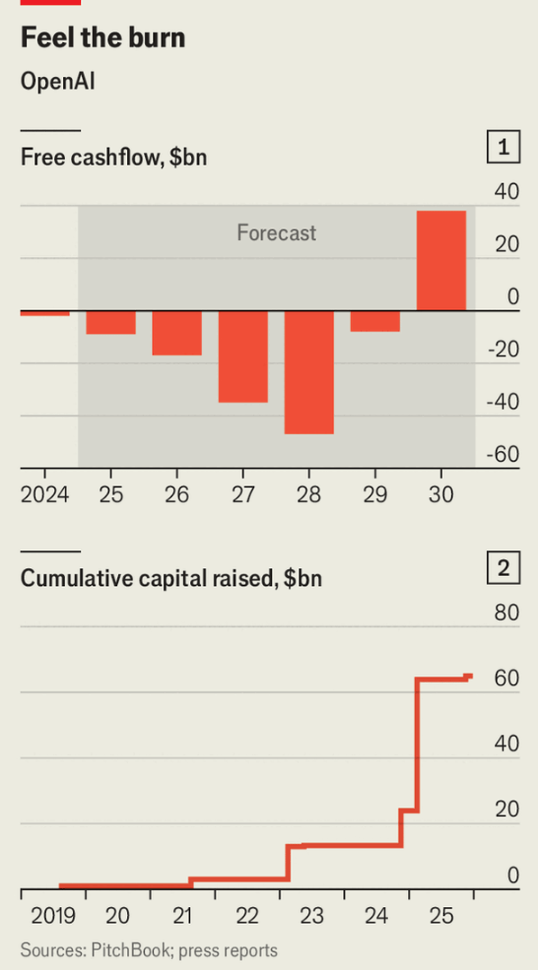

泄露的数字称,OpenAI 预计在 2026 年烧掉 170 亿美元现金,高于 2025 年的 90 亿美元,并且在随后三年里亏损还会继续累积;在此之前,它已筹集超过 600 亿美元,其中几乎全部来自 2022 年末以来。它在 2026 年可能再融资高达 1000 亿美元、估值或达 8300 亿美元(10 月为 5000 亿美元),同时还有亚马逊最高 100 亿美元与英伟达最高 1000 亿美元(以每次 100 亿美元为一档)投资的谈判。

收入从 2023 年超过 10 亿美元升至 2025 年约 130 亿美元,并在年末达到 200 亿美元的年化运行率,而谷歌与 Facebook 分别用 5 年和 6 年才达到类似规模。计算需求从 2023 年的 200 兆瓦增至 2025 年的 1.9 吉瓦(约 9.5 倍),并签署意向书在未来几年再新增 30 吉瓦、成本约 1.4 万亿美元,使成本与收入仍然紧密耦合。

ChatGPT 在 12 月中旬的月活用户为 9.10 亿,而 Gemini 为 3.45 亿,但欧洲的订阅增长在夏季停滞、此后几乎不再增长,促使公司在 12 月初启动“code red”。泄露数据暗示 2025 年上半年推理成本已超过收入,同时支出承诺被称约为 2025 年收入的 100 倍,且竞争对手缩小了模型差距(包括开放权重模型)。

Leaked figures say OpenAI expects to burn $17bn of cash in 2026, up from $9bn in 2025, with losses continuing for the following three years, after raising over $60bn mostly since late 2022. It may raise up to $100bn in 2026 at perhaps an $830bn valuation (vs $500bn in October), alongside talks for Amazon up to $10bn and Nvidia up to $100bn in $10bn tranches.

Revenue rose past $1bn in 2023 to about $13bn in 2025, reaching a $20bn annualized run rate by year-end, a pace Google and Facebook took 5 and 6 years to match. Computing demand scaled from 200MW in 2023 to 1.9GW in 2025 (~9.5×), with letters of intent for another 30GW costing about $1.4trn, keeping costs tightly coupled to revenue.

ChatGPT had 910m monthly active users in mid-December versus Gemini’s 345m, yet European subscription growth stalled in summer and barely grew afterward, prompting a “code red” in early December. Leaked figures suggest inference costs exceeded revenue in H1 2025, while spending commitments are cited at roughly 100× 2025 revenue and rivals narrow model gaps (including open-weight models).

Source: OpenAI faces a make-orbreak year in 2026

Subtitle: One of the fastest-growing companies in history is in a perilous position

Dateline: 12月 30, 2025 06:36 上午 | SAN FRANCISCO