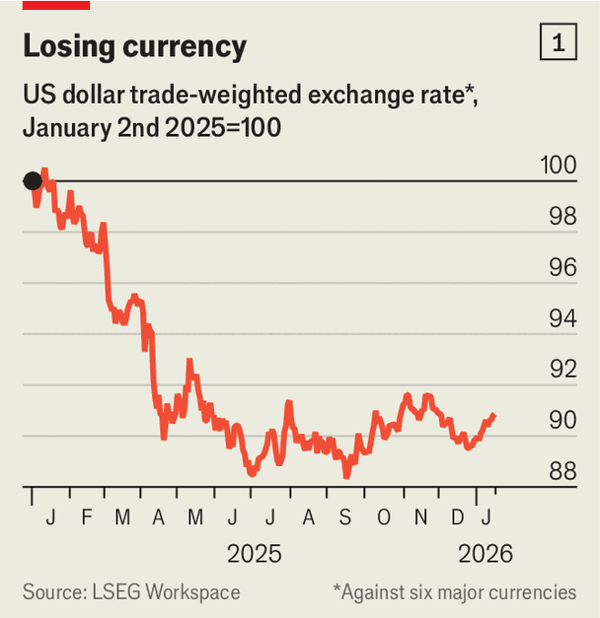

美元的全球角色更多取决于投资者对美国资产的信心,而不仅仅是外汇储备份额:自2025年初以来美元已贬值约10%,而央行外汇储备中美元计价资产的占比已从1999年的72%降至如今的57%。与此同时,央行与主权部门持有的美国债务证券在流入美国的组合投资中的重要性下降,从约17年前的38%降至今天美国组合持有价值的13%,为现代史最低。

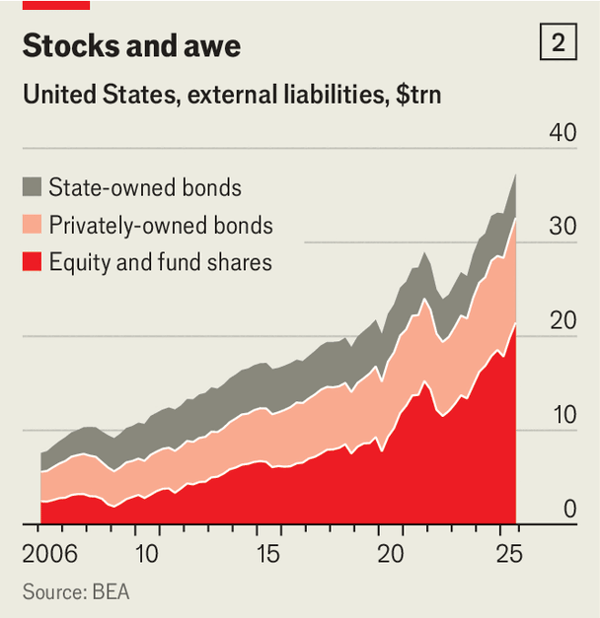

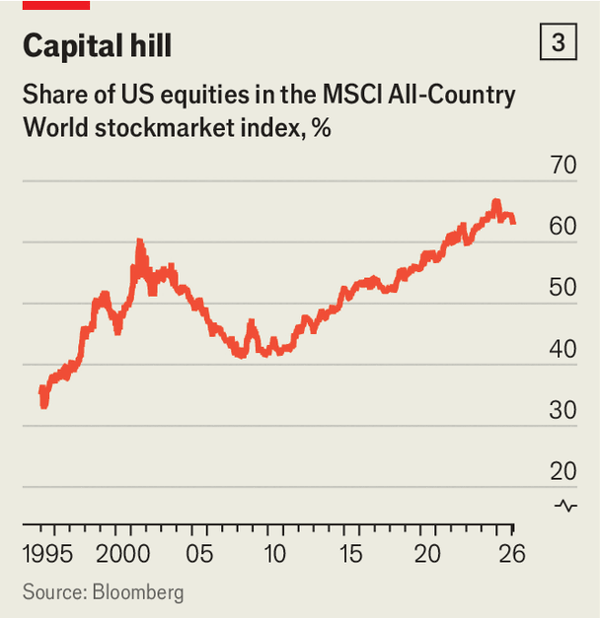

海外资金结构明显“冒险化”:在不到二十年里,外国持有的美国资产中由美国股票构成的份额几乎翻了三倍,从2007-09年全球金融危机后的低点21%升至如今的纪录58%。但风险回撤正在显现:去年美股总回报率比全球同业低5个百分点,为2009年以来最大差距,“七巨头”过去四个月基本持平,而关税与AI泡沫担忧叠加使避险逻辑受挫,关税冲击期间(4月以及10月和1月的动荡)长期美债收益率在股市下跌时反而上升。

主权与机构行为呈分化:部分投资者开始减持美债(例如管理规模逾1500亿美元的瑞典养老金Alecta自2025年初分批减少美债),但2025年主权投资者仍被估算向美国资产投入1320亿美元,接近2024年的两倍,且即便剔除最大单笔交易也创该数据发布六年来新高。更广泛的变化是对美元敞口的对冲在4月关税宣布后激增,外国资金更偏好对冲型ETF而冷落未对冲型;在相对价值上,除美国外G7政府债平均收益率升至2.8%(2008年以来最高),与美债的利差从2024年底的2.2个百分点收窄至如今的1.2个百分点,令美元在类似2002-2008年美元约下跌40%的循环风险下更易承压。

The dollar’s standing is increasingly tied to confidence in U.S. assets rather than reserve shares alone: since the start of 2025 it is down about 10%, while the dollar share of global central-bank FX reserves has fallen from 72% in 1999 to 57% today. At the same time, reserve and other sovereign holdings of U.S. debt securities have shrunk in importance, dropping from about 38% of portfolio investment into America roughly 17 years ago to just 13% of the value of U.S. portfolio holdings today, the lowest in modern history.

Foreign ownership has shifted sharply toward risk: in less than two decades, U.S. stocks’ share of foreign-owned U.S. assets almost tripled, from a post-2007–09 low of 21% to a record 58% today. That risk is showing up in returns and “safe-haven” behavior: last year U.S. stocks trailed global peers by five percentage points (the widest since 2009), the Magnificent 7 have largely flatlined for four months, and during tariff shocks (April, then again in October and January) long-term Treasury yields rose even as equities sold off.

Investor actions are diverging: some have reduced U.S. government-bond exposure (Alecta, with over $150bn in assets, cut holdings in several tranches since early 2025), yet sovereign investors are estimated to have put $132bn into U.S. assets in 2025, nearly double 2024 and the highest in six years even excluding the biggest deal. The broader shift is toward hedging dollars, which surged in April and is reflected in foreign flows favoring hedged ETFs over unhedged; relative yields also matter, with non-U.S. G7 government-bond yields at 2.8% (highest since 2008) and the gap to Treasuries narrowing from 2.2 percentage points at end-2024 to 1.2 points today, raising the risk of a feedback loop reminiscent of 2002–08 when the dollar fell around 40%.

Source: Why the dollar may have much further to fall

Subtitle: It is hard to be a safe haven when trouble starts at home

Dateline: 2月 05, 2026 06:12 上午 | NEW YORK