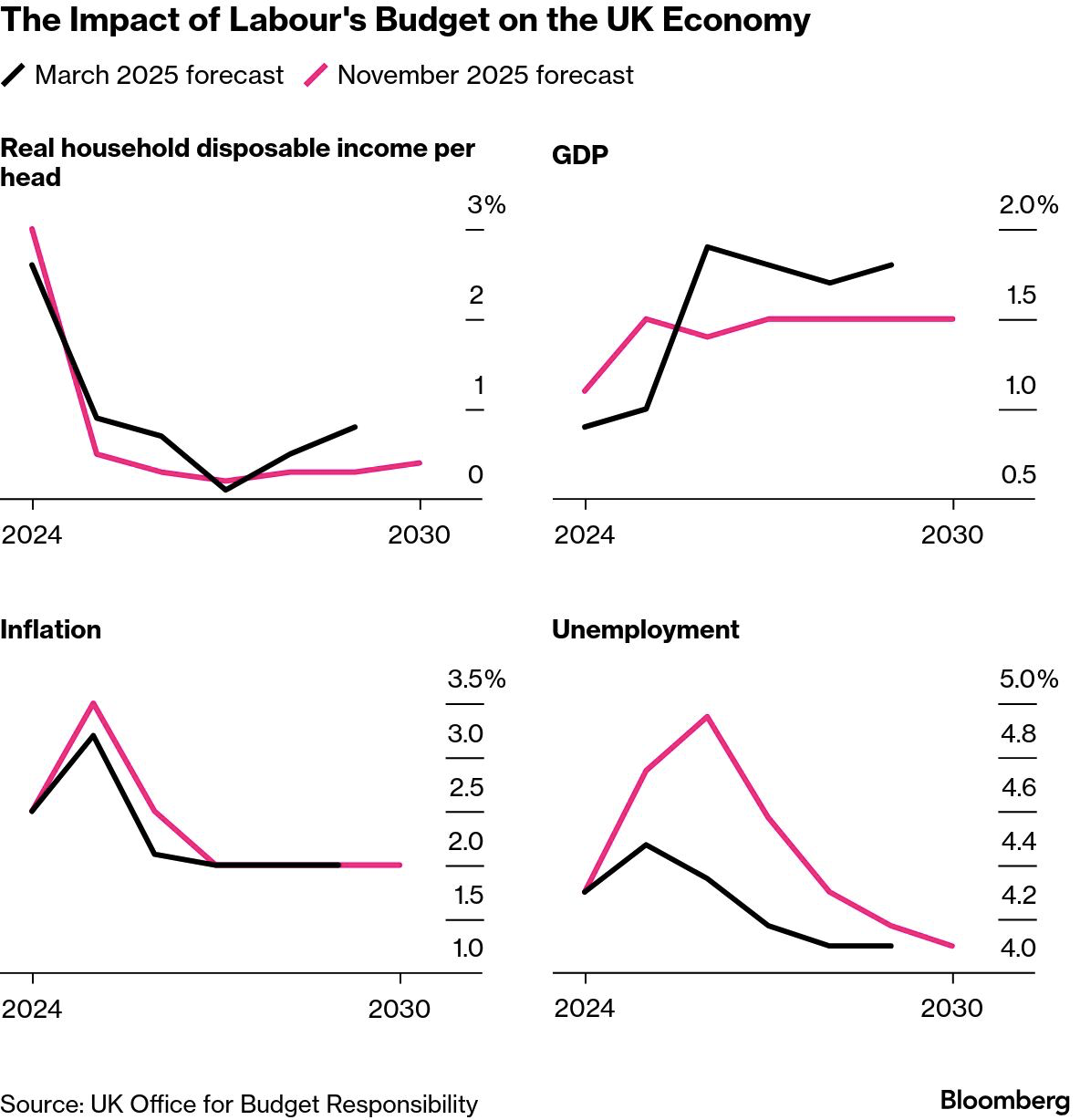

英国财政责任办公室在预算发布前公布的预测呈现四项核心指标的同步恶化:实际家庭收入、GDP、通胀与失业率前景均走弱,且现届议会(至 2030 年)每一年增长预期被下调。商业界反应冷淡,认为在政府强调“增长优先”的同时出现全面下修,显示经济动能不足。预测体系的前置公布进一步凸显预算逻辑与现实数据之间的落差,使短期与中期压力更加明确。

