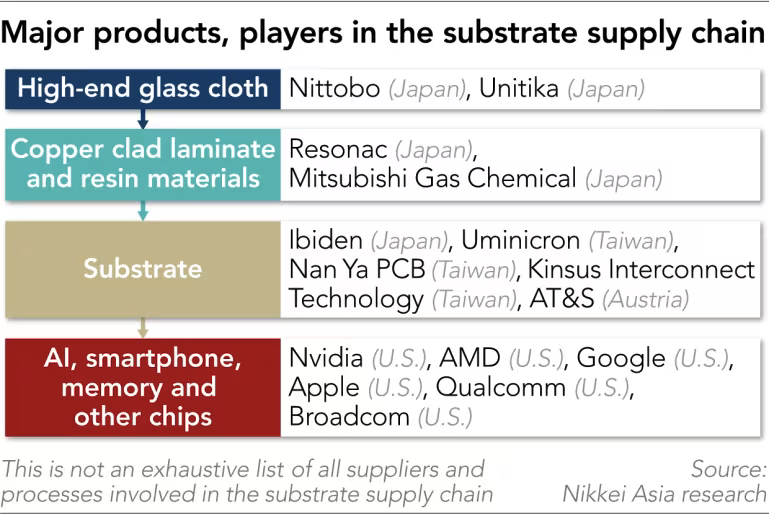

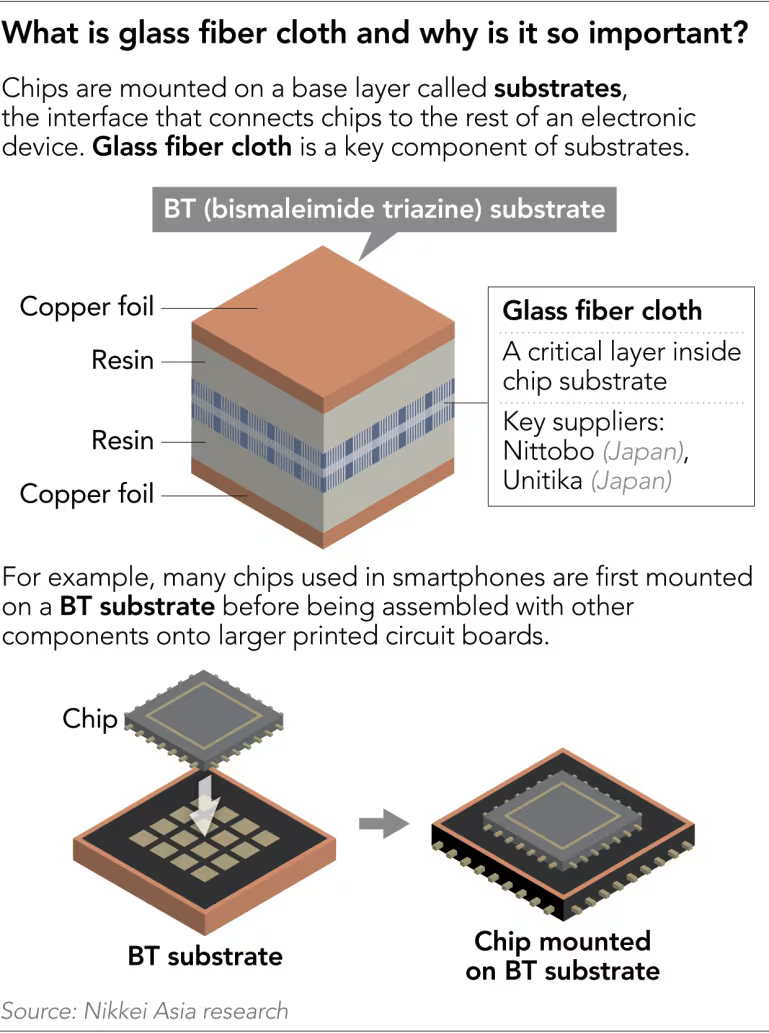

日本产高端玻璃纤维布(glass cloth)成为 2026 年电子制造与 AI 产业的关键瓶颈之一,迫使 Apple 与 Qualcomm 与 Nvidia、Google、Amazon 等 AI 巨头争抢稀缺供给。最先进类型几乎由日本 Nitto Boseki(Nittobo)独家生产,主要用于芯片封装基板与印刷电路板(PCB);AI 服务器与高性能处理器对高速数据传输的需求推高了对低热膨胀系数(low-CTE)的 T-glass 需求,导致供给紧张向下游扩散。

