在对贸易战引发衰退的担忧之后,2025年全球GDP仍很可能增长约3%,与去年相同;失业率几乎各地保持低位、股市上涨,而经合组织(OECD)通胀仍高于各国央行2%的目标。

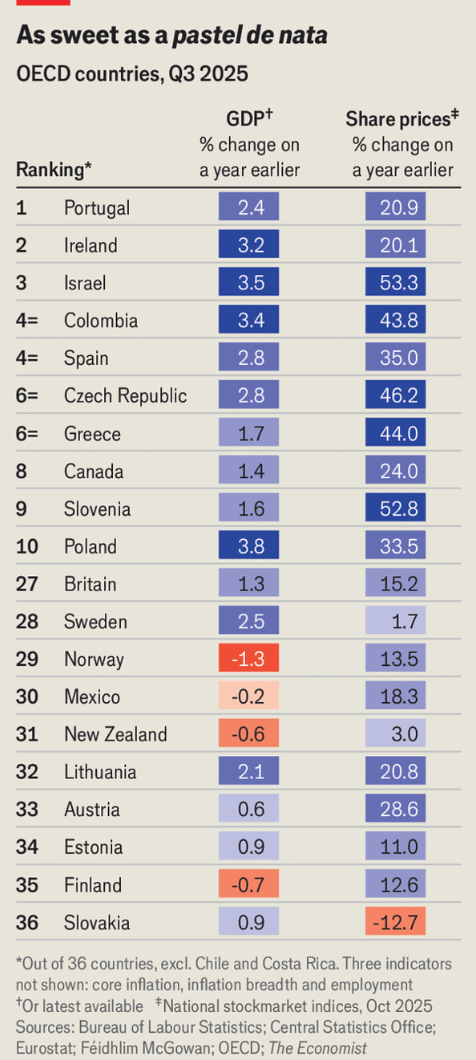

在36个以富裕国家为主的经济体中,依据5项指标(核心通胀、通胀广度、GDP、就业与股市表现)分别排名并汇总为2025年的总体得分:葡萄牙在西班牙去年夺冠、希腊于2022—2023年获胜之后位居榜首;爱沙尼亚、芬兰和斯洛伐克接近末位;美国仅居中游,低于意大利,部分原因是通胀相对偏高。

核心通胀以偏离2%的程度评判:爱沙尼亚在2025年第三季度接近7%,英国约为4%,而瑞典几乎为零;通胀广度在澳大利亚尤为极端,消费篮子中超过85%的项目价格年涨幅高于2%。在市场方面,丹麦最差(诺和诺德一年内下跌60%),以色列最好(列乌米银行上涨约70%),葡萄牙股市在2025年上涨超过20%;历史上,“年度经济体”的股市在次年平均还会再涨约20%。

After fears of a trade-war recession, global GDP is still likely to grow about 3% in 2025, matching last year; unemployment stays low almost everywhere and equities are up, while OECD inflation remains above central banks’ 2% targets.

Across 36 mostly rich countries, five indicators (core inflation, inflation breadth, GDP, jobs, and stockmarket performance) are ranked into an overall 2025 score, with Portugal on top after Spain last year and Greece winning 2022–23, while Estonia, Finland, and Slovakia sit near the bottom and America ranks mid-table, below Italy, partly because inflation is relatively high.

Core inflation is judged by distance from 2%: Estonia is near 7% in Q3 2025 and Britain about 4%, whereas Sweden is close to zero, and inflation breadth is extreme in Australia with over 85% of basket items rising more than 2% a year. In markets, Denmark is worst after Novo Nordisk fell 60% in a year, while Israel leads with Bank Leumi up about 70% and Portugal’s market up over 20% in 2025; historically, the “economy of the year” market rises about 20% on average the next year.

Source: Which economy did best in 2025?

Subtitle: Our annual ranking returns

Dateline: 12月 11, 2025 06:42 上午