美国政府宣布将控制多达 5,000 万桶委内瑞拉原油,引发石油交易商和美国炼油商迅速布局以争取获取渠道。这一规模被视为近年来最大规模的意外供应流之一。该政策由唐纳德·特朗普总统通过社交媒体率先披露,并由能源部长随后补充细节,标志着美国联邦政府直接介入国际石油市场,并可能在多年制裁后恢复委内瑞拉对美原油出口。

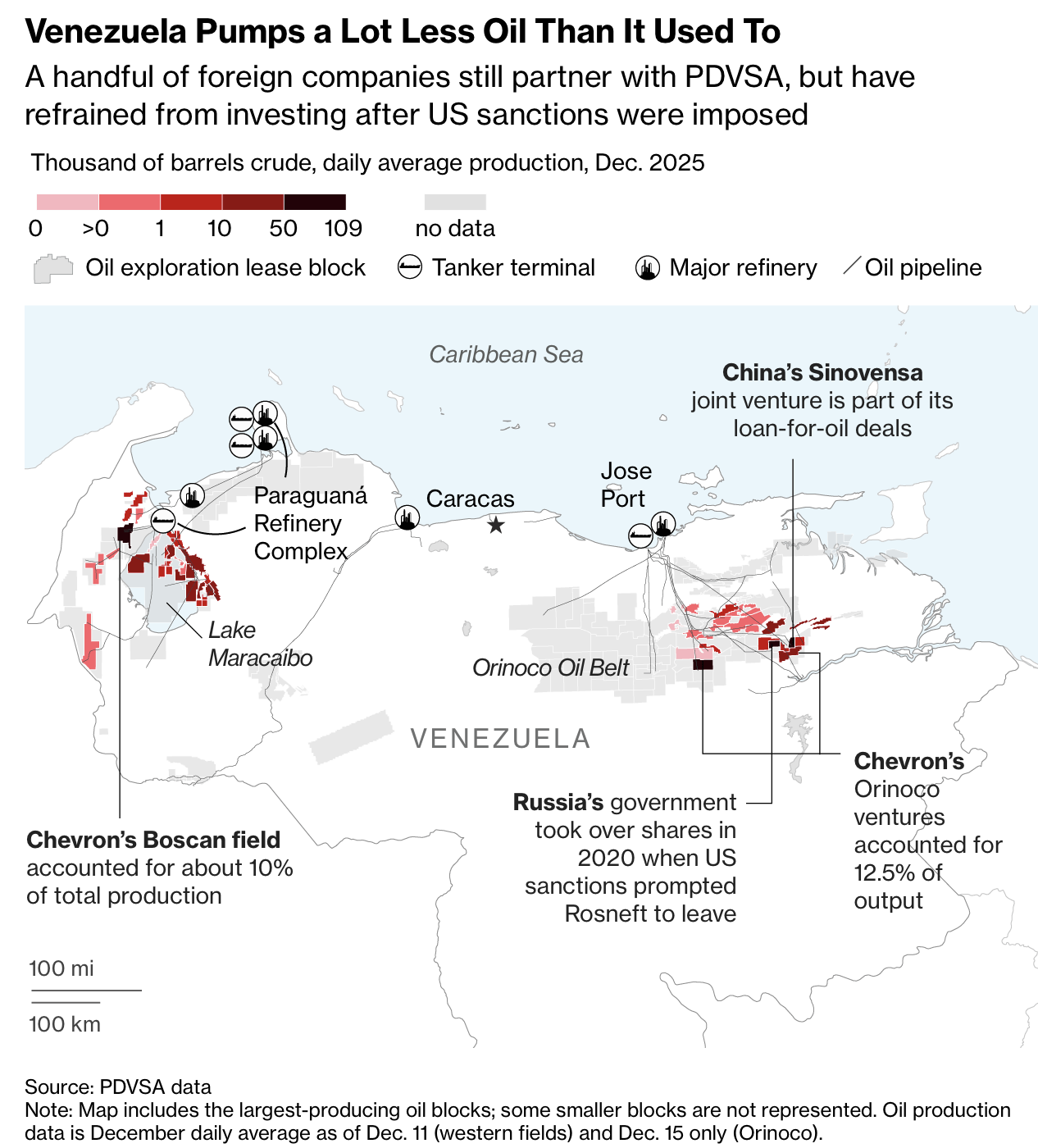

这一转向已对市场产生显著影响,加拿大原油价格下跌,国际基准油价承压。尽管委内瑞拉拥有全球最大探明石油储量,其日产量因长期投资不足和制裁已降至 100 万桶以下。潜在供应回归被视为近年全球能源格局的重大变化。相关企业迅速反应:Citgo 可能自 2019 年以来首次恢复采购,美国炼油企业股价上扬,其中 Valero Energy 股价盘中上涨逾 5%,创历史新高。

美国能源部表示,政府已开始在全球市场直接营销委内瑞拉原油,并与主要商品交易商和银行合作提供金融支持,同时选择性放松制裁以允许运输、销售及进口部分油田设备。分析人士指出,这种直接干预是美国近年来通过战略石油储备等工具影响油价的延伸,但规模更大、干预更深。尽管如此,地区紧张局势仍在,美国本周又扣押两艘受制裁油轮,显示能源政策与地缘政治风险并行存在。

The US government announced plans to take control of up to 50 million barrels of Venezuelan oil, triggering a rush by traders and US refiners to position for access. The volume represents one of the largest unexpected supply flows in years. First revealed by President Donald Trump via social media and detailed by the energy secretary, the strategy places the federal government directly into global oil markets and could restore Venezuelan crude flows to the US after years of sanctions.

The shift has already moved prices, sending Canadian crude lower and pressuring global benchmarks. Despite holding the world’s largest proven reserves, Venezuela’s output has fallen below 1 million barrels per day due to underinvestment and sanctions. The potential return of supply marks a major change in global energy dynamics. Companies have reacted quickly: Citgo is considering its first purchases since 2019, and US refining stocks surged, with Valero Energy rising more than 5% intraday to a record high.

The Energy Department said the US has begun marketing Venezuelan crude globally, engaging major commodity traders and banks, while selectively rolling back sanctions to allow transport, sales, and limited equipment imports. Analysts note this is a continuation of US price influence through tools like strategic reserve programs, but on a much larger and more direct scale. Regional tensions persist, however, as the US seized two additional sanctioned oil tankers this week, underscoring ongoing geopolitical risk alongside the policy shift.