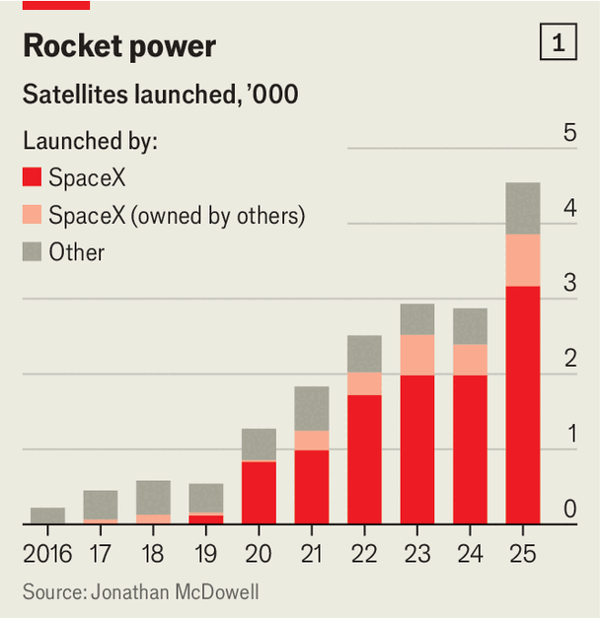

这笔合并将新实体估值定为1.25万亿美元,SpaceX投资者将获得80%,其余归xAI所有者。其逻辑是将数据中心送入太空并为今夏预期的上市造势,但这把2025年约发射4000颗卫星、占全球约85%,并拥有约900万Starlink订户(两年增长逾三倍)、约160亿美元收入和约80亿美元经营利润的SpaceX,与xAI的拖累捆绑在一起。

xAI去年Grok模型收入约5亿美元,而OpenAI约130亿美元;与其去年合并的X大约再贡献30亿美元销售额,但整体仍以每月约10亿美元的速度烧钱。监管与负债叠加:若被认定违规,欧盟可罚其全球收入的最高6%,英国最高10%,同时xAI还背负50亿美元借款、约35亿美元的表外债务工具、并从收购X遗留约120亿美元借款,外加SpaceX需承担的EchoStar约20亿美元利息。

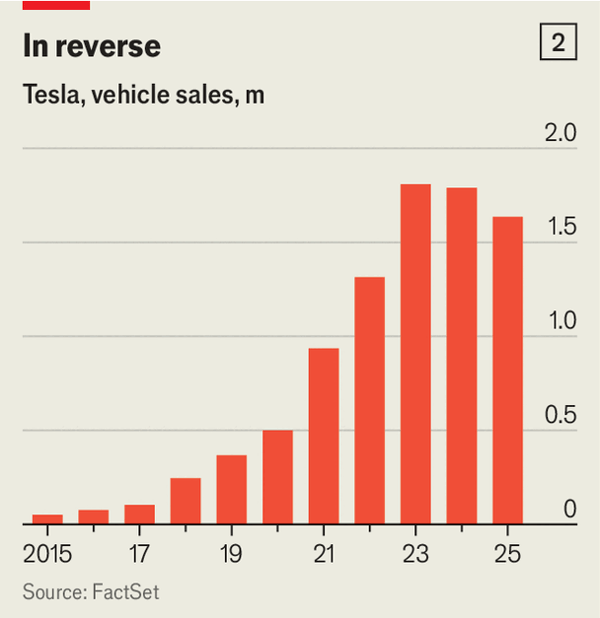

据报该合并体计划以至少1.5万亿美元估值融资500亿美元,这个估值与市值约1.5万亿美元但去年销售额950亿美元的特斯拉相当,而SpaceX与xAI合计收入约为其五分之一。新增押注包括:向FCC申请在1月30日部署100万座基于卫星的数据中心星座(谷歌计划2027年发射载其AI芯片的测试卫星,研究称发射成本至少十年内难与地面数据中心等价),以及特斯拉1月28日对xAI投资20亿美元、停产仅占其2025年产量2%的Model S与Model X以腾出空间生产Optimus(目标到2027年底年产100万),同时在2025年销量下降9%(欧洲下滑四分之一)之际推动4月量产Cybercab并宣称今年底机器人出租车可覆盖最多美国一半人口;2月5日的更正指出马斯克对SpaceX和xAI持有控制性股权而非多数股权。

The merger prices the new entity at $1.25trn, with SpaceX investors entitled to 80% and xAI’s owners to the rest. The stated logic is to loft data centres into space and juice a public listing expected this summer, but it ties SpaceX’s 2025 output of about 4,000 satellites (roughly 85% of the global total), about 9m Starlink subscribers (more than triple two years ago), and roughly $16bn revenue with about $8bn operating profit to xAI’s drag.

xAI made on the order of $500m of Grok revenue last year versus OpenAI’s roughly $13bn; X, merged in last year, may add about $3bn of sales, yet the combined business is reportedly bleeding about $1bn a month. Regulatory and leverage risks stack up: if courts find breaches, the EU could fine up to 6% of global revenue and Britain up to 10%, while debts include $5bn borrowed, an off-balance-sheet vehicle backed by around $3.5bn of debt, about $12bn of borrowings left from the X buyout, plus SpaceX’s obligation to cover $2bn of EchoStar interest.

The combined group is said to want to raise $50bn at a valuation of at least $1.5trn, matching Tesla’s market value even though Tesla generated $95bn of sales last year, about five times SpaceX and xAI combined. The new bets include a January 30 FCC filing for a 1m-strong satellite data-centre constellation (Google plans a 2027 test satellite with its own AI chip, and researchers say launch costs are unlikely to match terrestrial data centres for at least a decade) and Tesla’s January 28 disclosure of a $2bn xAI investment, the phase-out of Model S and X that were just 2% of 2025 production to make room for Optimus (a 1m-a-year target by end-2027), alongside an April Cybercab production ramp and a claim of robotaxis reaching up to half the US population by year-end even as 2025 vehicle sales fell 9% (down a quarter in Europe); a February 5 correction notes Musk has controlling, not majority, stakes in SpaceX and xAI.

Source: Elon Musk is betting his business empire on AI

Subtitle: The fates of xAI, SpaceX and Tesla are increasingly intertwined

Dateline: 2月 05, 2026 07:29 上午 | San Francisco