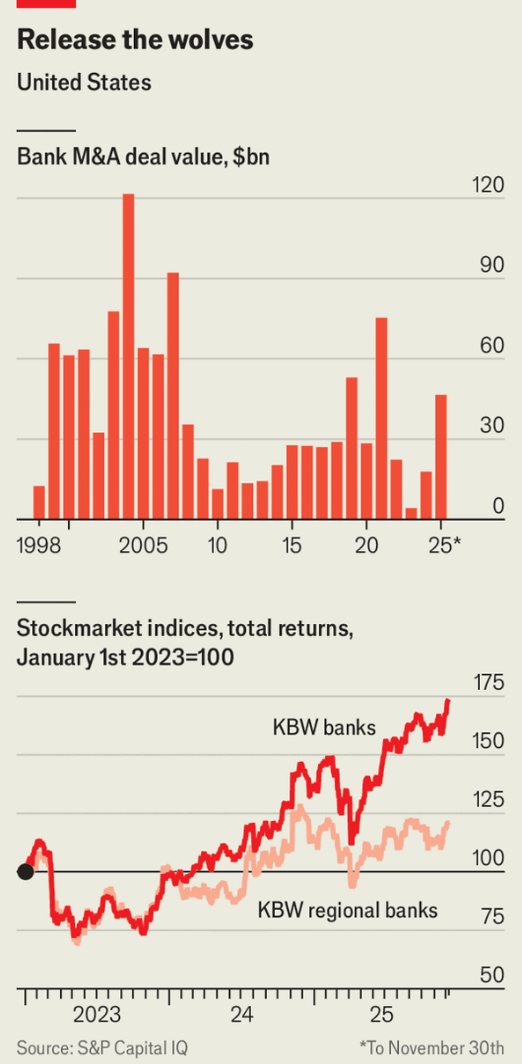

美国银行业整合正在加速:商业银行数量已从1990年的12,300家降至如今约3,800家,而2025年已宣布的银行并购交易总额约470亿美元,超过2023年和2024年合计的两倍。为获取规模优势的压力还被强化,因为全球银行和投行的技术支出预计将从今年的7,600亿美元增至2029年的1.1万亿美元,仅摩根大通今年就在技术上投入约180亿美元。

并购之所以更容易,是因为自2022年以来的利率上升已经让大量潜在损失显现,证券未实现亏损在三年内减半至3,370亿美元,同时最新的FASB规则调整阻止收购方在购入贷款时对信用损失进行“双重计提”。与此同步的是更宽松的监管环境——包括由亲银行派系主导的联邦存款保险公司领导层以及放松的大行资本要求——预计可释放约2.6万亿美元的信贷能力,相当于美国银行资产总额的约16%,为并购提供弹药。

近期交易凸显了银行追求规模和对监管更有把握:Fifth Third与Huntington分别斥资109亿和74亿美元收购小型银行,使各自资产规模突破曾被视为“红线”的2,500亿美元监管门槛,而一笔发生在南部、金额90亿美元的合并在不到五个半月内获批,是自2007–09年金融危机以来同等规模中最快。企业贷款质量可能恶化以及2026年后政治风向转向更严监管仍是潜在风险,但银行家普遍认为,他们至少还有数年相对宽松的窗口可以推动激进的并购。

The U.S. banking landscape is rapidly consolidating, with the number of commercial banks shrinking from 12,300 in 1990 to around 3,800 today. In 2025, bank deals have already reached about $47 billion, more than double the total from 2023 and 2024. Increasing scale is crucial as tech spending in global banking is projected to rise significantly. Deal-making has become more feasible, as rising interest rates since 2022 revealed hidden damages. A recent rule change also benefits acquirers regarding credit losses.

A more permissive regulatory environment, backed by a bank-friendly leadership at the FDIC and relaxed capital rules, could unlock about $2.6 trillion in lending capacity—roughly 16% of U.S. bank assets—to facilitate acquisitions. Recent transactions reflect this trend, as Fifth Third and Huntington acquired smaller banks for $10.9 billion and $7.4 billion, respecting the $250 billion asset threshold. Despite risks from corporate loan quality and potential future regulatory shifts, bankers are optimistic about pursuing aggressive M&A in the coming years.

U.S. banking consolidation is accelerating: the number of commercial banks has fallen from 12,300 in 1990 to about 3,800 today, and announced 2025 bank deals already total roughly $47 billion, more than double the combined value in 2023 and 2024. Pressure to gain scale is reinforced by an expected rise in global bank and investment-firm tech spending from $760 billion this year to $1.1 trillion by 2029, with JPMorgan Chase alone investing about $18 billion in technology.

Source: Wall Street is drooling over bank mergers

Subtitle: The world’s most fragmented financial industry faces dramatic change

Dateline: 12月 11, 2025 06:01 上午 | New York