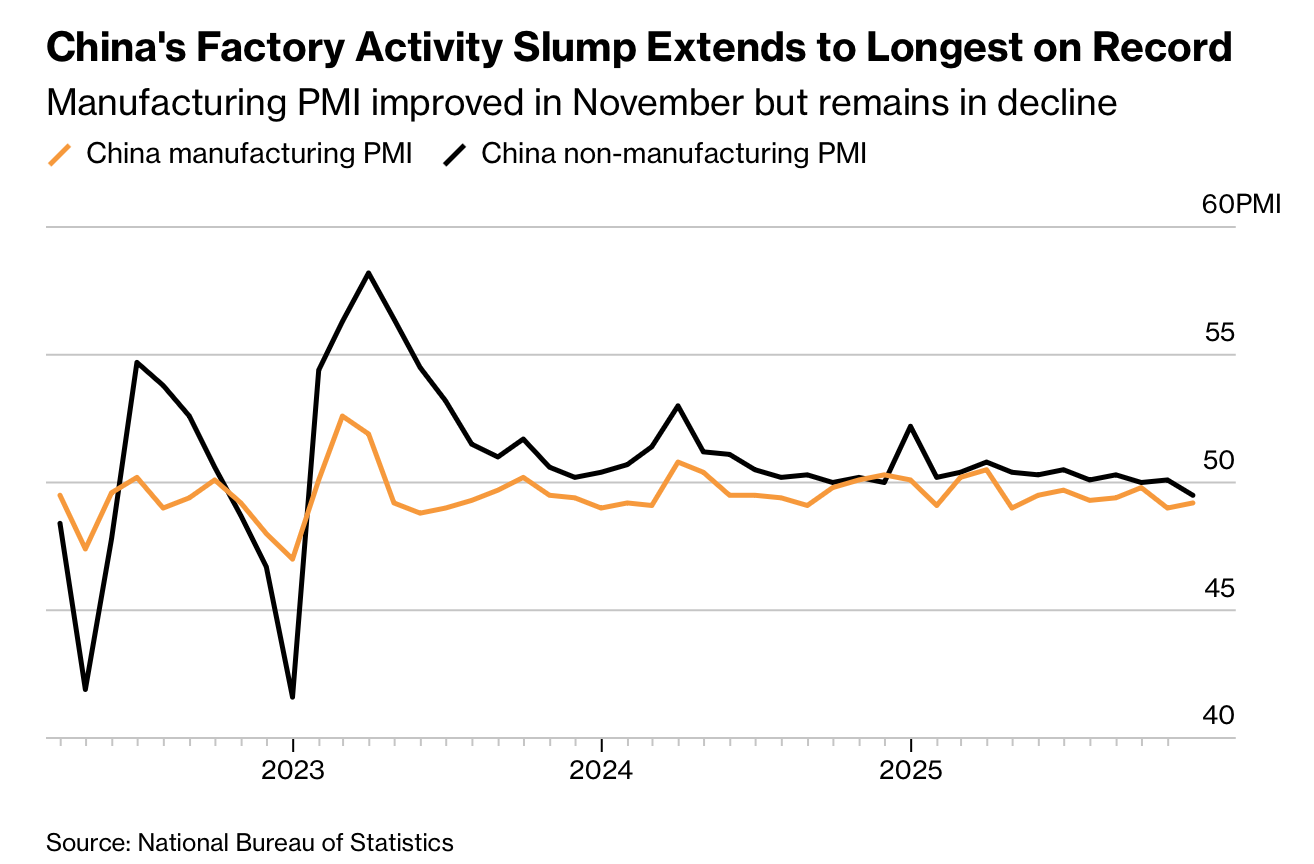

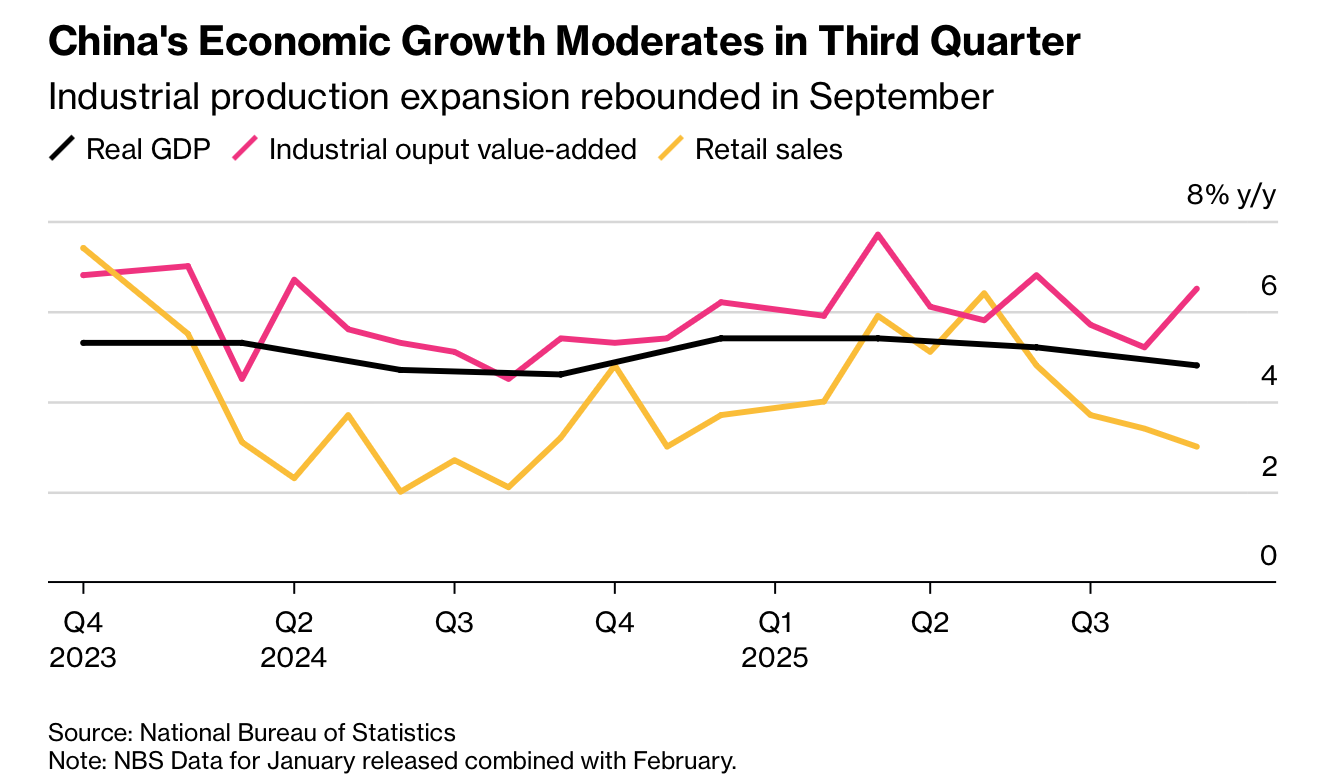

中国制造业 PMI 在 11 月录得 49.2,连续第八个月低于 50 的荣枯线,创下最长收缩纪录,且低于市场预期的 49.4。非制造业 PMI 从 10 月的 50.1 降至 49.5,为近三年来首次收缩,主要受房地产与居民服务疲弱拖累。工业生产本季度录得年初以来最小增幅,出口意外下滑,显示全球需求不足以抵消对美出口萎缩;零售销售已连续五个月放缓,为疫情初期以来最长减速。整体数据表明外需与内需同步走弱。

在外部环境中,中美因上月的临时休战而短暂缓和,但关于稀土出口等关键条款仍未敲定,反映协议脆弱性;与此同时,与日本的外交摩擦加剧贸易不确定性。尽管增长放缓至近一年最低且本季被预测为自 2022 年末以来最弱,政策层面并无立即加码迹象,因为全年约 5% 的增长目标预计可达成。高频指标显示企业投资持续创纪录下滑,冲击制造业景气。

今年 9 月下旬以来的累计 1 万亿元人民币(约 1410 亿美元)刺激包括地方专项债结余动用、用于扩投资与偿付企业欠款,以及政策性银行新增投放。未来五年,北京将科技与制造业维持为优先方向,同时承诺“显著”提高消费占比;净出口今年贡献了近三分之一的增长。总体趋势指向结构性放缓与需求疲弱交叠,制约工业部门的回稳。

China’s manufacturing PMI registered 49.2 in November, remaining below the 50 expansion threshold for an eighth consecutive month — the longest contraction on record and below economists’ 49.4 consensus. The non-manufacturing PMI fell from 50.1 to 49.5, its first contraction in nearly three years, driven by weakness in real estate and residential services. Industrial output posted its smallest gain of the year this quarter, exports unexpectedly contracted, and retail sales slowed for a fifth straight month — the longest such decline since early-pandemic closures — indicating simultaneous weakness in external and domestic demand.

Externally, US–China tensions eased following last month’s temporary truce, yet critical elements such as rare-earth shipments remain unresolved, underscoring fragility; a diplomatic rift with Japan has meanwhile added uncertainty. Despite growth slowing to its weakest in a year and forecasts pointing to the softest quarter since late 2022, policymakers are not poised to deploy major new stimulus because the ~5% annual growth target is still within reach. High-frequency indicators show investment continuing an unprecedented contraction, weighing heavily on factory conditions.

Since late September China has injected 1 trillion yuan ($141 billion) in stimulus via unused provincial bond quotas for investment and arrears repayment, plus new policy-bank funding. For the next five years Beijing will prioritize technology and manufacturing while pledging to “significantly” raise consumption’s share of GDP; net exports contributed nearly one-third of this year’s growth. The combined signals point to structural deceleration and persistent demand weakness constraining industrial recovery.