预测市场被宣传为高度精准的信息引擎,但其迅速扩张暴露出显著的数量化风险与监管真空。到2025年,Kalshi与Polymarket估值多次翻倍,双双超过100亿美元,传统交易所如CME Group、ICE和Cboe已累计投入数十亿美元。Kalshi称其年化交易量刚刚突破1000亿美元,而Robinhood首席执行官Vlad Tenev预测未来将达到“每年数万亿份合约”。然而,市场结构高度失衡:体育合约在近期约占Kalshi全部交易量的90%,在Polymarket约占40%,显示出以高频、短周期投机驱动的流动性,而非长期信息定价。

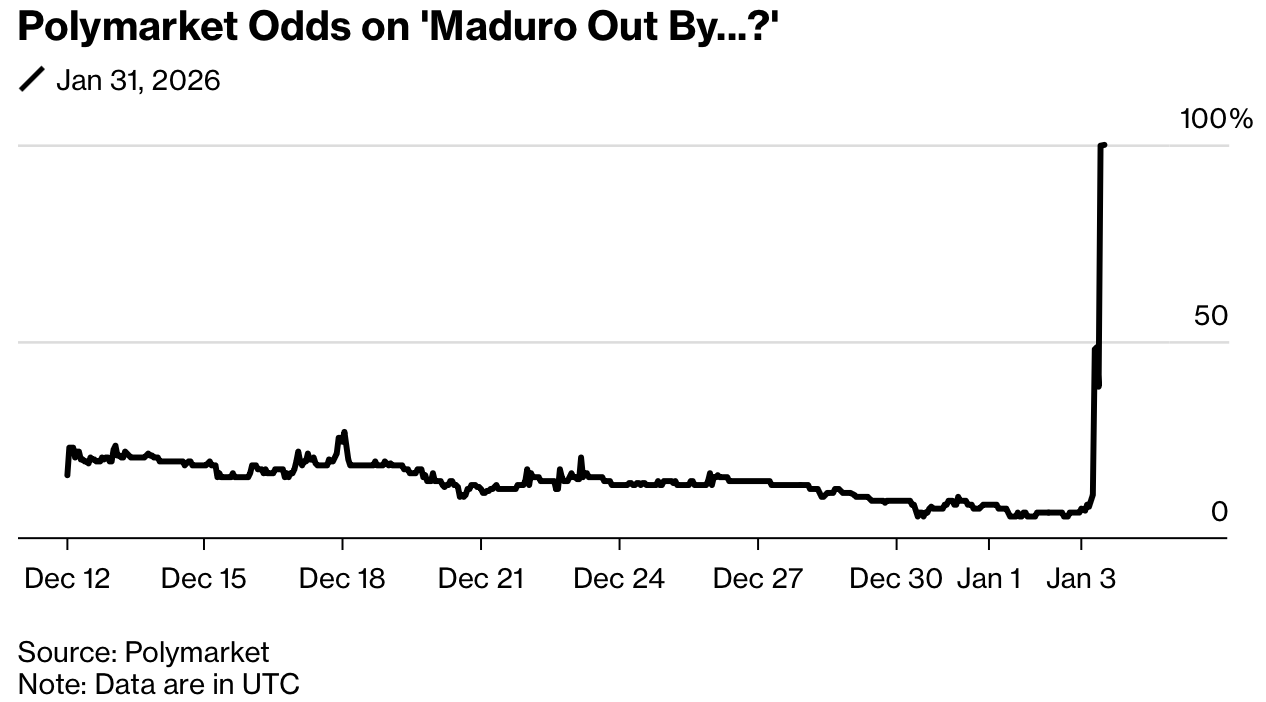

关键事件凸显了信息不对称的量化后果。2025年12月底,一名Polymarket交易者以约3.3万美元押注尼古拉斯·马杜罗将在月底下台,在结果兑现后获利超过40万美元,回报率超过1100%。该市场价格在官方公告前数小时即开始上升,引发对内幕交易的强烈质疑。类似的价格跳跃也出现在其他合约中,例如唐纳德·特朗普在年内“获得格陵兰”的概率从6%跃升至11%,以及伊朗最高领袖被罢免的概率从19%升至35%,表明少量资金即可显著扭曲概率信号。

监管与社会成本的统计迹象同样突出。研究显示,在美国各州合法化在线体育博彩后,信用评分下降、债务水平上升,而预测市场正将类似机制扩展至更广人群,包括体育博彩仍属非法的地区。监管层面,商品期货交易委员会原定五人委员会目前仅剩一名共和党委员,执法能力受限。尽管支持者声称市场能提供“群体智慧”和低成本保险替代,但当前数据更接近零和博弈:高交易量、集中化利润与潜在的系统性外溢风险并存。

Prediction markets are promoted as highly accurate information engines, yet their rapid expansion reveals clear quantitative risks and regulatory gaps. By 2025, Kalshi and Polymarket had seen valuations double multiple times, each exceeding $10 billion, with traditional exchanges such as CME Group, ICE, and Cboe committing billions of dollars. Kalshi reported annualized volumes just topping $100 billion, while Robinhood CEO Vlad Tenev projected growth to “trillions of contracts per year.” Market composition is highly skewed: sports contracts recently accounted for about 90% of all trading on Kalshi and roughly 40% on Polymarket, indicating liquidity driven by high-frequency, short-duration speculation rather than long-horizon information pricing.

Specific episodes illustrate the numerical impact of information asymmetry. In late December 2025, a Polymarket trader wagered roughly $33,000 that Nicolás Maduro would be removed by month’s end and earned more than $400,000 after the outcome, implying a return exceeding 1,100%. Prices began rising hours before the official announcement, intensifying insider-trading concerns. Similar price jumps occurred elsewhere, with odds of Donald Trump acquiring Greenland by year-end moving from 6% to 11%, and bets on Iran’s supreme leader being removed rising from 19% to 35%, demonstrating how limited capital can materially distort probability signals.

Regulatory and social-cost indicators are equally stark. Studies show that legalization of online sports gambling in U.S. states coincided with falling credit scores and rising debt, dynamics prediction markets may extend to broader populations, including jurisdictions where sports betting remains illegal. Oversight is constrained: the Commodity Futures Trading Commission, designed as a five-member body, is currently led by a single Republican commissioner. While proponents argue these markets generate “wisdom of crowds” and cheaper insurance substitutes, available data point to predominantly zero-sum outcomes, concentrated profits, and growing systemic spillover risks.