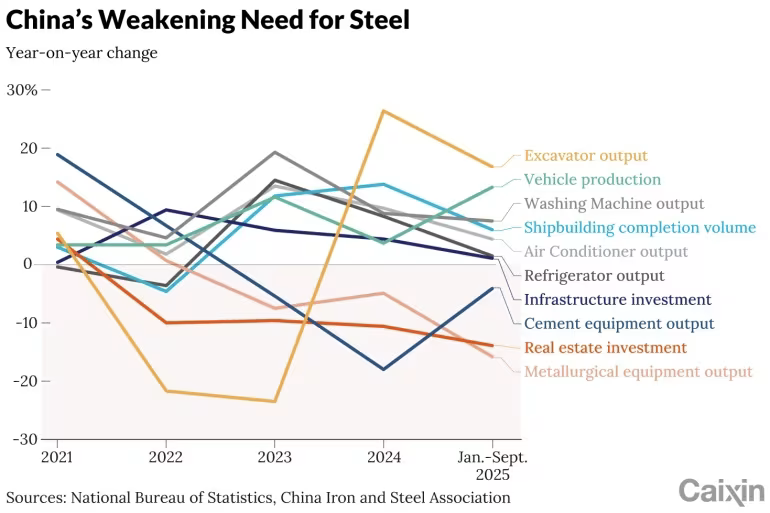

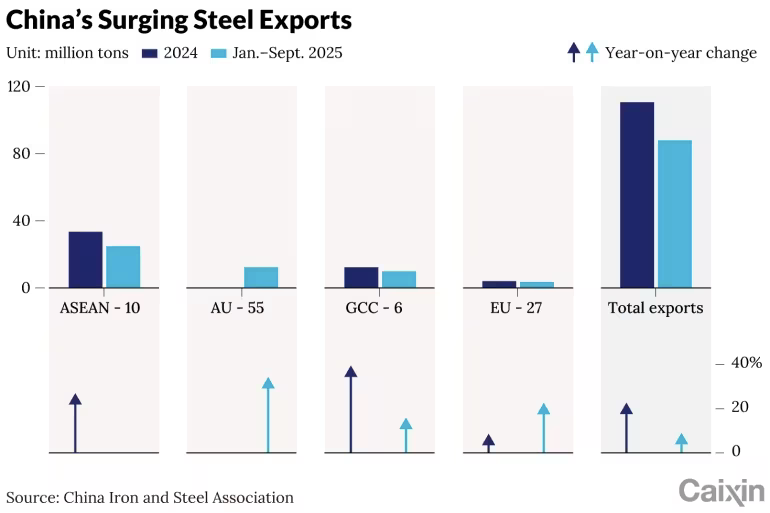

中国国内钢需下滑速度快于产量收缩,2025 年前三季度粗钢产量 7.46 亿吨,同比跌 2.9%,但消费量仅 6.49 亿吨,跌幅达 5.7%。价格同步下探,钢价指数 6 月跌破 90 创 2017 年以来最低。出口成为主要出路:2024 年出口 1.1 亿吨,同比增长 22.7%;2025 年前九个月出口 8796 万吨,同比增长 9.2%,全年或达 1.3 亿吨。然而出口均价在 2024 年下降 19.3% 至每吨 755.40 美元,2025 年再跌 9.5%。同时海外建厂迅速扩张,超过 20 国在建项目,海外产能突破 1.2 亿吨。长期看,出口已接近全球贸易 30% 的上限,未来五年或减半,中国表观消费量可能从逾 10 亿吨降至约 7.5 亿吨。

成本端为产量维持提供短期动力。2025 年上半年钢价下跌 7–9%,但炼焦煤指数暴跌 31.5%,低硫主焦煤跌 19.7%,铁矿石跌 7.3% 至每干吨 93.55 美元,使行业前三季度利润达 960 亿元,同比增长近 190%,销售利润率升至 2.1%。但 10 月煤价反弹 10%,利润或再受压。国家要求将粗钢产量从 2023 年水平削减 5%,但“产能置换”导致潜在产能估计达 14 亿吨。上市钢企中仍有 8 家亏损,个别企业库存高达 17 亿至 73 亿元。越南与至少 11 国反倾销措施使部分市场出口量下跌近 30%,但总出口仍因提前采购、新兴市场需求与半成品出口(前三季度 1100 万吨,三倍增)保持高位。

铁矿石需求承压,中国 2024 年进口 12.4 亿吨,占消费量八成,价值 1322 亿美元。四大矿商控制 70% 海运供应,指数定价结构长期不利于中方。为削弱 Platts 影响,中国推出“北京铁矿石价格指数”,已有主要钢企与 Hancock Iron Ore 参与使用。海外工业化进一步推升外部钢需,例如几内亚项目使中国对该国挖掘机出口从 2023 年同期的 294 台跃升至 2292 台,增幅 179%。但海外投资亦伴高风险,如京义集团收购 British Steel 后持续每天亏损 70 万英镑并被政府接管。

Domestic steel demand in China is falling faster than output, with 746 million tons of crude steel produced in the first nine months of 2025, down 2.9% year-on-year, while consumption fell 5.7% to 649 million tons. Prices weakened, with the steel index dipping below 90. Exports surged to 110 million tons in 2024 (+22.7%) and 87.96 million tons in the first nine months of 2025 (+9.2%), possibly reaching 130 million tons for the year, while average export prices fell 19.3% in 2024 to $755.40 per ton and another 9.5% in 2025. Overseas investments expanded to more than 20 countries with over 120 million tons of capacity. With exports nearing 30% of global trade, volumes may halve within five years, reducing China’s apparent consumption from over 1 billion to about 750 million tons.

Falling raw material costs have supported production. In early 2025, steel prices declined 7–9%, but coking coal plunged 31.5%, low-sulfur coal 19.7%, and iron ore 7.3% to $93.55 per ton. Industry profit reached 96 billion yuan in the first three quarters (+190%), with margins rising to 2.1%. Coal prices rebounded 10% in October, pressuring margins again. The government targets a 5% cut from 2023’s output, but capacity swaps keep effective capacity near 1.4 billion tons. Eight listed mills posted losses, with inventories such as Chongqing Steel’s 1.7 billion yuan and Bengang’s 7.3 billion. Despite antidumping actions from Vietnam and at least 11 countries, total exports rose due to frontloaded buying, expansion in Africa (+34.3%), and a surge in billet exports to 11 million tons (tripled).

Iron ore demand is weakening; China imported 1.24 billion tons in 2024 worth $132.2 billion. Four miners control 70% of seaborne supply, and index pricing often disadvantages Chinese buyers. China launched the Beijing Iron Ore Price Index to diversify benchmarks, now adopted by major mills and Hancock Iron Ore. Overseas industrialization increases external steel demand, exemplified by excavator exports to Guinea rising from 294 to 2,292 units (+179%). But overseas projects carry risks, as shown by Jingye’s loss-making British Steel acquisition.