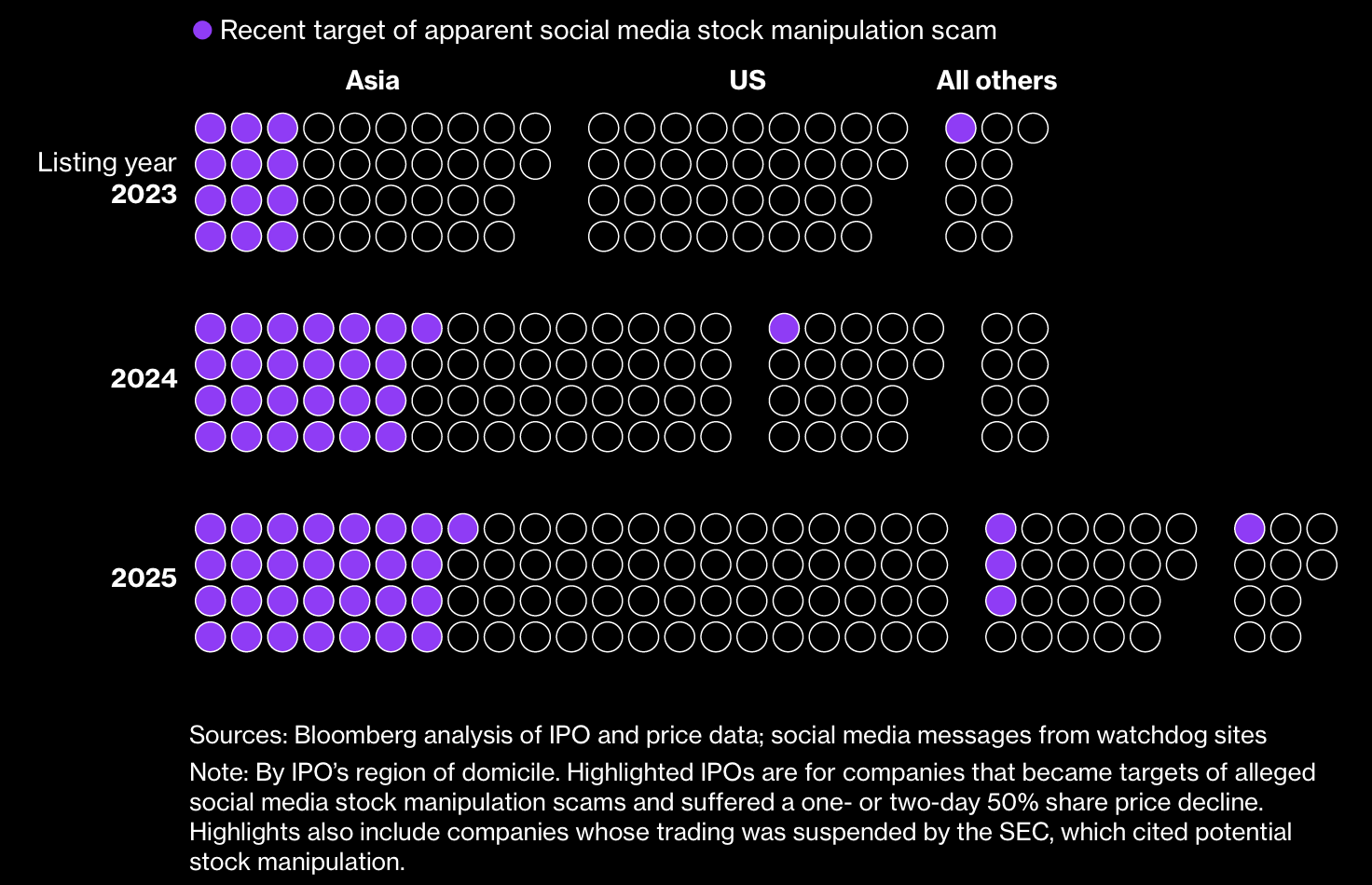

自2023年以来,彭博分析显示,美国资本市场中疑似“拉高出货”事件显著增加。在纳斯达克最小上市层级,超过250家IPO中约25%在上市后被WhatsApp群组推广,随后在一到两天内股价暴跌50%或被美国证监会暂停交易。同期,纽约证券交易所小盘层级亦有5家公司出现类似模式。自2023年以来,约60家新上市公司的一日或两日市值蒸发合计约160亿美元。

这些案例高度集中于亚洲背景公司。自2023年以来,在纳斯达克最小层级上市、平均募资不足1000万美元的亚洲总部公司数量翻倍,其中约三分之一(66家)显示操纵迹象,而非亚洲公司仅6家。部分企业在上市后短期内市值从数百万美元飙升至数亿美元甚至百亿美元,例如收入仅300万美元、员工28人的公司市值一度达100亿美元,随后迅速崩盘。

