自 2025 年 9 月以来,山东等富裕省份的地方政府产业投资平台与融资平台从信托与租赁机构借入合计达数十亿美元,高于债券市场三倍以上的融资成本,被报道普遍在 8% 或更高。这发生在中央限制 LGFV 借款、压缩银行贷款与债券渠道之后,使影子银行重新扩张。影子融资的增长与专项债发行量跌至 2020 年以来最低相并行,反映投资放缓与融资缺口扩大。Fitch 估算 LGFV 总债务超 60 万亿元人民币,其中约 90% 为银行贷款与债券,其余来自“非标”影子信用。

在第四季度项目清算与利息支付集中到期之际,这些平台被迫以更高利率再融资以避免违约。官方的债务置换计划规模达 10 万亿元人民币,本旨在把隐性债务转回地方资产负债表,但当前影子借贷的回潮构成反向压力。中国信托行业自三年前停止披露行业数据,使影子银行规模追踪更加困难。融资渠道收紧导致基础设施投资大幅下滑,尽管部分地区经济实力较强,但财政纪律使其不得不接受高成本融资。

人民银行行长潘功胜指出,截至 2024 年 9 月,全国平台公司数量与经营性金融债规模较 2023 年 3 月末分别下降 71% 与 62%。监管部门强调不得新增表外债,并于 2025 年 10 月强化非标融资限制。12 月财政部长兰福安再次提出以“铁纪律”防止新增隐性债务,同时遏制“借新还旧”行为,显示政策高压态势持续。

