 2022—including increased steel costs and canceled projects—have strained profits.

In 2024, China accounted for over 70% of new global wind installations, but with subsidies being withdrawn, overcapacity is becoming an issue.

Chinese firms are accelerating exports, expecting to add significant capacity overseas in the coming years.

Source: China’s wind giants are coming for Europe

Subtitle: Protectionism and security concerns may yet halt their advance

Dateline: 12月 30, 2025 05:49 上午