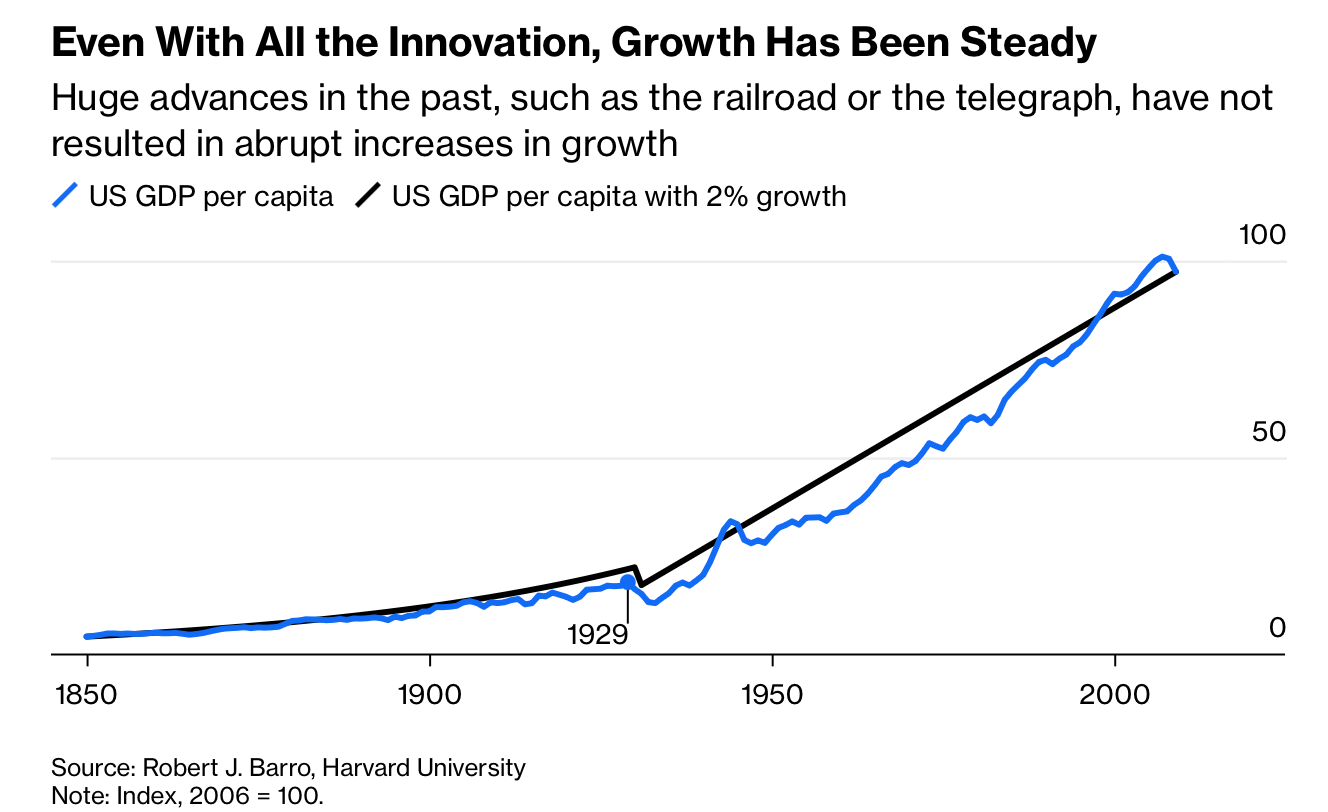

作者对人工智能持乐观态度,但否认其能废除基本经济规律。埃隆·马斯克预测,人工智能将在未来十到二十年内创造极度丰裕,从而使个人无需为退休储蓄。历史经验并不支持这一判断。19世纪至20世纪初的重大技术创新,如铁路、电报和电力,深刻改变了经济与生活方式,但1850年至1929年间的长期经济增速仍仅略低于2%。这些创新提高了生产率,却未带来足以消除个人储蓄需求的爆炸式增长。

在更激进但仍属乐观的情形下,人工智能可能显著加快创新速度,甚至直接完成创新,从而在所有部门推动生产率上升。即便如此,退休储蓄仍然必要。若人工智能治愈癌症,人们寿命将延长,退休年限随之拉长,对资金需求反而增加。护理与陪伴等难以被人工智能替代的工作仍需人类完成,其工资水平可能上升,从而抬高养老和医疗成本。

在较不乐观的情形下,人工智能对生产率的提升有限,类似互联网初期效果,数据中心投资难以兑现预期,市场可能下跌并多年不复原,政府税收减少而债务压力加剧。在这种情况下,储蓄的重要性更加明显。由于未来路径高度不确定,储蓄与投资的核心功能在于对冲风险。即使出现最理想的人工智能未来,个人仍需为退休积累财富。

The author is optimistic about artificial intelligence but rejects the idea that it can suspend basic economic laws. Elon Musk predicts that AI will create such abundance in ten to twenty years that individuals will not need to save for retirement. Historical evidence does not support this claim. Major technological innovations from the nineteenth to early twentieth centuries, such as railroads, the telegraph, and electricity, transformed economies and daily life, yet long-run growth from 1850 to 1929 averaged just under 2%. These innovations raised productivity but did not generate explosive growth sufficient to eliminate the need for personal saving.

In a more radical yet still optimistic scenario, AI could sharply accelerate innovation, even performing innovation itself, lifting productivity across all sectors. Even then, retirement saving would remain necessary. If AI cures cancer, people will live longer, extending retirement spans and increasing lifetime funding needs. Care and companionship, tasks poorly suited to AI, would still require human labor, and wages in those roles would likely rise, pushing up retirement and healthcare costs.

In less optimistic scenarios, AI delivers only modest productivity gains, similar to the early internet, data center investments fail to meet expectations, markets fall, and recovery takes years, while tax revenues decline and public debt pressures intensify. In such conditions, the need to save is even clearer. Because future outcomes are highly uncertain, the core purpose of saving and investing is risk hedging. Even under the most favorable AI-driven future, individuals still need to accumulate wealth for retirement.