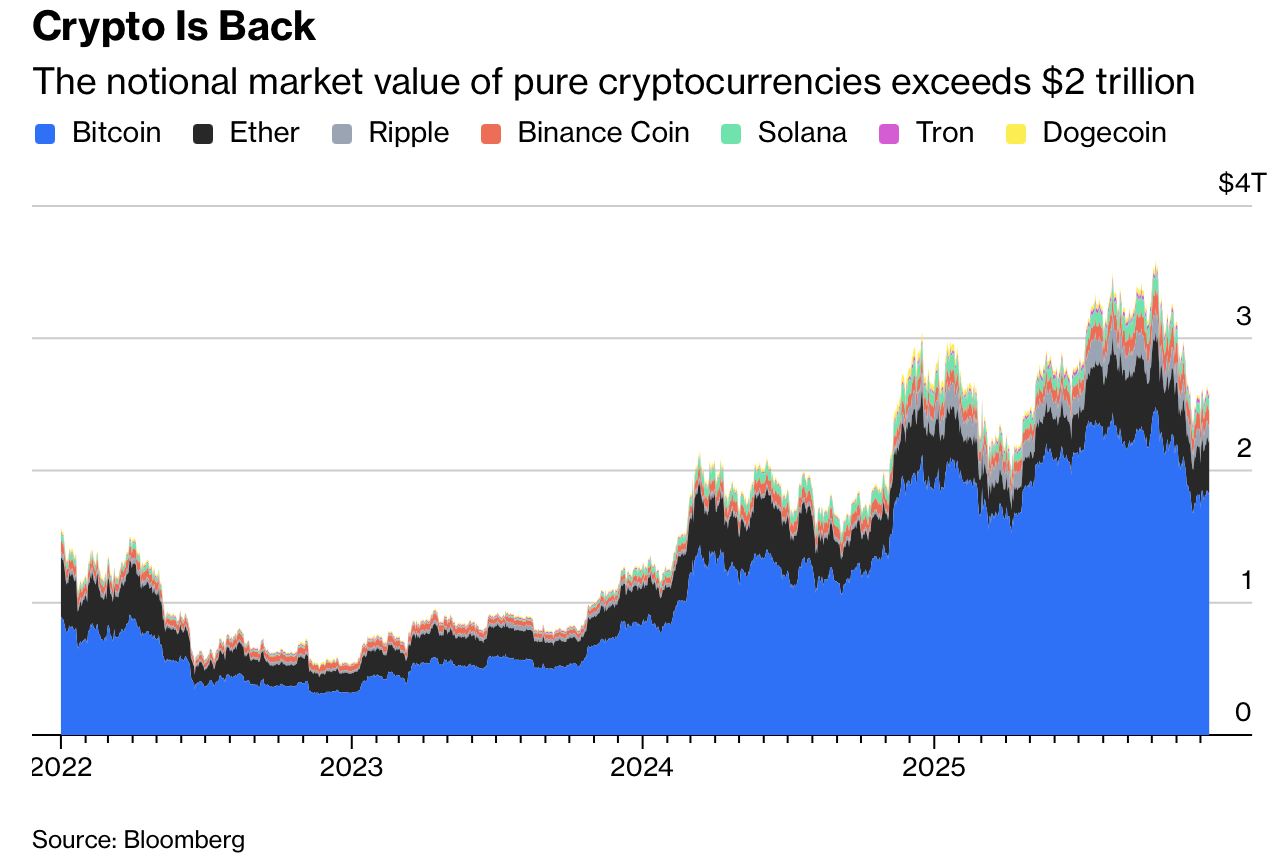

狗狗币并不具备传统意义上的资产属性,其市值却因投机被推高至超过200亿美元,而包括比特币在内的所有纯加密货币总市值已超过2万亿美元。这种规模并未建立在真实经济活动或现金流之上,而是一种可能迅速消散的社会性投机现象。在此背景下,若银行以真实美元为此类资产提供杠杆融资,将把原本局限于投机者的风险放大并传导至金融体系核心,显著提高系统性危机的概率。

此前的监管框架有效遏制了这种风险。巴塞尔银行监管委员会将代表真实资产、且可可靠赎回的代币与纯加密货币严格区分,要求后者必须以全额吸收损失的股本支持,并且在银行总资本中占比极小。这一制度在2022年加密市场崩盘、FTX等机构倒闭时经受住考验:银行体系几乎未受冲击,潜在的系统性损失被限制在自愿参与者范围内,显示出监管约束在数量和结构上的有效性。

当前的变化在于监管态度的转向与行业游说的增强。金融与加密行业提议放松资本要求并取消对银行加密敞口的上限,理由是部分加密资产在流动性和波动性上“类似”股票或货币对。但这一比较忽视了关键差异:前者缺乏任何真实世界现金流支撑。若采纳该提案,银行存款可能被用于为对狗狗币等“玩笑式”代币的杠杆押注融资,从而把无内在价值的价格波动引入高度杠杆化的银行体系,对金融稳定性造成不成比例的威胁。

Dogecoin does not qualify as an asset in any conventional sense, yet speculation has driven its market capitalization above $20 billion, while the total value of pure cryptocurrencies, including Bitcoin, exceeds $2 trillion. These figures are not grounded in claims on real economic activity or cash flows but reflect a social betting phenomenon that could unwind abruptly. Allowing banks to lend real dollars against such instruments would amplify risks that are currently borne mainly by speculators and transmit them into the core of the financial system, materially increasing the likelihood of a systemic crisis.

Earlier regulatory frameworks successfully constrained these dangers. The Basel Committee on Banking Supervision drew a sharp line between tokens representing genuine assets, which could be treated like their underlying instruments, and pure cryptocurrencies, which were required to be fully backed by loss-absorbing equity and capped at a tiny share of bank capital. This structure proved effective in 2022, when crypto prices collapsed and intermediaries such as FTX failed: banks had minimal exposure, and losses that might have destabilized the financial system were largely confined to those who had chosen to participate.

The current shift reflects softer regulatory attitudes and intensified industry lobbying. Finance and crypto trade groups are pressing to relax capital requirements and remove limits on bank lending against a broad range of cryptocurrencies, arguing that some display liquidity and volatility profiles similar to major stocks or currency pairs. This analogy overlooks a fundamental distinction: unlike assets tied to real-world cash flows, these digital tokens are backed by nothing. In practice, such reforms would allow insured bank deposits to support leveraged bets on instruments like Dogecoin, importing extreme price volatility into a highly leveraged banking system and creating a disproportionate threat to overall financial stability.