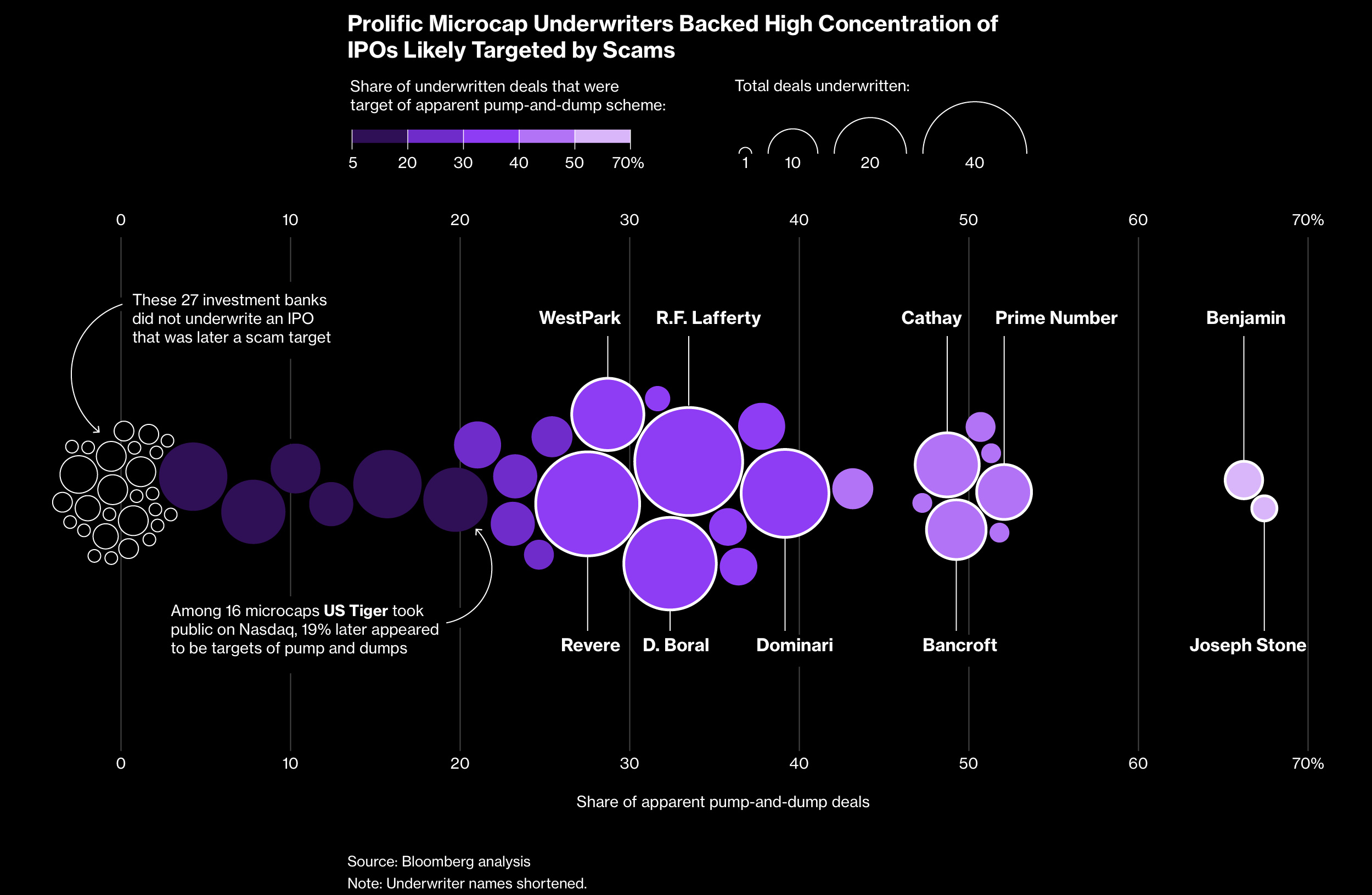

承销环节呈现显著集中度。在70多家活跃微型IPO承销商中,30家曾承销后来遭推广并暴跌的外国公司,仅8家承销了约四分之三的相关案例。典型承销费用介于数十万美元至100万美元。监管部门自2024年9月以来已暂停十余只股票交易,数量超过此前三年总和,但社交媒体跨境传播、低流通股比例及集中承销结构,使操纵风险在统计上持续放大。

Since 2023, Bloomberg analysis shows a sharp rise in suspected pump-and-dump activity in U.S. markets. On Nasdaq’s smallest listing tier, about 25% of more than 250 IPOs were promoted in WhatsApp chats and then fell 50% within one or two days or were suspended by the SEC. Five small-tier NYSE listings showed similar patterns. Roughly 60 new listings have erased about $16 billion in market value since 2023 through one- or two-day crashes.

The cases are heavily concentrated among Asia-based firms. Since 2023, the number of Asia-headquartered companies listing on Nasdaq’s smallest tier, raising under $10 million on average, has doubled. About one-third of them, or 66 firms, showed signs of manipulation, compared with only six non-Asian companies. Some firms briefly reached market caps in the hundreds of millions or even $10 billion despite revenues in the low millions and workforces under 50, before collapsing.

Underwriting activity is highly concentrated. Of more than 70 active microcap underwriters, 30 backed foreign firms later promoted online and followed by sharp declines, and just eight underwriters accounted for nearly three-quarters of such cases. Typical underwriting fees ranged from hundreds of thousands to $1 million. Since September 2024, regulators have suspended trading in over a dozen stocks, more than in the prior three years combined, yet cross-border social media promotion, low public float, and concentrated underwriting continue to amplify manipulation risk statistically.