疫情冲击打乱了关键数据序列,使脱欧影响更难精确归因,但多项研究仍指向显著成本。NBER 于 11 月的论文估算脱欧已使英国人均 GDP 下降 6–8%,高于 2016 年公投期平均预测的长期 -4%(英国预算责任办公室仍认可该值)。

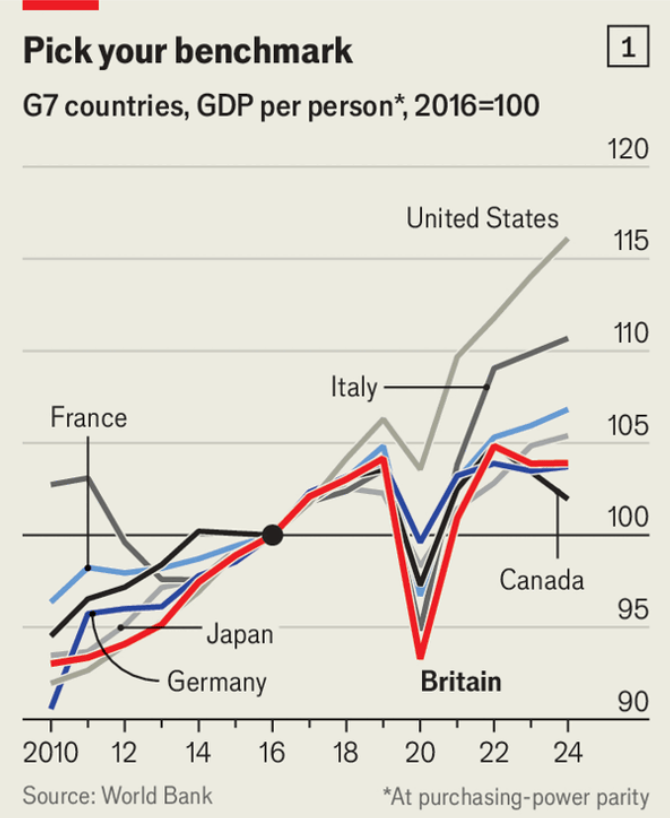

对 NBER 的质疑集中在其将英国与 33 个国家对比、且美国在疫情后明显跑赢导致可比性偏弱;剔除美国后,英国在人均 GDP 上的表现大体处于 G7 中游。2016–2024 年英国人均 GDP 增长 3.9%,低于法国和意大利,但高于德国和加拿大,这意味着若 -6–8% 为真,反事实增长需异常强劲。

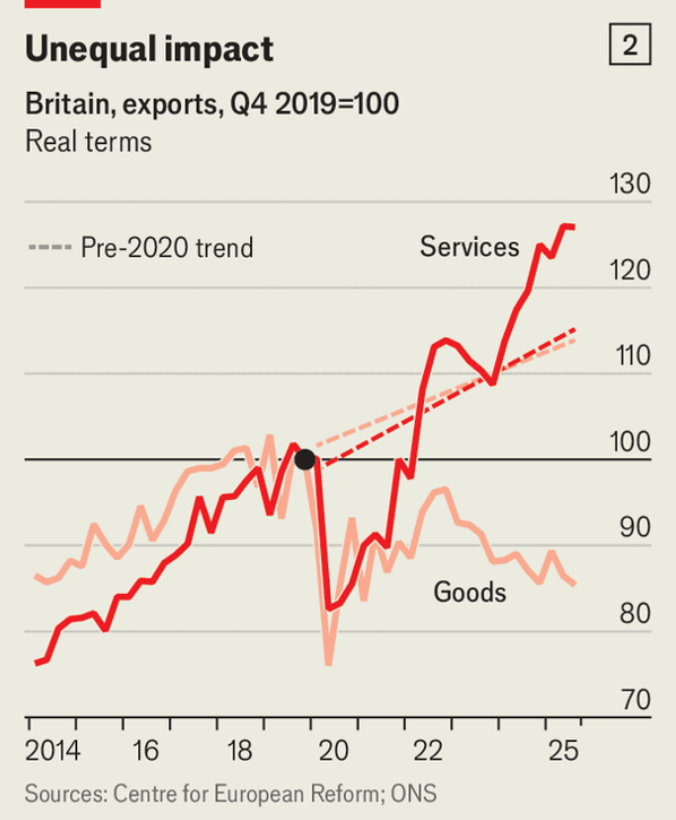

成本最集中在三处:投资、制造业与服务业。2011–2016 年商业投资年均增 6% 后在接下来 6 年基本停滞;两项估计认为到 2022 年企业投资存在约 10% 的“脱欧缺口”;2000–2022 年英国全球制造业出口份额已下降逾半,货物出口降至较疫情前低近 15%,而服务出口自 2019 年实际增约四分之一但仍被估计因脱欧低 4–5%;政策修复方面,2025 年 5 月“重置”协议长期仅提振 GDP 0.3%,加入关税同盟或可使长期 GDP 增加超过 2%(分歧很大)。

The pandemic scrambled economic data, making Brexit’s impact harder to isolate, but the balance of evidence still points to material costs. An NBER paper published in November estimates Brexit has already cut UK GDP per person by 6–8%, above the 2016-referendum average long-run forecast of -4% that the OBR still views as accurate.

Critics argue the NBER approach fails a “smell test” because it benchmarks Britain against 33 countries and includes the United States, whose post-pandemic outperformance is a difficult comparator; excluding the US, Britain looks fairly average within the G7. UK GDP per person rose 3.9% from 2016 to 2024—below France and Italy but above Germany and Canada—implying unusually strong counterfactual growth would be required if the -6–8% estimate were right.

The largest costs cluster in investment, manufacturing, and services. Business investment grew 6% a year in 2011–2016 then flatlined for the next six years, with two estimates attributing a roughly 10% investment shortfall by 2022 to Brexit; the UK’s share of global manufacturing exports fell by more than half from 2000 to 2022 and goods exports are nearly 15% below pre-pandemic levels; services exports are up about a quarter in real terms since 2019 yet are estimated to be 4–5% lower because of new EU barriers. London remains the world’s No. 2 financial centre and the UK’s share of global FX and interest-rate-derivatives turnover is higher than in 2016, while Labour’s May 2025 “reset” is put at only a 0.3% long-run GDP boost and rejoining a customs union is estimated by one firm to lift long-run GDP by over 2% (with wide disagreement).

Source: Brexit has deepened the British economy’s flaws and dulled its strengths

Subtitle: The question is what to do about it

Dateline: 12月 31, 2025 03:40 上午