周一殖利率下跌,因国家经济委员会主任 Kevin Hassett 表示,随著人口成长放缓,未来几个月美国就业数据可能走低;交易员称此番言论对短端影响尤为明显。彭博(Bloomberg)调查的经济学家预期失业率将持平于 4.4%。交易员普遍预期联准会在下次会议将按兵不动,此前联准会在 1 月将政策利率维持在 3.5% 至 3.75%。稍早,受中国银行可能减持美国公债的担忧影响,长天期殖利率曾跳升;同时,在有报导称监管机构因市场波动建议金融机构抑制公债曝险后,美元走弱也推动了此走势;另有政治因素驱动的英国金边债抛售,以及 Alphabet 以美元与英镑进行的大型债券发行,带来额外压力。

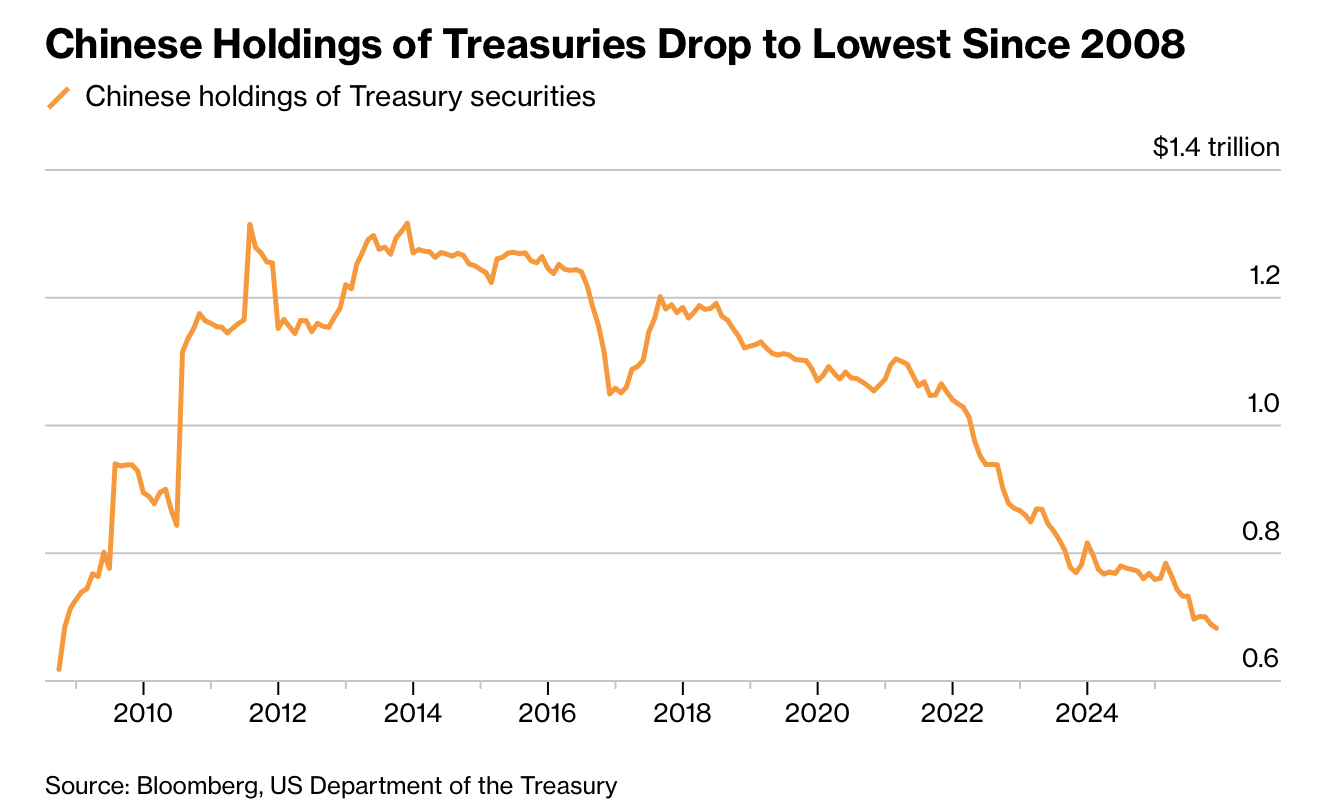

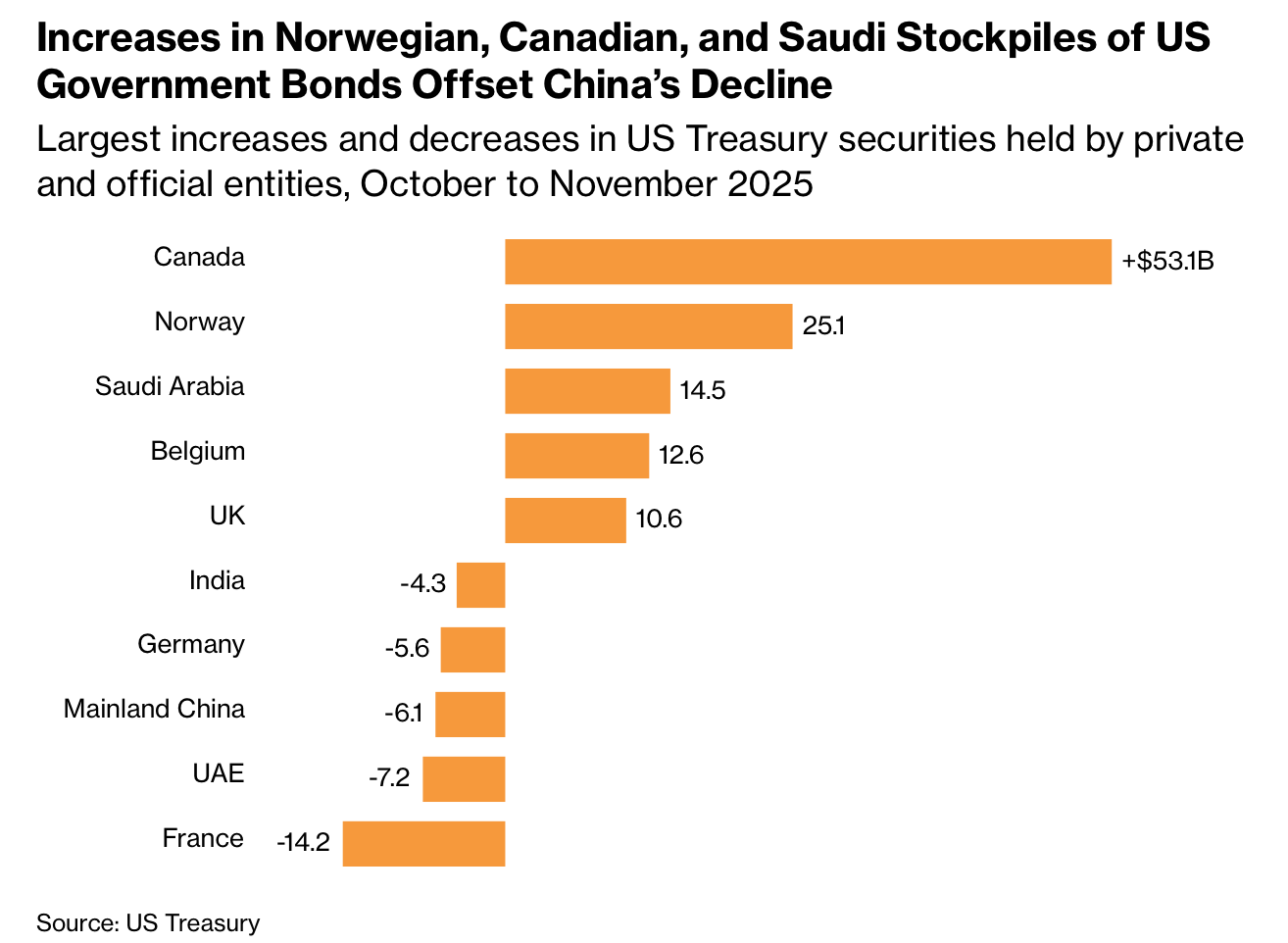

策略师将与中国相关的头条解读为更广泛、渐进式多元化趋势的一部分;有人认为这暗示美元资产在较长期间可能出现外流,但也有人主张市场假设任何减持都会是缓慢而非具破坏性的;其中一项被点出的风险是,大规模抛售可能推升殖利率并使全球经济失序。美国官方数据显示,来自中国的投资人持有的美国公债规模,已从 2013 年底约 $1.32 trillion 的高峰,约减半至 $682.6 billion(自 2008 以来最低);同时,比利时的持有量自 end-2017 以来已成长 4 倍至 $481 billion(常被视为包含与中国相关的托管帐户)。尽管各类别内部出现变化,中国对美国证券(包括机构债与股票)的总投资被描述为自 late 2023 以来相对稳定,而中国仍是继日本与英国之后的第 3 大外国美国公债持有人。

US Treasuries edged higher at the start of a pivotal week as investors awaited 2 major US data releases: January employment (due Wednesday) and January CPI (2 days later), with the schedule shifted by a brief government shutdown. In a choppy session, yields ended about 1 basis point lower, with the 10-year yield down to 4.2%. The market focus is on whether incoming labor and inflation prints confirm a slowing economy or renewed price pressure.

Yields fell Monday after National Economic Council Director Kevin Hassett suggested lower US jobs numbers in coming months as population growth slows, a comment that traders said notably influenced the short end. Economists surveyed by Bloomberg were looking for the unemployment rate to hold at 4.4%. Traders were broadly expecting the Federal Reserve to stay on hold at its next meeting, after keeping the policy rate at 3.5% to 3.75% in January. Earlier, long-dated yields jumped on concerns Chinese banks might reduce Treasury holdings, alongside a weaker dollar after reports regulators advised institutions to curb Treasury exposure due to market volatility; additional pressure came from a politically driven UK gilt selloff and a large Alphabet bond sale in dollars and pounds.

Strategists framed the China-related headlines as part of a broader, gradual diversification trend that some see as implying longer-run outflows from dollar assets, though others argued markets assume any reduction would be slow rather than disruptive; one risk cited was that a large-scale sale could spike yields and destabilize the global economy. Official US data show China-based investors’ Treasury holdings have roughly halved to $682.6 billion (the lowest since 2008) from a late-2013 peak of $1.32 trillion, while Belgium’s holdings have quadrupled since end-2017 to $481 billion (often viewed as including custodial accounts tied to China). Despite shifts within categories, China’s total investment in US securities (including agency bonds and equities) was described as relatively stable since late 2023, and China remains the 3rd-largest foreign Treasury holder after Japan and the UK.