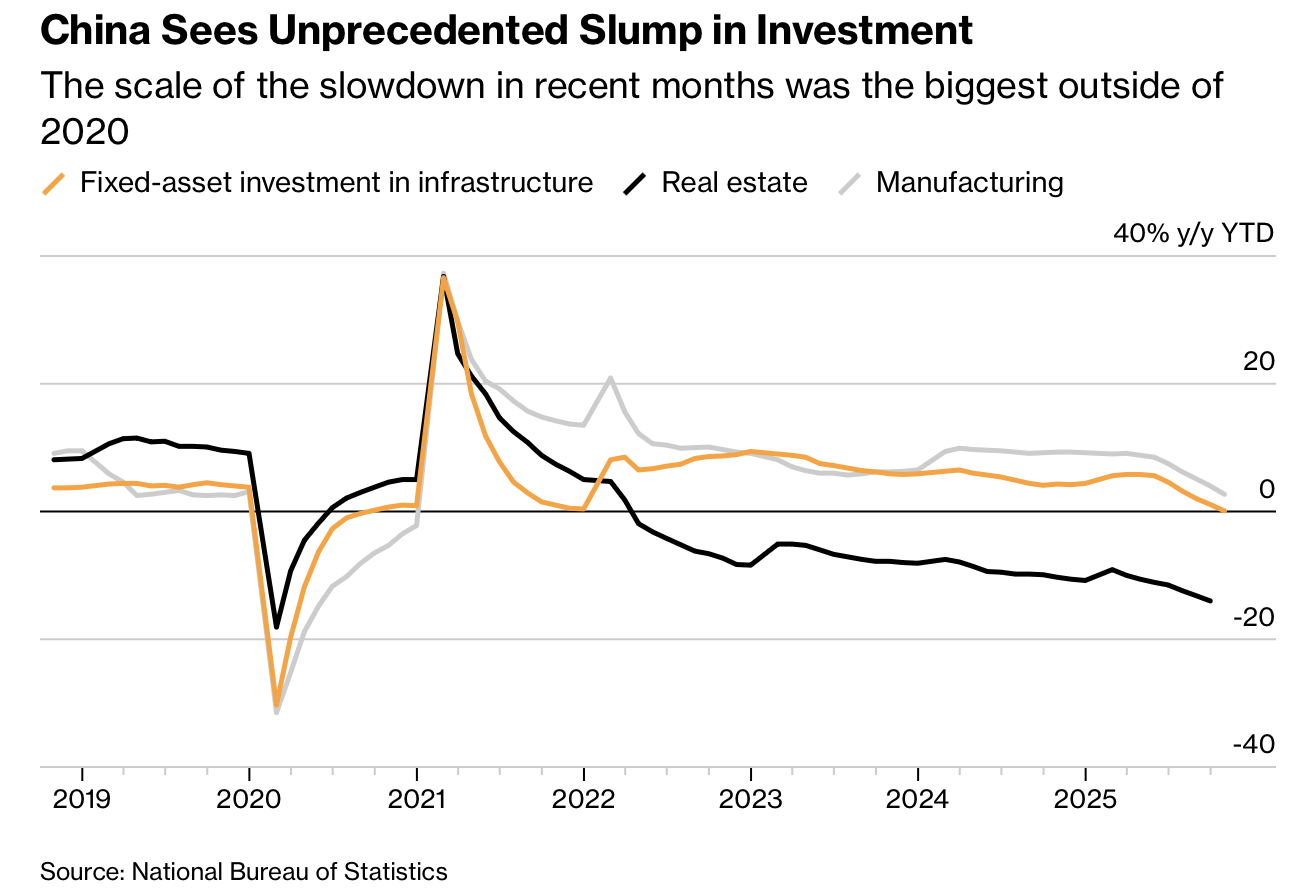

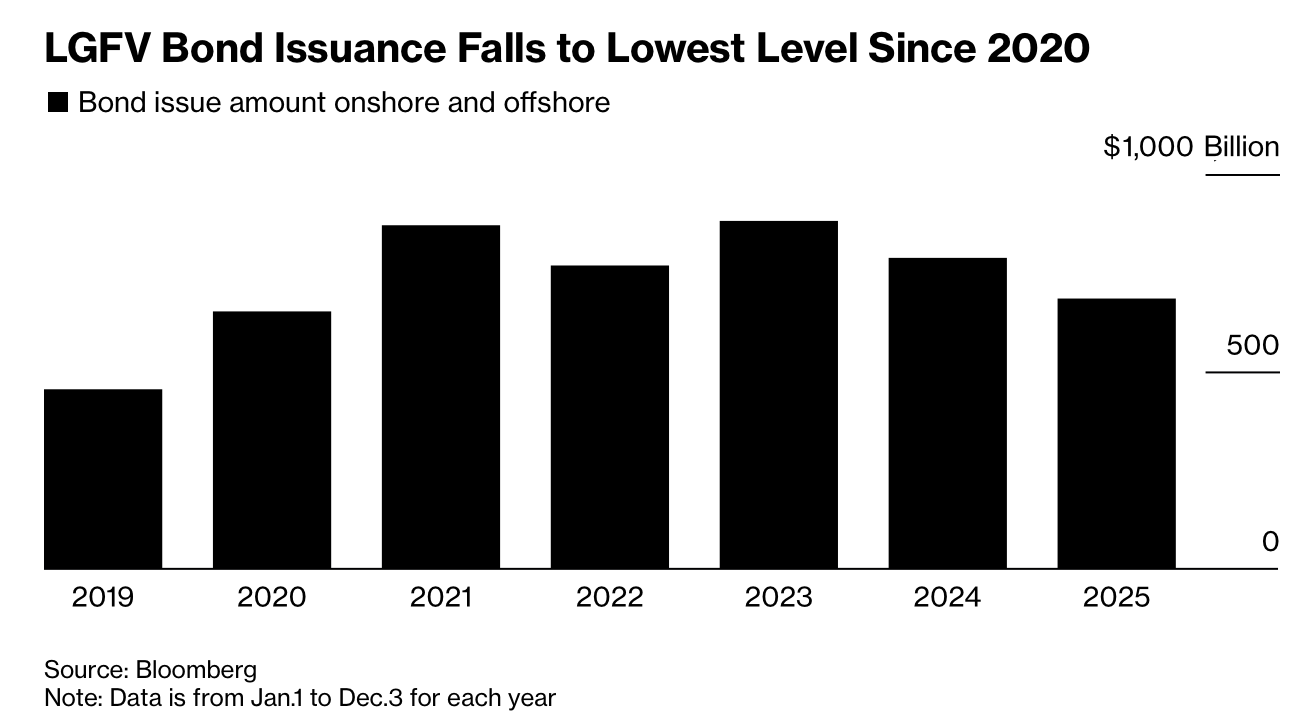

Since September 2025, industrial investment units and LGFVs in wealthy provinces such as Shandong have borrowed several billion dollars from trust and leasing firms at rates of 8% or above—more than triple bond-market costs. This shift follows tightened restrictions on bank loans and bond issuance, reviving shadow banking activity. The surge coincides with special-purpose bond issuance falling to its lowest level since 2020, highlighting widening funding gaps and a broader investment slowdown. Fitch estimates LGFV liabilities exceed 60 trillion yuan, with roughly 90% from bank loans and bonds and the remainder from non-standard shadow credit.

With fourth-quarter project settlements and interest burdens coming due, platforms have resorted to high-rate refinancing to avert defaults. The government’s 10-trillion-yuan debt-swap program, intended to migrate hidden liabilities back onto local books, now faces pressure from the rebound in shadow loans. Tracking the system has grown more difficult since trust-industry disclosures ceased three years ago. Investment weakness reflects the tightened fiscal discipline, which forces even affluent regions to use costly stopgap funding.

PBOC Governor Pan Gongsheng stated that by September 2024, the nationwide count of financing platforms and the stock of operating financial debt had fallen 71% and 62% from March 2023 levels. Authorities continue prohibiting new off-balance-sheet borrowing, issuing further curbs on non-standard LGFV financing in October 2025. On Dec. 2, Finance Minister Lan Fo’an reaffirmed the goal of preventing new hidden debt with “iron discipline” and halting the accumulation of new obligations while old ones are cleared.