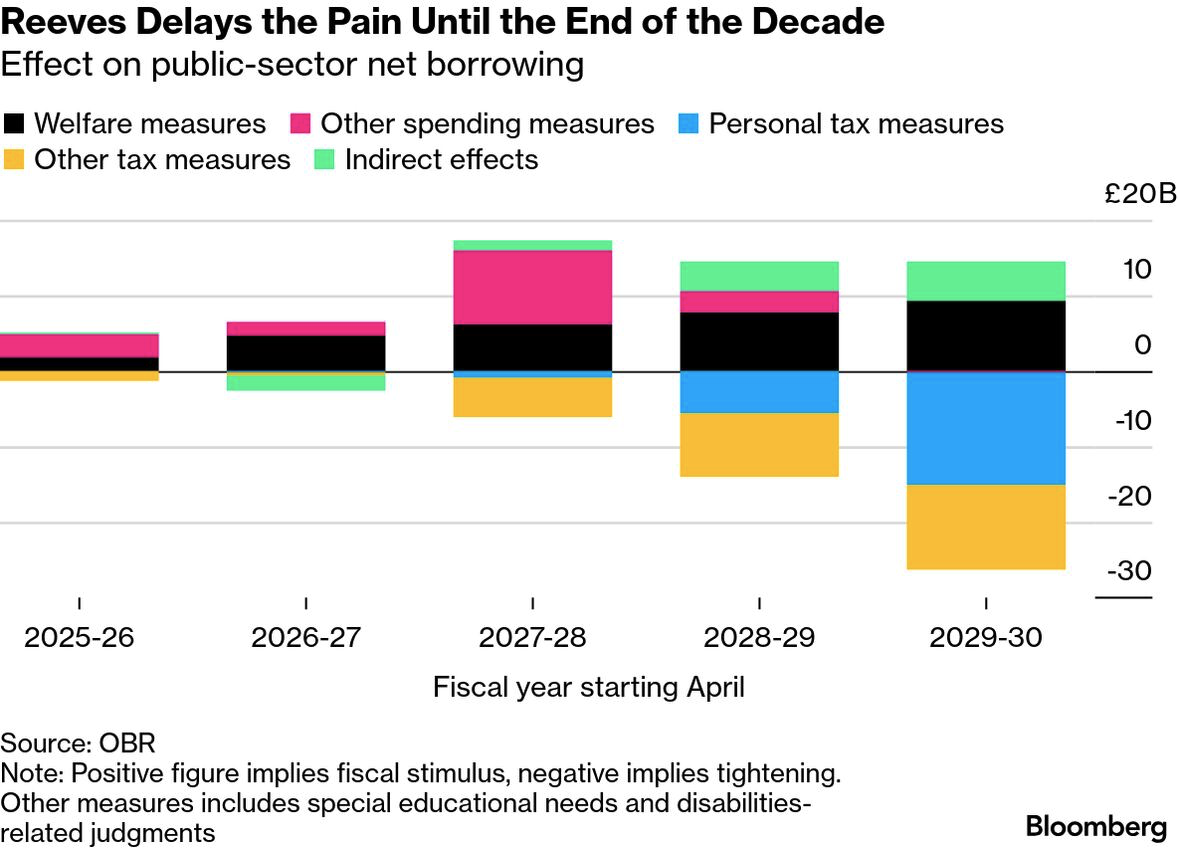

预算的结构性问题集中在税收变化的时间分布上。Reeves 的 260 亿英镑增税包大幅向后移,图示支出在未来几年保持较高水平,而“财政拖累”将在选举前几年集中爆发。这种时间错配意味着调整成本被推迟,但不可避免地在后期强化经济与政治压力。财政路径由此形成“前放松、后紧缩”的节奏,实际改革影响将在 2028 年后集中体现。

尽管市场因更高的财政缓冲而保持稳定,对连续第二个增税预算未显示明显不安,但选民反应仍不确定。从 2028 年起税负压力加剧,将决定政治叙事能否被政府重新塑造,或是否引发更明显的民意反弹。整体判断表明:短期稳定是以未来更高强度的政策收紧为代价,而核心宏观变量的系统性下调暗示中长期风险已被结构化地锁定。

The Office for Budget Responsibility’s pre-budget release shows simultaneous deterioration across four core indicators: real household income, GDP, inflation, and unemployment all worsen, and growth is downgraded in every year of the current Parliament through 2030. Business leaders reacted coolly, noting the contradiction between the government’s “growth-first” messaging and a forecast landscape uniformly revised downward. The early release of forecasts underscored the gap between budget rhetoric and economic reality, clarifying both short- and medium-term pressures.

The structural issue lies in the timing of the tax changes. Reeves’ £26 billion in tax increases are heavily backloaded, with charts showing spending remaining elevated for the next few years before fiscal drag intensifies ahead of the next election. This delay shifts adjustment costs into the later decade, amplifying economic and political strain once tightening arrives. The fiscal path thus adopts an early-loose, late-tight profile, with substantive reform effects concentrated after 2028.

Although markets remained steady due to a larger-than-expected fiscal buffer, voter behavior is uncertain. The post-2028 escalation of tax pressure will determine whether the government can reshape the narrative as elections approach or whether discontent will rise. The overall assessment indicates that short-term stability is bought at the cost of sharper future consolidation, while the OBR’s across-the-board downgrades embed notable medium-term macroeconomic risks.