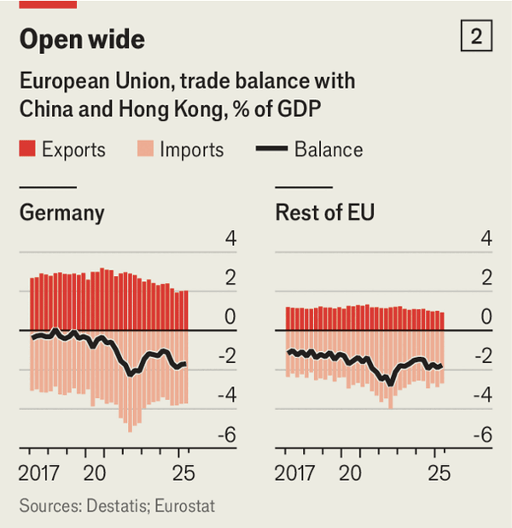

德中之间的贸易逆差激增,2022年达到660亿欧元(约占德国GDP的1.5%),2023年预计再上升至870亿欧元。德国对中国的汽车市场份额已从2020年的27%降至17%;中国品牌现占欧洲混合动力和电动车市场的20%和11%。中国汽车净出口从2020年的零增长到去年达到500万辆,而德国同期减半至120万辆。调查显示,一半受中国竞争影响的德国工业企业计划削减产量和就业。中国出口至美国下降了17%,但对欧洲出口增加了8%。

中国通过限制稀土和Nexperia芯片出口,加强了对欧洲制造业的威胁。部分稀土出口管制虽暂缓一年,但原许可制度对七种稀土依然有效。德国约有50%的制造企业依赖中国产品。欧盟虽拥有反倾销等工具,但统一反制措施推进困难,且即使对中国电动车征收的27%~45%关税,进口仍不断上升。中国对欧投资以匈牙利为主,2023年占比高达44%;比亚迪正投资45亿美元建厂,部分中东欧国家反对限制中资措施。

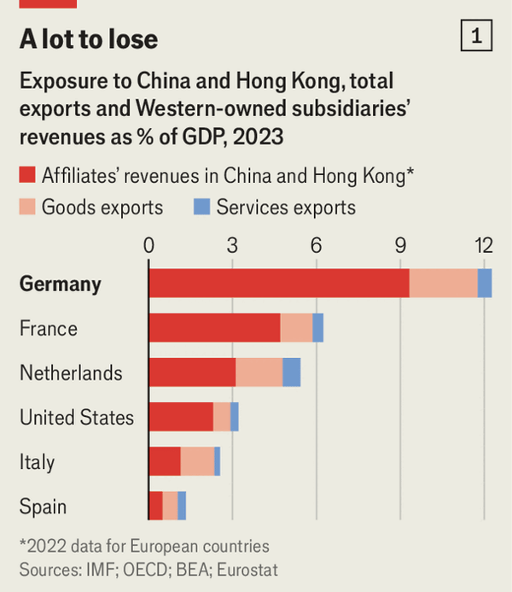

制造业仅占欧盟GDP的16%,德国占20%;大部分国家受中国影响的汽车、化工等行业仅占工业产值10%以上。经济结构调整或可缓冲冲击。即便中国电动车市场份额五年内提升15个百分点,IMF预计对德国GDP影响仅为0.2%,主要因劳动力和资本会流向服务业。困扰德国的核心问题在于生产率低增长和劳动力缩减,而非单一对华竞争。

Germany’s trade deficit with China surged to €66bn (1.5% of GDP) in 2022, with forecasts for 2023 hitting €87bn. German share of the Chinese car market fell from 27% in 2020 to 17%, while Chinese brands account for 20% of Europe’s hybrid and 11% of its EV market. China’s net car exports rose from zero in 2020 to 5m units last year, versus Germany’s declining to 1.2m. Half of German industrial firms exposed to Chinese competition plan job and output cuts. While Chinese exports to the US fell 17%, exports to Europe grew by 8%.

China has intensified its threat to European industry by restricting rare earths and Nexperia chip exports. Some controls are on hold for a year, but licensing for seven other rare earths persists. About 50% of German manufacturers rely on Chinese goods. Despite having trade defense tools, the EU struggles to agree on countermeasures; even tariffs of 27–45% on Chinese EVs haven’t curbed imports. Chinese investment is concentrated in Hungary (44% in 2023), with BYD building a $4.5bn factory. Some Central and Eastern European states resist calls for tighter controls on China.

Manufacturing accounts for just 16% of EU GDP and 20% in Germany; the China-impacted auto and chemical sectors make up over 10% of industry value in only a few countries. Economic adjustment may buffer the China shock. Even if Chinese EV share in Europe rises 15 percentage points in five years, the IMF estimates Germany’s GDP hit at only 0.2%, as labor and capital move into services. Germany’s woes stem more from slow productivity and shrinking workforce than from Chinese rivalry alone.