供给侧的时间与产能约束明确:即便施压也难以立刻扩产,业内判断要到 Nittobo 新产能在 2027 年下半年上线后才会“真正显著改善”。Apple 去年秋天派员赴日,进驻 Mitsubishi Gas Chemical(MGC)以争取 BT 基板材料供给(BT 即 bismaleimide triazine),并据称向日本政府寻求协助以满足其 2026 产品路线图(包括首款折叠 iPhone)。同时 Apple 也在培育替代来源,派员接触中国小型厂商 Grace Fabric Technology(GFT),并要求 MGC 协助其质量提升。Qualcomm 则据称拜访日本较小供应商 Unitika,但其产量远小于 Nittobo。

替代供给的“数量扩张慢、质量门槛高”趋势贯穿全文。潜在新进入者包括 Taiwan Glass、Taishan Fiberglass、Grace Fabric、Kingboard Laminates Group,但技术要求苛刻:每根玻璃纤维比头发更细,必须完全圆整且无气泡,且玻璃布深埋于基板内部,无法事后拆修,促使大厂不愿冒险。文章还将其与其他 AI 相关瓶颈并列:Counterpoint 预测 2026 年存储芯片短缺将导致智能手机市场下滑;AI 服务器板更厚更硬使钻头更频繁更换,产能主要在中国(Guangdong Dtech、Shenzhen Jinzhou)与台湾(Topoint),而高品质来自日本(Union Tool、Kyocera)。供应商因 2022 年末跨行业下行导致的过剩记忆而更谨慎扩产,进一步放大单点短缺的连锁效应。

Japan’s high-end glass cloth fiber has become a key 2026 bottleneck for electronics and AI, forcing Apple and Qualcomm to compete with Nvidia, Google, and Amazon for scarce supply. The most advanced glass cloth is made almost exclusively by Japan’s Nitto Boseki (Nittobo) and is critical for chip substrates and printed circuit boards; AI-driven demand for low-CTE “T-glass,” prized for stability and high-speed data transmission, is tightening the entire downstream supply chain.

Supply constraints have a clear timing signal: industry insiders say conditions will only improve meaningfully when Nittobo’s new capacity comes online in the second half of 2027. Apple sent staff to Japan last autumn to station at Mitsubishi Gas Chemical (MGC) to secure materials for BT (bismaleimide triazine) substrates and reportedly even sought help from Japanese officials to meet its 2026 product roadmap, including its first foldable iPhone. Apple is also cultivating alternatives by engaging China’s small Grace Fabric Technology (GFT) and asking MGC to help oversee quality improvements. Qualcomm reportedly visited smaller Japanese supplier Unitika, but its output is far below Nittobo’s.

The broader statistical pattern is “slow substitution under extreme quality barriers.” Entrants such as Taiwan Glass, China’s Taishan Fiberglass, Grace Fabric, and Kingboard Laminates Group are trying to scale, but fibers must be thinner than human hair, perfectly round, and bubble-free; because the cloth sits deep inside substrates, failures cannot be fixed later, keeping buyers risk-averse. The article ties this to other AI-linked pinch points: Counterpoint projects memory shortages will push the smartphone market to decline in 2026; thicker AI server boards require more frequent drill-bit replacement, with capacity led by China (Guangdong Dtech, Shenzhen Jinzhou) and Taiwan (Topoint) but top quality from Japan (Union Tool, Kyocera). Suppliers’ hesitancy to expand after the late-2022 oversupply downturn amplifies single-component shortages into wider disruptions.