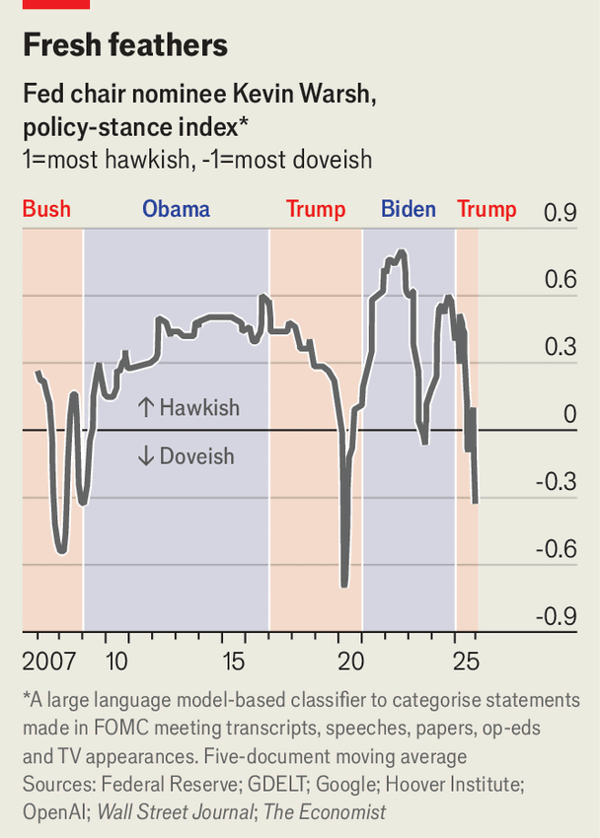

沃什在2006年首次会议上曾让一位联储理事唱起歌,但其更重要的变化是:在长达20年以上的联储批评记录中,他从长期的通胀鹰派转向在特朗普赢得第二任期后反复要求降息。基于对其近200次演讲、电视露面和论文的AI“鹰鸽谱”测绘,除2007-09年金融危机、新冠疫情以及2023年硅谷银行倒闭等严重冲击外,他在今年之前几乎不曾偏鸽。

他现在把AI带来的生产率繁荣和去监管视为压低通胀的力量,但文中强调这与当前通胀仍高于联储2%目标的现实相冲突:一旦通胀抬头,仍需要更高利率来挤压需求。并且生产率上行往往推高投资与“中性利率”,在基准上升时下调利率的净效应可能是过度刺激并加速通胀。

他对“多万亿美元”量化宽松余额表扩张的指责更为一贯,并主张通过卖债收缩资产负债表,即使这会立刻压低债券价格并推高收益率与按揭等长期利率。其设想是用下调短端利率来抵消,从而使收益率曲线更陡并拉大长短端利差,但这需要在不重演2019年回购市场流动性紧张的前提下维持足够准备金,同时还要在特朗普、市场与联储内部投票者三方之间取得脆弱平衡。

Warsh’s story starts with a 2006 first meeting and a 20-plus-year record of Fed critique, but the key numerical shift is his turn from an inflation-first hawk to repeated calls for rate cuts after Trump won a second term. An AI “hawk-dove” mapping of nearly 200 speeches, TV appearances, and papers shows he was dovish before this year mainly during the 2007-09 financial crisis, the covid-19 shock, and the 2023 Silicon Valley Bank collapse.

He now argues that an AI-driven productivity boom and deregulation will restrain inflation, yet the context stresses that inflation is still above the Fed’s 2% target and that higher rates are required once inflation emerges to curb demand. It also highlights a structural trend: productivity gains typically lift investment and the “neutral rate,” so cutting policy rates as that baseline rises can become over-stimulative and risk turbocharging inflation.

On balance-sheet policy he remains consistent, blaming a multi-trillion-dollar QE footprint for wide-ranging harms and pushing to shrink holdings even after the Fed recently ended quantitative tightening. Selling bonds would mechanically push long-term yields up while he would try to offset with lower short-term rates to steepen the curve, but doing so risks leaving too few reserves and replaying, at larger scale, the 2019 repo-market liquidity crunch while he juggles three audiences: Trump, markets, and Fed voters.

Source: Untangling the ideas of Donald Trump’s Fed nominee

Subtitle: What is Warshonomics?

Dateline: 2月 05, 2026 04:18 上午